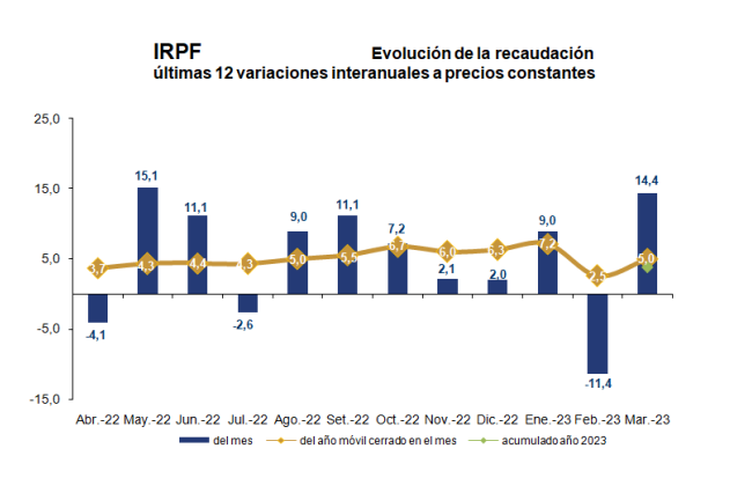

The tax that collected the most, in addition to VAT, was Personal Income Tax (IRPF) with a real variation of 14.4% compared to February.

The General Tax Directorate (DGI) published its monthly collection report for the month of March, which shows an annual variation of -3% of gross collection, if the inflationary effect is discounted, being the Value Added Tax (VAT) the one with the highest collection and the Tax on Personal Income (IRPF) the second.

The content you want to access is exclusive to subscribers.

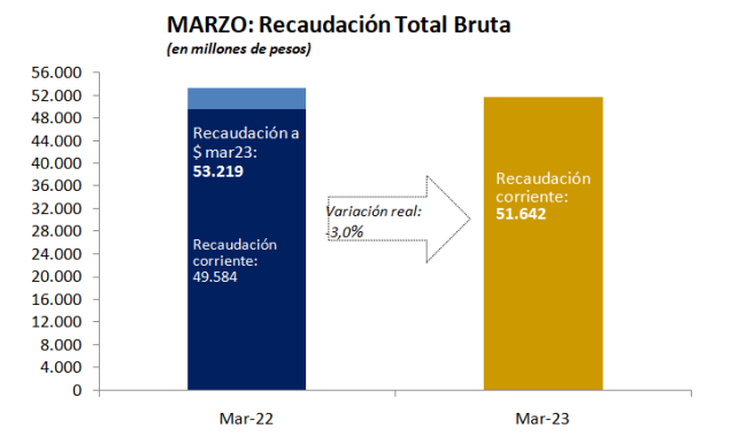

The total of gross collection of the DGI in March 2023 was 51,642 million pesos which, according to management, implies an interannual variation of -4.1% of current prices and a year-on-year variation of -3% if inflation is discounted. This is the third month of the rolling year that the DGI shows negative variations, along with February of this year and December 2022. According to the entity, the rolling year, closed in March, obtained a positive variation of 2.6%while the real variation of the period January-March 2023 compared to 2022 was -1.1%.

DGI gross.png

DGI

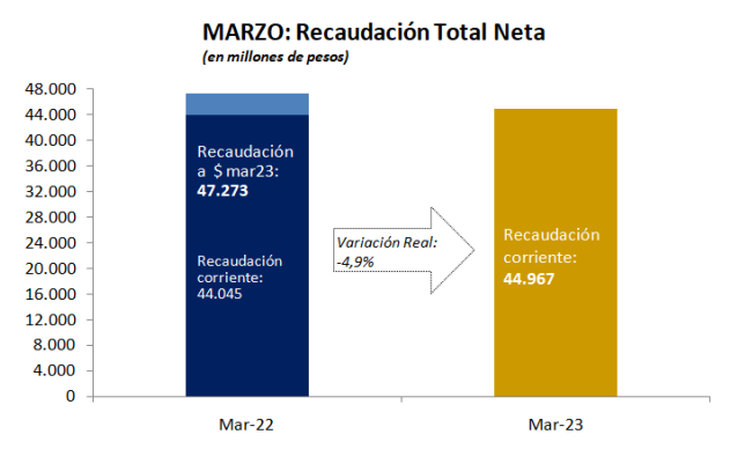

The net collection, for its part, where tax refunds are discounted, was 44,697 million pesos showing an interannual variation in real terms of -4.9%.

dgi net.png

DGI

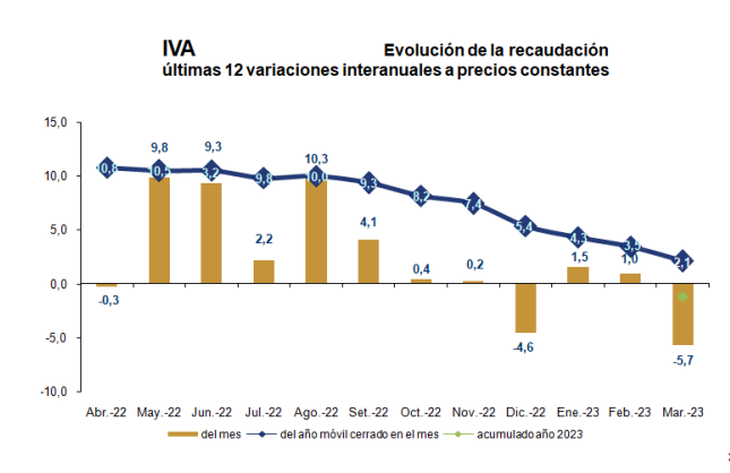

The collection of VAT reached the 24,346 million pesos in March 2023, representing 47.1% of total gross collection, increasing its real variation in the moving year of 2.1% but a real variation compared to the same month last year of -5.7%.

dgi vat.png

DGI

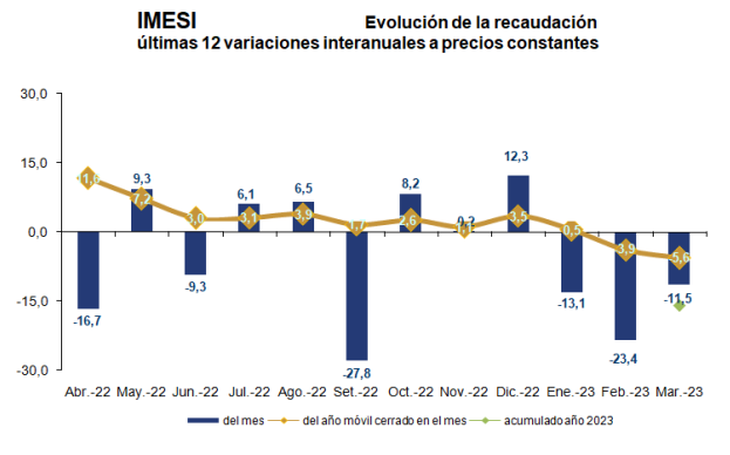

For its part, the collection of Internal Specific Value Tax (IMESI) it was of 4,452 million pesos in March 2023, representing 8.6% of the collection and with a drop in the annual variation in relation to the same period last year, of -11.5%.

dgi imesi.png

DGI

He Personal Income Tax (IRPF)for its part, represented a collection of 10,322 million pesos, 20% of the total collected, reaching a positive real variation, compared to the same period last year, of 14.4%. According to the DGI, this increase is due to the fact that there was a cash flow that would have been collected in February of this year, as there was also a cash flow in March 2022. If these data are taken into account, the real variation of the tax would have been 5.9%.

say irpf.png

DGI

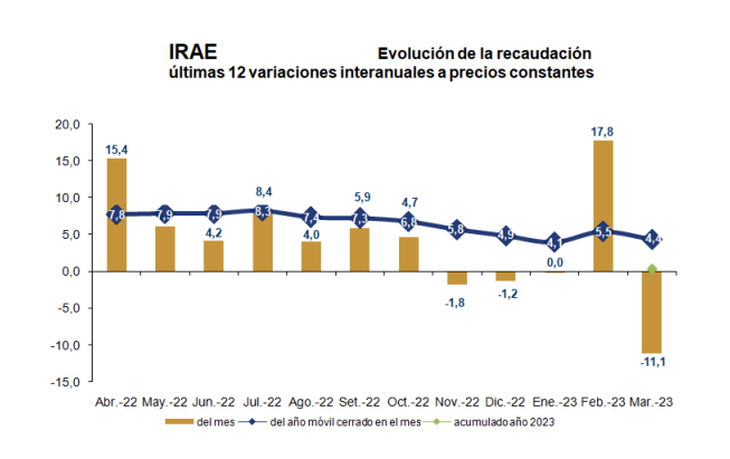

Lastly, the Income Tax from Economic Activities (IRAE) was from 6,458 million pesosrepresenting 12.5% of the total collected, achieving a real variation of -11.1% compared to the same month of the previous year.

dgi irae.png

DGI

Source: Ambito