The fiscal scenario deteriorated rapidly and everything indicates that the problem goes beyond the current situation. Although there is an effect of the situation in Argentina and – to a lesser extent – of the drought, there are underlying issues that are not resolved.

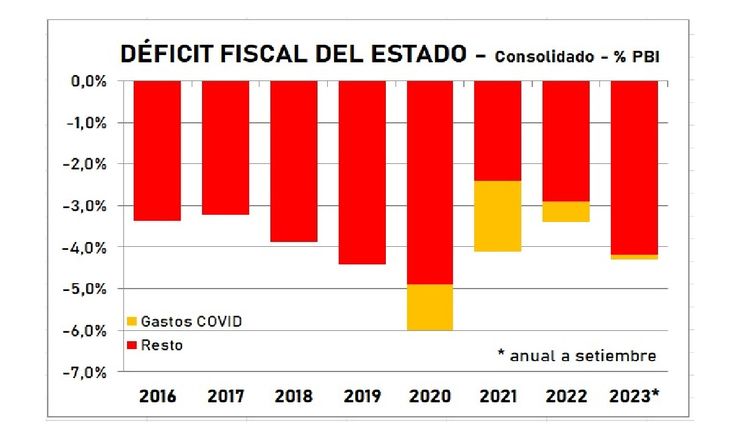

He fiscal deficit of the Uruguayan State rose to 4.3% of GDP in the moving year to September, according to the Ministry of Economy and Finance (MEF). This is equivalent to about US$3,230 million. Uruguay has good access to credit to meet its financial obligations, but the increase in the deficit puts pressure on that high-quality position with Investor Grade. It must be remembered that the deficit is measured in relation to GDP and it is correct, with the understanding that – in the long or short term – the State’s ability to finance its expenses depends on the collection at all levels, and this depends on the performance of the economy. But we must not lose sight, particularly when thinking about how to reduce the deficit, that in terms of income and expenditures what enters the State today covers only 87% of what is spent. In other words, the deficit over total spending is 13%.

The content you want to access is exclusive to subscribers.

The fiscal situation is worrying in itself, but even more so when the immediate scenario (next year) is considered, at different levels. On the one hand – we have commented on it in this column – the increase in the international interest rate is going to add spending pressure to the interest account, both at the business level and in the State itself. This will negatively impact activity and spending, in a dimension that is difficult to estimate, but will surely be significant. The US Federal Reserve decided this week to maintain the reference interest rate and the labor market in the US was weaker than expected, all of which increased the chances that the Fed will complete its hike cycle and eventually begin to lower the interest rate. It would be the best for Uruguay, but it won’t be fast; The outlook is one of high real interest rates, as was not the case years ago.

On the other hand, it was reported this week that the real salary has continued to increase in year-on-year terms, both at the private level and particularly in the public sector. It is no secret that this is a key factor for the fiscal result: salaries make up more than 60% of the State’s total expenditure so that their real evolution very importantly determines the fiscal result. Something similar can be said of the retirements. And it is difficult for the government to make decisions that imply a setback on this level: the commitment to recover salaries to pre-pandemic levels has already been fulfilled (even with some advance), and it is unlikely that this will change, especially in a election year.

Finally, and linked to the previous one, the economy is having problems of competitiveness. After a cycle of increases in export prices, linked to the post-pandemic exit and firm demand in certain markets, such as Chinaexport prices fell, due to China’s own difficulties and the strengthening of the dollarInter alia.

Consolidated fiscal deficit

They are not bad prices in historical comparison, but with the current levels of state spending – and therefore internal cost pressure in the country -, competitiveness suffers and – therefore – it is difficult to consider a scenario of improvement of collection in 2024 due to a strong economic revitalization. Possibly there is in the agriculture, as the climate normalizes, and some other sectors could join. But this – surely – will not be enough to appreciably improve the fiscal situation. Of course the situation in Argentina It is also having a very hard impact on the local collection. There is an increase in spending by Uruguayans in the neighboring country due to the exchange differencewhich means that a good part of the potential collection that may exist in the Uruguay due to the increase in employment and salaries, go to the other side of the river. And the matter does not seem to be changing, nor even the electoral panorama in Argentina resolved.

Risks

The risk rating agencies They are watching this situation carefully. He fiscal deficitIt has returned to levels similar to those recorded in 2019, despite the withdrawal of expenses associated with Covid (those expenses that Minister Arbeleche aimed to “encapsulate”) (graph). Although they recognize the incidence of cyclical factors such as drought, they see structural changes: social spending increased, there were tax cuts and payments for PPP contracts increased. Some analyzes also indicate that tax collection (in Uruguay and in many other countries) had a boom in 2021-2022, which now appears to be declining. It is one of the effects of the pandemic and post-pandemic period that distorted the evolution of economic variables and is now beginning to clear up.

The rating agencies have put Uruguay 2 steps in the Investment Grade and are cautious when evaluating and making possible changes. But today’s deficit figure in Uruguay is much higher than what they have on their payroll. And more than one point higher than the government’s own projection in the last rendering of accounts (3.2%).

Source: Ambito