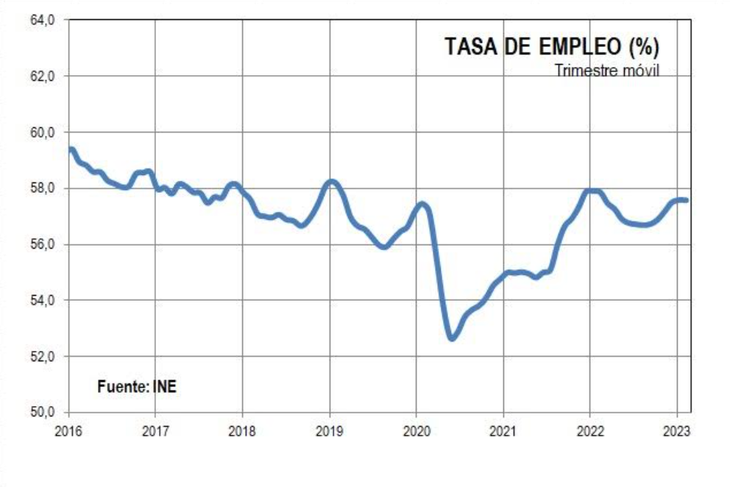

The employment rate was 57.5%, while the unemployment rate was 8.1%; therefore, almost 148,000 workers are currently out of work.

He Work market in Uruguay was relatively stable in February, According to data released today by the National Statistics Institute (INE). The employment ratewhich measures the percentage of people who work in the population over 14 years of age, remained at 57.5%. This implies that in February it is estimated that there were 1,678,500 people working in the country. The number implies a increase of almost 11,000 jobs compared to a year ago.

The content you want to access is exclusive to subscribers.

Given that the Activity rate dropped modestly, there was a reduction in the unemployment ratewhich was left in 8.1% According to the INE, it is estimated that some 147,900 workers they were in this condition in February.

image.png

When analyzing the data by geographic area and compare with respect to a year ago, a slight improvement in employment in Montevideo, with a contrary behavior in the rest of the country. Although they are not appreciable differences, it must be taken into account that trade on the coast continues to be significantly affected by the exchange rate difference with Argentina.

Drought and the international context complicate forecasts

To this must be added the drought impact, which has already begun to affect the Gross Domestic Product (GDP) accounts and will surely do so in the labor market in the coming months. The Chamber of Industries of Uruguay (CIU) expects a loss of jobs for this semester due to the water deficit.

“Indeed the drought further complicates the future scenario. We come with drops in international prices, costs in dollars that skyrocketed due to the drop in the exchange rate, and a drought of exceptional characteristics was added to us. A good part of our industry processes agricultural goods and will be impacted by supply problems,” stated its president, Fernando PacheIn a recent interview with scope.com.

Added to this is the more difficult external financial scenario, with rising interest rateand the tight monetary policy of the Central Bank of Uruguay (BCU) to lower inflation.

In favor I could play the real wage recovery which is estimated for the coming months, to the extent that wage councils are incorporating higher increases than projected inflation. This could boost domestic consumption more vigorously.

Source: Ambito