The indicator was rehabilitated after three months in decline, helped by better VAT and personal income tax numbers.

The collection of taxes by the DGI had in May a positive year-on-year variation of 2.7%, breaking a streak of three consecutive falls, in what had been a slow start to the year 2023.

The content you want to access is exclusive to subscribers.

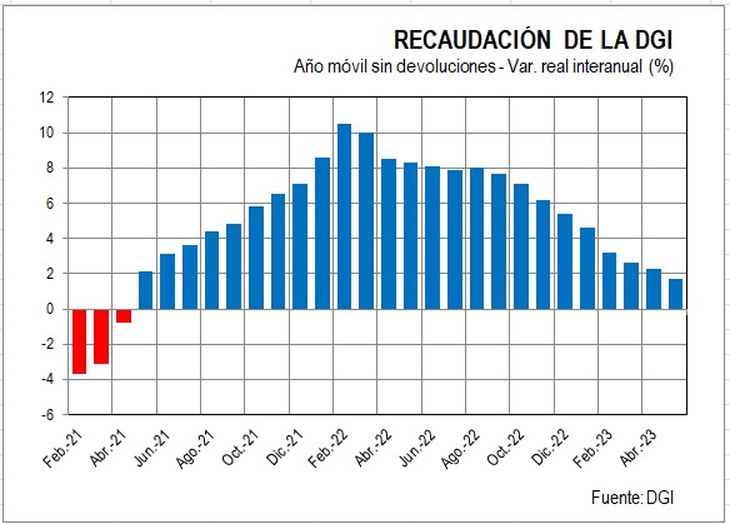

With the interannual increase in May, in the accumulated of the first 5 months of the year the collection still shows a slight fall of 0.3%. The advance in the last month probably reflects the improvement in the economy that was registered in the GDP data for the first quarter, after two consecutive quarters of decline at the end of last year. In the mobile year, the collection continues to slow down, but still with a real increase compared to the previous moving year (graph).

If an improvement in collection is confirmed (or, at least, a brake on the downward trend), this could be reflected, in turn, in the taxes workout, which has been deteriorating in recent months in Uruguay.

GraphicDGI.jpeg

Graphic: DGI

The higher collection of VAT, key to the general improvement

The increase in collection in May was mainly due to the higher VAT collection, which increased 4.1% year-on-year, as well as the increase in the collection of the Personal Income Tax (IRPF), which rose 11.4%. This last tax has been rising compared to last year in real terms, in line with the increase that is being registered in real wages.

In the annual accumulated, the VAT still shows a decline of something more than 1%, while the income tax collection up 4.1% and that of Income Tax on Business Activity (IRAE) increases 1%. An increase of almost 3% real yoy in property tax collection, including wealth tax, property transfer tax, and primary tax. This set of taxes responds for more than 6% of the total collection and increased more than 4% real in the annual accumulated to May.

In the collection structure, VAT remains the main tax, with just over 45% of the total, while the IMESI accounts for almost 9%. Income taxes (IRPF and IRAE) account for almost 38% of the total, according to data released today by the DGI.

Source: Ambito