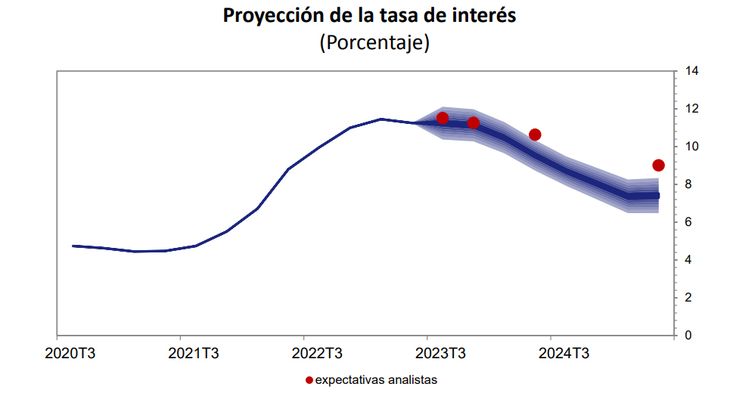

The state body expects a TPM at a relatively stable level during 2023, which will gradually decrease next year.

He Central Bank of Uruguay (BCU) assured in his last Institutional Monetary Policy Report that he expects a Monetary Policy Rate (dwt) relatively stable during the current year, but that It will gradually decrease during 2024 until it is close to the 8%.

The content you want to access is exclusive to subscribers.

According to the fan chart presented by the BCU, the internal confidence that the TPM falls within a range between a figure greater than 6%, and another greater than 8%, is up to 80%. These projections are below the expectations of financial analysts, who expect the TPM to be in the order of 9% by that time in the coming year.

In the document, the BCU explains that “monetary policy reacts to inflation and activity deviations, and generates a MPR path for the entire projection horizon”, where this resulting path is “conditional to a set of exogenous variableswhere the international context, rates in line with the macroeconomic coordination framework and nominal wages evolve as agreed in the agreements”.

In turn, the path incorporates the reduction of the MPR by 25 basis points adopted that established the Monetary Policy Committee (Copom) on April 19. The following graph shows the range in which the TPM would be expected to be located in “the framework of the base scenario and the risk map, being consistent with the projections previously presented,” explains the BCU.

BCU.jpg

Chart: BCU

Main risks that may affect the baseline scenario projections

These projections, derived from the base scenario, are framed in a context of risks and are subject to a high level of uncertainty, whose main external triggers, according to the BCU, are the financial situation of the region, progress in the contractionary phase of monetary policy in developed countriesthe expansion of banking problems in these countries, the persistence of the war between Russia and Ukraine.

At the domestic level, the potential misalignment of inflation expectations with respect to the target range appears as the main difficulty to be overcome. For the Central, “the identification, evaluation and management of risks complements the prospective analysis presented as a base scenario”, and these “are the reason for permanent monitoring by the Monetary Authority”.

Source: Ambito