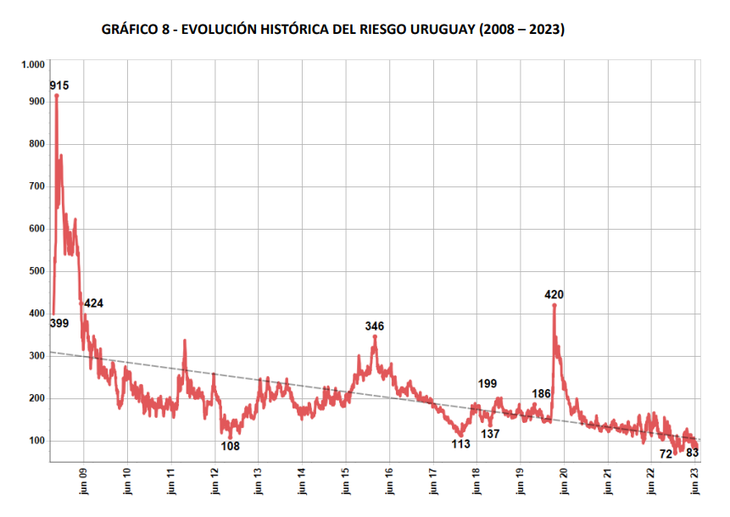

The monthly newsletter of the Electronic Stock Exchange of Uruguay (Bevsa) reported a setback of the Uruguay Risk Index (Irubevsa) 22 points, becoming the second lowest ever after the close of last year.

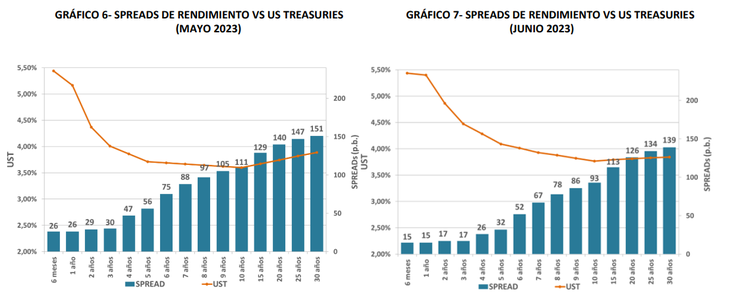

The Irubevsa measures the yield spread of the Uruguay’s debt in dollars relative to the US debt. (US Treasuries) and recorded a decrease of 22 basis points in June, going from 105 to 83, or also seen as 0.83% per year at the end of last month. According to the Stock Exchange bulletin, this was due to a mixed behavior of the CUD and the UST where the spread was reduced in all cases.

country risk.png

Compared to the month of May, the UST curve registered at the end of June, obtaining upward shifts in all nodes except the first and last, which registered a fall. On the other hand, in relation to the previous month, he also presented a mixed movement with falls in the first and last five nodes, and increases in all the others. As a result of that, the spread decreased for all nodes and with it there was a sharp drop in the Irubevsa.

country risk 1.png

Regarding the year-on-year comparison, in June 2022 the index reached 157 basis pointsa 47% less was reached at the end of June of this year. This loss is the second highest in history since 2009, which is only surpassed by the 72 points at the end of last year.

country risk 2.png

May numbers

During the month of May, the Country Risk had several days with different movements, both upwards and downwards, which made the authorities keep an eye on the indicator and be attentive to the unusual variations that may present. However, she reached 105 basis points or 1.05% per year at the end of May; the same level that was observed for the end of April.

Although the Uruguay Risk Index (Irubevsa) It started that month with a rise to 107 basis points and reached its maximum of 115 bp two days later. The rest of May showed a downward trend, registering a minimum of 84 bp. The positive numbers are even more evident if the indicator is observed in May 2022, when it closed at 132 bp.

Since the beginning of the year, the Irubevsa increased —considering the 88 bp at the close of the day yesterday— 16 bp; and its maximum was 129 bp on April 5. If you observe the Uruguay Bond Index (UBI) produced by AFAP Republic, the result is similar: so far in 2023 it increased 17 basis points.

However, the economist CPA Ferrere, Giuliano Cantisani, in dialogue with Scope.com, established that “This variation is very insignificant, so it could be considered that it has remained relatively stable throughout the year.”

Source: Ambito