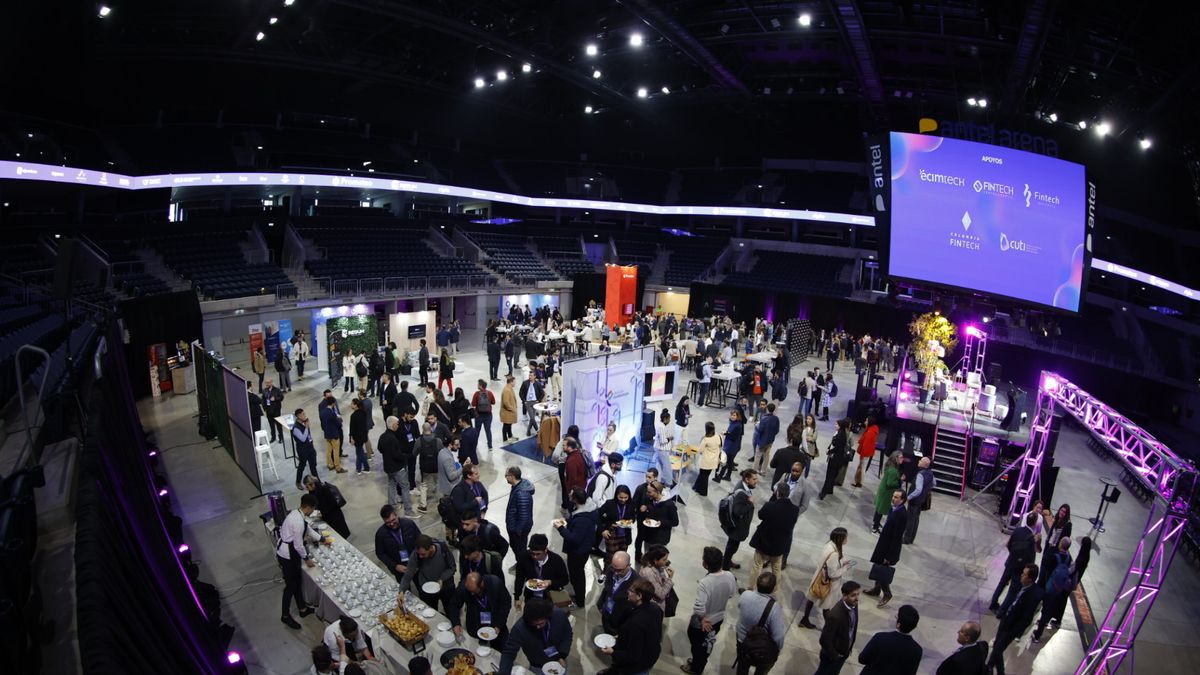

Users and experts in the field of fintech, defined as a “perfect mix” between finance and technology, were found in Montevideo this Thursday, so that, between work workshops, capitation talks and a lot of networking, the Antel Arena It hosted this activity with a lot of human exchange, but also digital, where cryptocurrencies and the profile of local investors were one of the central topics of interest.

In dialogue with Ambit.com, Martin Larzabal, co-CEO and co-founder of Crypto Trust Fiduciary Company defined the Uruguayan investor in cryptocurrencies in this way: “Over 40 years of age who define themselves as medium risk, with assets saved at that point in their lives that allow them to absorb an exposure in digital assets between 5% if they are very aggressive and 1% if they are more conservative, with an average ticket that is around $40,000.”

Larzabal directs one of the existing proposals in the market, which it presents as “an administration trust that invests in a diversified portfolio of cryptocurrencies. Today, as the market is, it is concentrated in Bitcoin and Ethereum, but we knew how to have 12 coins,” he clarified.

Asked about the motivations for the investment, Larzabal He explained that fundamentally “he does it to diversify his portfolio where Uruguayans generally have a lot of brick, bank savings and bonds, but very little capital appreciation component.”

The importance of being informed to invest

The level of information seems to be fundamental for this type of investments. “We do not take investors who do not know what they are doing. In other words, if they do not understand the decision they are making, we will not accept them,” the expert said.

And he pointed out: “We make a form to find out the financial knowledge they have and, based on that, we also filter whether they are a suitable person or not. Because the last thing we want is to have a problem that the client is looking at the screen and “That is continually watching it go up or down and suffering because of it. This is a medium-term investment, forget about the short term, but in the medium term you know that you are going to make money.”

Those who master the subject consider that Uruguay It has wide development possibilities in the area. At the same table as Larzabal they participated Martín Benítez, Eltan Fogel and Pedro Copelmayer, who agreed to point out that the important arrival of Argentines to Uruguay and the entrepreneurship that this is generating “is here to stay” and can be an incentive for the sector.

Furthermore, this is having an impact on the view that the traditional financial sector has of the phenomenon. “The banks did not want to know anything about the cryptocurrencies. In this cycle we are seeing that they are getting involved, that in some way they are wanting to enter that world because they understood that it is something that is here to stay and in some way this time of bear market gave them the opportunity to prepare and join in.” , he pointed Benitez.

FinTech South Hub

The Fintech Chamber seeks to unite the different actors in the financial and technology sector to offer a better user experience at a lower price and reducing intermediaries. It also encourages networking and collaboration between companies and promotes knowledge of what is being done in other parts of the world.

Rodrigo Tumaian, president of the Uruguay Chamber of Fintech and co-CEO and co-founder of Prometeo Open Bank He also spoke with Ambit about the importance of this regional event. “This meeting is the spirit of the chamber, of collaboration, but with one more step, which is not only to collaborate among ourselves as Uruguayans, but also to demonstrate what we are doing and, in turn, bring people from abroad so that show what is being done outside,” he highlighted.

Tumaian highlighted that “Uruguay It has a mix of financial stability and quality of life and quality of professionals that is very good. So, I think that positions us well at the business level, at the regulatory level” and he noted: “I think that the central bank is taking steps in favor of regulations that put us ‘within reach’ in what are issues of instant payments, which is soon to be released, but also issues such as open banking and crypto issues. “So, in that scenario, there are some things that we are still running from behind,” he concluded.

Source: Ambito