In recent days, uncertainty gained ground in the market. The Warehouses on appreciation of weight and lack of concrete novelties of the agreement with the IMP that seeks to close the government revived the Doubts about the sustainability of the exchange scheme. Despite the messages of Javier Milei and Luis Caputo in search of anchoring expectations, the blackboards were painted red for several of the last wheels for Argentine bonds and actions. In that framework, The Central Bank expanded its intervention on financial dollars To contain the gap.

This Tuesday, in particular, the City Tables detected a strong participation of the BCRA with the sale of reservations To avoid a jump from the MEP and CCL dollar. Some sources point out that it could have been the greatest intervention since mid -January.

It was a day when Argentine actions collapsed both in the local market and on Wall Street and the country risk exceeded 700 basic points. However, the weight had a different behavior. For example, the MEP dollar dropped 0.3%. However, the financial dollars had begun the wheel with a marked upward trend that was later reversed.

Dollar: Another strong intervention of the BCRA

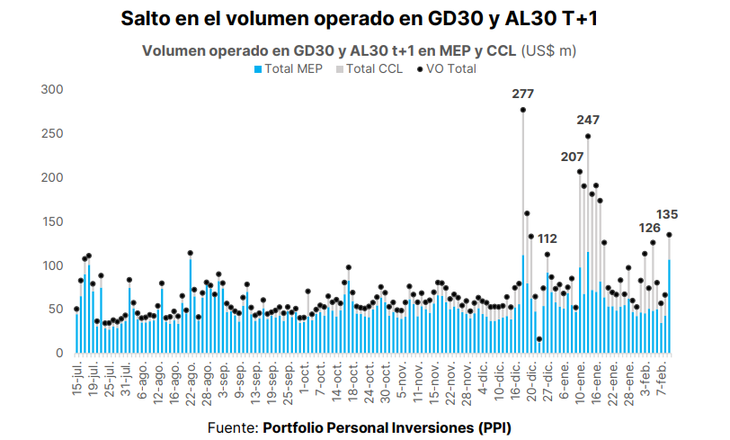

What happened? “Judging by the jump in the volume operated in GD30 and to 30 t+1, The BCRA would have acted to contain financial dollars ”, Portfolio Personal Inversiones said (PPI) In a report for your customers.

According to PPI calculations, The volume operated more than doubled from Monday to Tuesday. It went from US $ 67 million au $ 135 millionthe highest since the BCRA actively intervened between January 10 and 20. In that period, the volume operated averaged US $ 159 million per day. Thus, the intervention would have been somewhat lower on this occasion, but it approached that peak quite close.

image.png

The truth is that, since mid -December, when the exchange gap had touched a minimum of 5%, the BCRA accelerated its interventions and seems determined to sustain it to prevent an expansion from increasing the expectations of devaluation.

According to data revealed by the vice president of the central, Vladimir Werning, Only in the first half of January the entity spent $ S619 million of the reserves to intervene directly over the MEP and the CCL. However, the gap advanced to the current 13%. And that seems to be the roof that seeks to fix the economic team through direct interventions.

But it is not the only intervention. The most important is indirectly, through the “Blend dollar”. This type of export exchange, in reality, implies that 20% of exports are liquidated in the CCL market And, therefore, it adds an additional offer to the usual that limits the possibilities of Suba. These are dollars that do not enter BCRA reserves. Therefore, one of the IMF orders during the last year, breached by the government, was to eliminate the “blend.”

An operator told Scope That the expectation is that, before each moderately important movement of the MEP and the CCL, the BCRA intervene directly again. “The market is taking the timing,” he said.

Intervention and exchange scheme

PPI He argued that The official objective behind the interventions is to guarantee “the sustainability of the exchange scheme”. And he expanded: “To extend the virtuous dynamics of the Mulc, the monthly crawl of 1% must be perceived last very attractive officers. ”

At the moment, the BCRA maintains its daily purchasing rhythm tractioned by the liquidation of the indebtedness of the companies. It is the pillar in which the Government seeks to lie, underpinned by the incentive to the “Carry Trade”, to compensate for the exchange current account deficit, which already accumulates seven consecutive months and that tends to be enhanced as the exchange appreciation is accentuated.

Luis Caputo hugs his exchange tab as the main anchor to decelerate inflation. But, with negative net reserves in about US $ 10,000 million and a growing appreciation, doubts about the sustainability in the future of the scheme are the main member at the City’s tables.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.