According to a technical report from the Uruguayan Banking Association (AEBU), private banks accumulated 245.3 million dollars in profits during the year 2022this implies an increase of $37.5 million compared to 2021which had been 207.8 million dollars.

In the breakdown, the Banco Santander led the gains with some 110 million dollarsan annual variation of 38.53% compared to the 79.4 million registered in 2021. At the other extreme, and being the only private bank that had a negative balanceis found the Heritage Bank with losses of $226,000.

He Bandes Banksame as him National Bank, were very close to breaking even, posting profits of $591,000 and $481,000, respectively. The private bank that lost the most compared to 2021 was the Itauwith an annual drop of 25.6 million dollars.

AEBU.jpg

AEBU

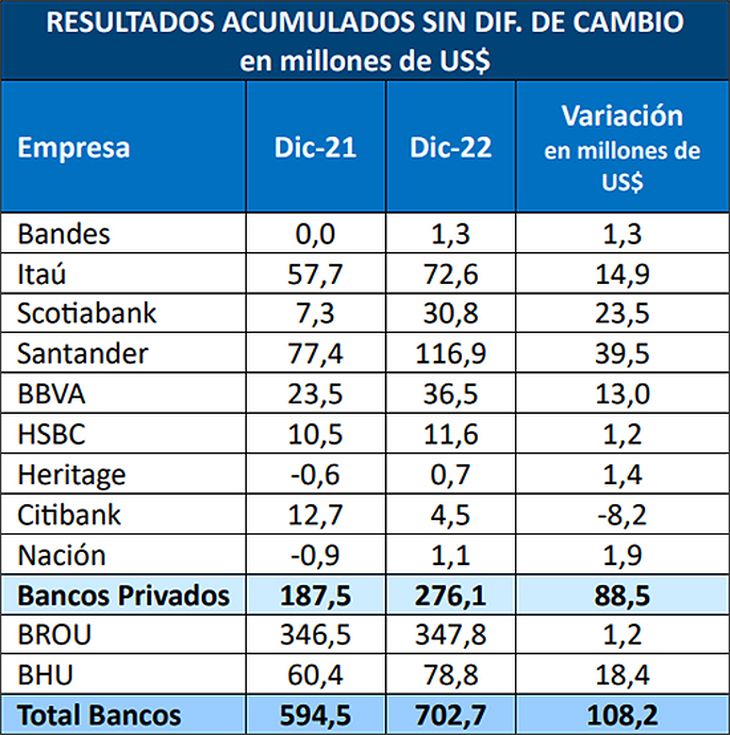

By correcting the results generated by the difference in exchange rate Due to the valuation of assets and liabilities of each institution, it is observed that this variable had a downward influence on the accounting profits of the institutions, detailed AEBU.

The results associated with the exchange rate difference in 2022 were negative, since the Uruguayan peso appreciated against the dollar, contrary to what happened in 2021. For this reason, when excluding the result, the improvement with respect to the previous year is bulkier and reaches $276.1 million.

AEBU3.jpg

AEBU

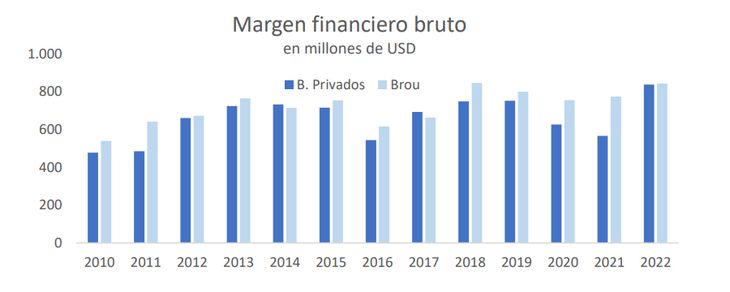

The profits presented a level similar to those of the years 2019 and 2020, meaning the best results of the last 15 years. One factor that influenced these earnings was the performance of the financial margin. Gross financial margin increased by 48% for banks, the highest in the last 10 years.

AEBU2.jpg

AEBU

Public banks earned more than 307 million dollars in 2022

In the case of public banksthese had earnings of $307.3 million in 2022. In the breakdown, the Republic Bank (BROU), accumulated a positive balance of $227.3 millionand the hipotecary Banc (BHU) of 80 million dollars.

The BROU balance registered a fall of $173.5 million compared to 2021, particularly due to the appreciation of the Uruguayan peso against the dollar, but the BHU increased its coffers by about 20.3 million dollars.

With a total of $552.5 millionbanks in Uruguay recorded on their balance sheets a result lower than 2021which had been $668.2 millionmainly explained by the deterioration of Banco República and Itaú.

However, this decrease in profits is explained by the decline in the price of the dollar, since without this effect the banks had higher profits compared to 2021.

Source: Ambito