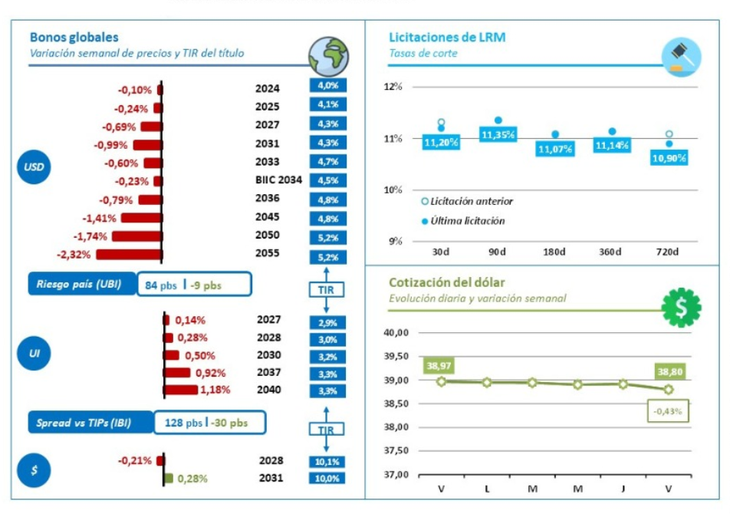

The sovereign spread of dollar securities fell 9 units to 84 bps and that of indexed instruments fell 30 units to 128 bps.

He sovereign spread of Uruguay fell 9 basis points (bps) to 84 bps this week, according to the report of the weekly monitor of the AFAP Republicwhich measures its own risk country with its Uruguay Bond Index (UBI).

The content you want to access is exclusive to subscribers.

In turn, the Uruguayan dollar bonds showed –all– falls of different magnitudes. Since the 2024 global bond –with an Internal Rate of Return (IRR) of 4%–, which registered a weekly variation of 0.1% in negative; going through the global bond 2045 –IRR of 4.8%–, which fell by 1.41%; up to the global bond 2055 –IRR of 5.2%–, which fell 2.32%.

“Sovereign spread fall week (“country risk”) of Uruguay at 84 bps, but drops in the prices of its bonds in dollars due to increases in long rates in the United States,” the economist noted. aldo motto on their social networks.

image.png

In return, the bonds in Indexed Units (UI) they were all upward in the week that was from Monday the 15th to Friday the 19th of May. The one that matures in 2027 –IRR of 2.9%– rose 0.14%; while in 2030 –IRR of 3.2%–, 0.5%; and in 2040 –IRR 3.3%–, 1.18%.

Meanwhile, the country risk calculated by República AFAP for these titles (IBI), which measures the average spread between the yield of the bonds issued in UI by the Uruguayan State and the yield of the TIPS (Treasury Inflation Protected Securities) of the United States government, fell to a greater extent –30 bps–1, until reaching the 128 bps.

For their part, the bonds in pesos They had different variations. While the price of the global bond 2028 –IRR of 10.1%– fell by 0.21%, that of the global bond 2031 –IRR of 10%– rose by 0.28%.

Source: Ambito