He Ministry of Economy and Finance (MEF), through the Debt Management Unit (UGD), revealed that the Treasury Notes in Pension Units (UP) concentrate almost 17% of the total stock of government debt, five years after its first issuance.

in his last Sovereign Debt Report, which is prepared on a quarterly basis, the UGD highlighted the evolution of NT indexed to the nominal wages. In addition, he stressed that this market instrument provides the government with “better coverage against shocks to economic activity and other macroeconomic shocks that may affect tax revenues” due to “the procyclical nature of real wages.”

The new value unit was approved by the Parliament on April 13, 2017 and varies daily to reflect the monthly variation of the Average Nominal Wage Index. Then, on July 24, 2018, it tendered the first NT in UP, with a maturity of 7 years, a semi-annual coupon of 1.5% and principal repayment through equal, annual and consecutive payments in the last three years.

The objective was to allow the government to issue market instruments to be acquired by insurance companies, allowing them to cover the risks due to currency mismatches and the maturity of their assets and liabilities in the life annuity market. In addition, the UP planned to complement the regulatory changes established by the Central Bank of Uruguay (BCU) “to establish dynamic and predictable actuarial parameters”.

graphic .jpg

FEM chart

In just over 5 years, the government issued 6.5 billion dollars in UP

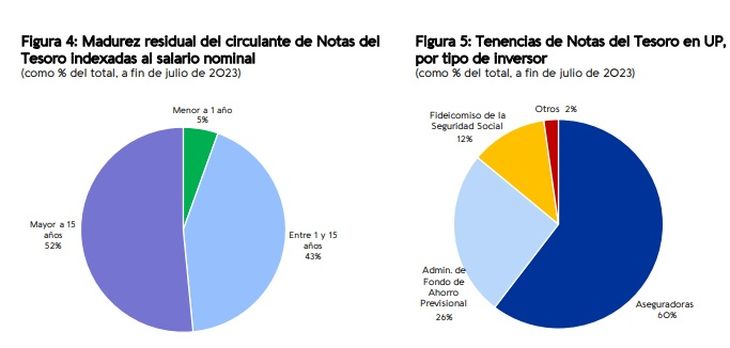

In the report, the UGD pointed out that in just over 5 years, the government issued a total of 6.5 billion dollars equivalent to UP securities, with six different maturities, mostly medium and long (between 7 and 26 years of maturity).

In turn, they highlighted that “the demand for Treasury notes in UP have risen steadily, both in absolute and relative terms” and assessed a significant increase in 2022 and 2023.

Specifically, so far this year, the NTs in UP represented 67% of the total debt issued in the domestic market. Thus, they became “a key source of financing in local currency for the government.”

In fact, taking the data up to the end of June of this year, the instruments indexed to wages issued by the government reached 17% of the total debt stock, adding titles and loans. In turn, they represented 31% of the total stock of debt in local currency.

Finally, if the debt securities issued in the local market are counted, the instruments denominated in UP represent 45% of the total. In addition, the average maturity of the outstanding debt issued in UP is 15.5 years.

Graphic2.jpg

FEM chart

The demand for sovereign bonds in UP

When analyzing the demand for sovereign bonds in UP, investors such as pension funds and insurance companies are counted, most of which have adopted a “buy and hold” strategy, according to the survey.

At the same time, they specified that the availability of the instruments allowed insurance companies in the life annuity business (particularly, State Insurance Bank) cover their long-term obligations and reduce risk on their balance sheets.

Finally, it is worth noting that, according to the UP yield curve of the Electronic Stock Market (Bevsa)in the last two years the average difference between the NT indexed by inflation (UI) and by UP, with a maturity of 20 years, was approximately 123 basis points.

Source: Ambito