The market cut its forecasts for inflation and provides that the Consumer Price Index (CPI) will pierce 2% monthly in April. The fact was prior to the official INDEC data that showed that January inflation was 2.2%. As for the dollar, the projections were crowded for the short term, in line with the decline of the “crawling pigh”, although from here to 12 months a greater increase is expected.

“The January REM reflects more optimistic expectationss, with inflation in descent, exchange stability and moderate growth. However, the Challenges persist in fiscal consolidation and in the support of the commercial surplus“They highlighted from the Córdoba Strategic Planning Center (CEPEC).

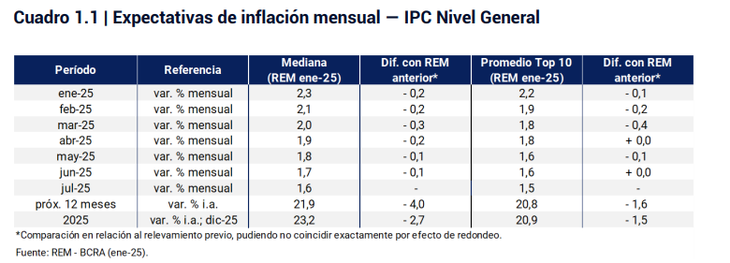

The consultants and financial entities that participated in the Survey of market expectations (REM) Prepared by the Central Bank (BCRA) in January, they had estimated a 2.3% price increase for the first month of the year, when in December they expected 2.5%. Finally, according to INDEC, he was slightly inferior.

1726448468686-DOOLO-INFLACION-FISCALJPG.JPG

Dollar, inflation and GDP: the guru will give their forecasts.

According to the new projections, the price increases will travel a soft descending path, which will pierce 2% in April and will reach 1.6% in July. In addition, For all 2025 the private sector projects an inflation of 23.2%2.7 percentage points (pp) below what the previous REM indicated.

The peculiarity is that those entities types by the central among the ten most precise are even more optimistic and see that the CPI will already rise less than 2% in February.

image.png

Dollar

As for the projections for the official dollar, reductions were observed for the first semester This year, in tune with the decision of the BCRA to reduce the rhythm of adjustment to 1% monthly. If the forecast is fulfilled, in the first half of 2025 the currency would climb 7.9%. For the whole year the expected increase is 17.6%lower than the projected inflation for the same period.

Nevertheless, For the next 12 months the increase in the planned wholesale exchange rate exhibited an upward adjustment (to 19%)which implicitly indicates that the market sizes a exchange correction (although not very significant) in early 2026. It is worth remembering, in this regard, that this week President Javier Milei said that on January 1 of next year there will be no more stocks .

GDP

Meanwhile, banks and consultants They foresee a growth of the internal gross product (GDP) of 4.6%0.1 pp above the previous estimate. A fact to highlight is that for the last quarter of 2024 an advance of the economic activity of 1.6% was estimated, when before the number was 0.9% versus the predecessor quarter. The open unemployment rate for the fourth quarter of the year it was estimated at 7.0% of the population

Unemployment

The open unemployment rate for the fourth quarter of 2024 was estimated at 7% of the economically active population, 0.2 pp lower than the previous REM. Identical was the adjustment for expected unemployment at the end of 2025, which would be 6.8% according to the market.

Rates

Who participate in the REM forecast a Private banks for February 30.6% TNA (equivalent to a monthly effective rate of 2.5%, higher than estimated inflation). By December 2025 the expected figure is annual nominal (equivalent to a monthly effective rate of 2.0%).

Commercial balance and tax balance

Private expect a Commercial surplus US $ 14,026 millionwhich meant a reduction of US $ 1,343 million compared to the previous estimate. At the same time, they project $ 11.6 billion of Primari fiscal surpluseither.

From CEPEC, they stressed that government challenges are “to comply with inflationary deceleration, without affecting the level of activity, Hold the fiscal surplus without resorting to sudden adjustments in social spending and subsidies, and strengthening foreign trade, since the reduction of the commercial surplus can generate pressures in the currency market“

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.