However, the impact of the drought on the price of fruits and vegetables prompted an increase in the Consumer Price Index.

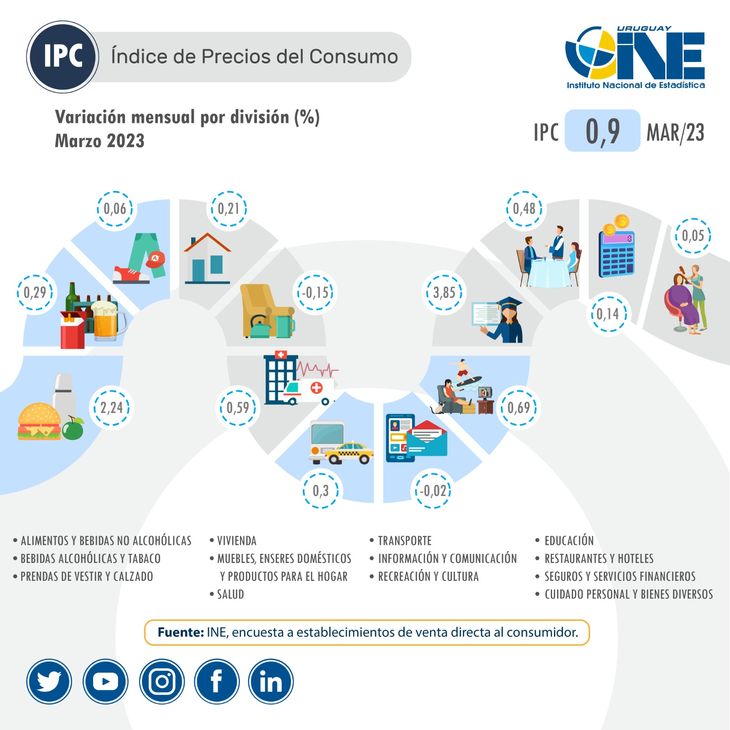

He Statistics National Institute (INE) reported today the new data of the CPI (Consumer Price Index) corresponding to the month of March. said month, the CPI rose 0.9%driven particularly by the increase in prices of fruits and vegetableswhat happened with 10.9% and 12.3%, respectively. This is largely reflecting the impact of the drought, which pushed up the price of several of these products. Lettuce and potatoes, for example, rose 28% and 20% in the month.

The content you want to access is exclusive to subscribers.

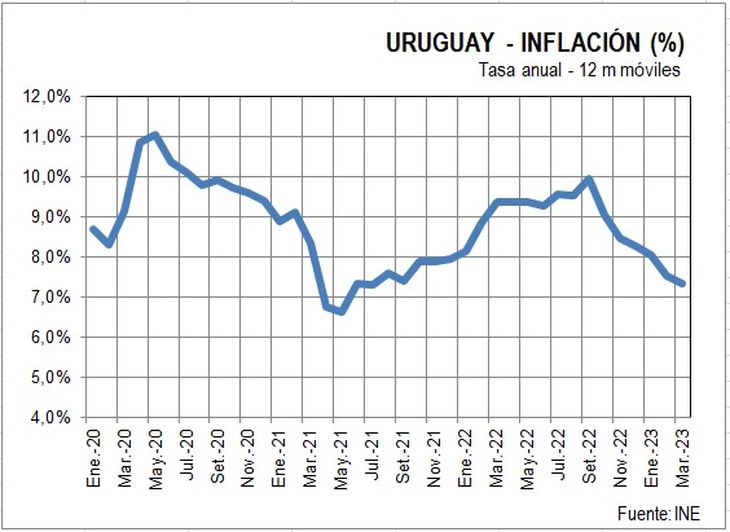

However, the maintenance in the price of fuels and the drop in some other prices of services are pushing back inflation measured in annual terms. Indeed, in March annual inflation dropped to 7.33%, after having settled at 7.55% in February. Thus, the sixth consecutive drop in annual inflation in Uruguay, after having reached a peak of almost 10% in September of last year. The March record is the minimum annual inflation since July 2021.

inflation.jpg

Monetary politics

Beyond the impact of the drought on fruits and vegetables, and the decline in fuel prices after the sharp rises last year, a factor with an important incidence in the drop in inflation is the monetary policy of the Central Bank (BCU), which has maintained a rising interest rate in recent months, taking it to the 11.5% in December and keeping it there until now.

The increase in the interest rate seeks to moderate the speed of circulation of money in the economy and restrict credit. In Uruguay, in addition, an immediate impact is generated on the price of the dollarwhich has fallen significantly in recent months and marked an annual decrease of 7.4% in March. This also has a significant impact on the decline in inflation, to the extent that many prices are denominated in dollars, both at the wholesale and retail level. At the same time, the decline in the dollar has brought competitiveness problemswhich have put the business sectors and the government itself on alert: with the CPI rising and the dollar falling, retail prices measured in dollars rose 16% in the last yearwhich makes Uruguay more expensive in relative terms than other countries.

INE.jpeg

Likewise, the drop in the dollar in recent months has generated a significant loss in the balance sheet of the BCU, given that its reserve assets -which are in dollars- have lost real value compared to its monetary liabilities, basically current currency and monetary regulation bills. These have been strengthened precisely by the increase in the interest rate that the bank itself has defined, which will force the Uruguayan State to capitalize the BCU, a matter whose details will be known in a few days.

Besides, the decline in inflation is allowing a strong recovery in real wages, as already seen in the data corresponding to the month of February. As inflation continues to decline and nominal wage increases are above, real wages continue to recover, something that will surely continue in March. In dollars, salaries in Uruguay rose 22% annually to February, on average.

Source: Ambito