The total volume traded with debit and credit cards and electronic money instruments increased by 8% in Uruguay during the first semester of the year with respect to the previous six months; and a 23% YoY. However, within the category, were the transactions carried out with electronic money the ones that made the greatest leap: a 35% in relation to the same period of 2022.

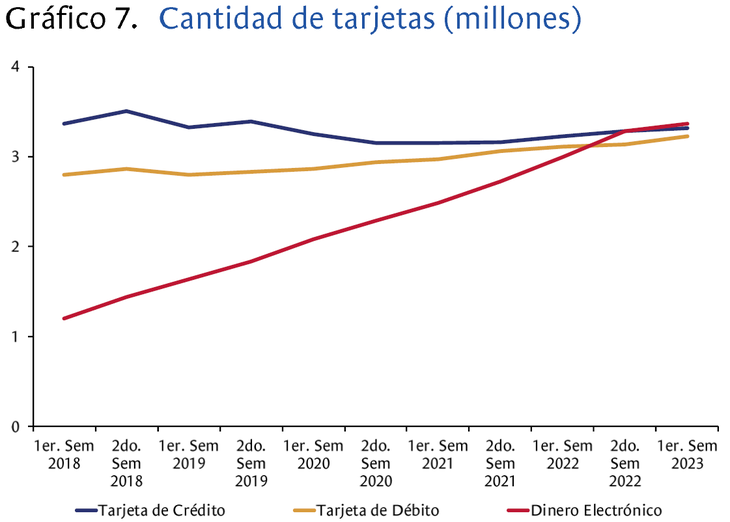

As for the debit cardsthe number of cards issued nationwide increased by 3% compared to 2022, reaching 3,224,180 as of June 2023. Likewise, the volume operated during the first semester increased by 20% year-on-year for operations with cards issued locally, and 27% for those issued in the outside. Regarding the amount traded, there was an 8% increase compared to the same period last year, although the average amount per trade fell by 10%.

An interesting fact is that the operations abroad made with debit cards issued in the country grew 33% and the total amount traded increased by 14%.

Regarding the Credit cardsthe total number of plastics emitted grew by 1.5%, thus reaching 3,319,464 cards in the middle of the year. In turn, around 9,000 new cardholders were identified —holders of this type of payment instrument.

According to the BCU report, operations carried out in the country with credit cards grew by 22%, while the total amount operated also increased by 10%. On the other hand, the operations carried out abroad they increased by 20%and the amount traded was 11% more than in the first half of 2022.

Operations.png

Debit cards continue to have a weight of 51% in operations with electronic payments in Uruguay.

Central Bank of Uruguay.

What happened to payments with electronic money?

The number of instruments electronic money issued during the first half of the year also grew compared to 2022, although it did so in the order of 2.46%thus placing it in second place in terms of issuance — surpassing the growth of credit cards and approaching that of debit cards.

The total volume traded during the first semester was 31% higher than the same period last year, with the transactions with general electronic gave representing a good part of this positive variation, with an increase of the 88% The total amount traded, for its part, grew by 22%.

A relevant fact that the BCU points out in its report is that the operations of purchase of goods and servicesincluding automatic debits with this type of payment instrument, grew by 35% —44% if the total amount operated is considered—, accounting for the increasingly daily use of electronic money.

In addition, as the head office points out, the greater dynamism during the first semester it was observed in transactions made with electronic money instruments: while the total volume operated with debit and credit cards and this type of instrument in total was 23% in interannual terms, if only electronic money is considered , the positive variation is 35% —although the market structure still remains stable, with debit cards maintaining a relative weight of 51%.

Amount.png

Transactions with electronic money were the ones that presented the greatest dynamism in the first semester in Uruguay.

Central Bank of Uruguay.

More POS, less banks

A piece of information that allows us to observe the magnitude of the development of the electronic payments in Uruguay is the growth of Points of Sales (POS) in relation to the physical branches of banks: while in the first case, only during the first half of the year did they grow in 5,000 units installed in the country —thus reaching 109,323, a figure four times higher than that registered at the time of the promulgation of the law Financial Inclusion Law (2014)-; the amount of Bank branches continues to decrease, with 260 branches at the end of the first half of 2023, that is, 10 minus than in 2022.

Source: Ambito