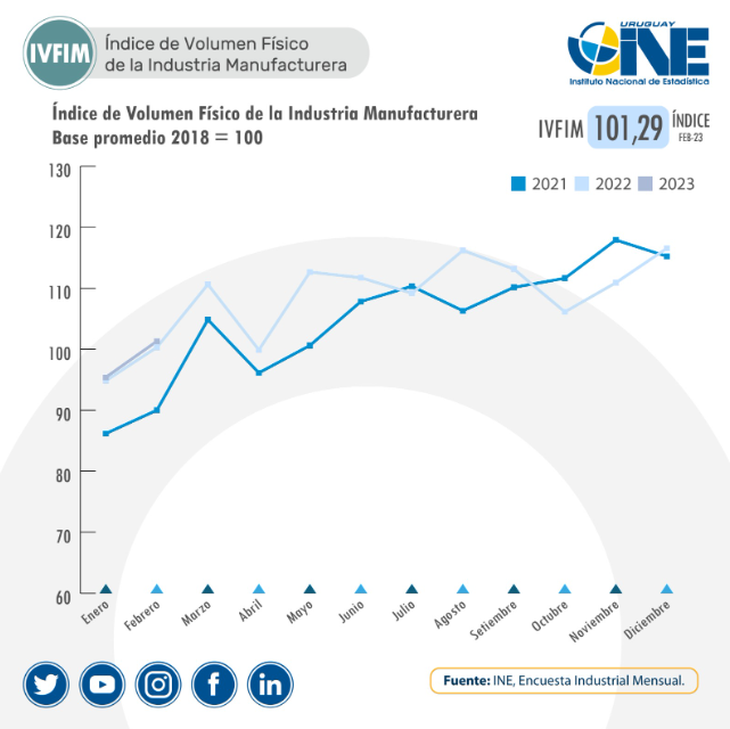

The rise in the latest data for February showed significant increases in the production of beverages and the pharmaceutical industry.

He National Statistics Institute (INE) released today the data of the Industrial production corresponding to February. Leaving aside the oil refinery, production was almost 1% up from the same month last year. Given that January had had a negative behavior, in the BIMESTER the production “tie” the same period last year.

The content you want to access is exclusive to subscribers.

The data for the two-month period show an interesting increase in the beverage production (8%) and in the pharmaceutical industry (13%). However, they are shown low in the tannery industries, lumber and automotive, the latter coming from high production levels last year. To this must be added the interannual decrease in the slaughter activitywhich implies less activity in the refrigeration industry.

image.png

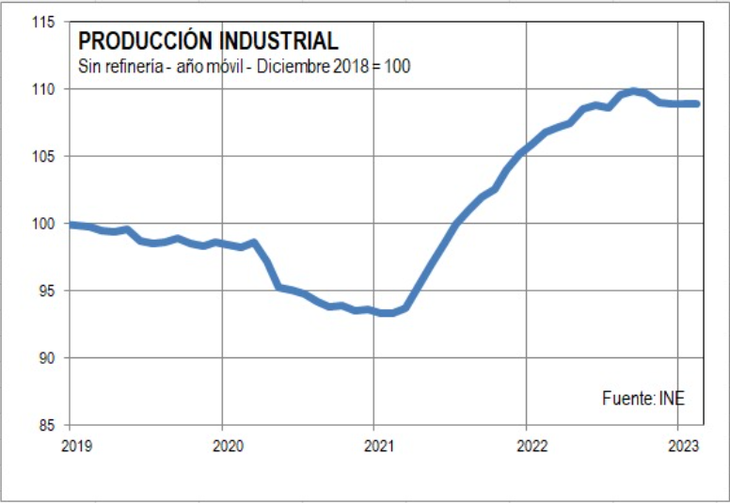

Analyzing the trend of the moving year shows that the industry tends to stabilize its production at 11% above the pre-pandemic level. It is possible that in the coming months the production will show some decline, especially since the interannual variation of the refrigeration industry will continue to be negative. This could be reversed in the second semester.

image.png

On the other hand, the start-up of UPM 2 is expected in the coming weeks, which has already received the latest environmental authorizations and reported the environmental Baseline (pre-operation comparison parameters) from which the monitoring of its impact on the environment, a prerequisite for commissioning. With UPM 2, industrial production will take a significant leap and pulp will become the main item.

Industrial employment fell 2.4% year-on-year

He industrial employment showed a setback in februarywith a year-on-year drop of 2.4%. In it BIMESTER the fall is from 1.7% The data is worrying to the extent that industrial employment registers better wage income than average from the workers.

One of the possible causes of this trend –which will have to be confirmed in the coming months– is the sensitive relative price increase what is happening in the workforce cost in Uruguay, where wages in dollars have risen more than 20% from last year.

This can complicate and generate loss of jobs especially in industries with relatively large workforces and relatively lower productivity, both among those that compete in the local market with imported production, and at the level of the export sector.

Source: Ambito