The sector is dynamic and demand is growing alongside the increase in real wages and employment.

He Uruguayan real estate market has been dynamic in the last year, with firm demand associated with the increase in real wages and employment. In the real estate purchase and sale market, there were more than 50,200 transactions in the moving year to August, according to the INE, which constitutes a historical record. Prices – measured in dollars – rose 9% average annualwhich implies almost stability in real terms.

The content you want to access is exclusive to subscribers.

Regarding the housing supply for medium and medium-high sectors, the Promoted Housing continues to show dynamism. This regime, established in 2011 (law 18,795), grants broad tax exemptions (income, VAT, assets, ITP) to housing investors who join. Obviously, there are conditions: projects established in certain prioritized areas, where the supply wants to increase, can access the benefits. In Montevideo, It targets more central neighborhoods with potential for appreciation, outside the coast, which is the traditional area with the highest real estate value. The same concept is proposed to promote projects in the rest of the country.

According to the data of the ANV (National Housing Agency) the program already accumulates 1,270 projects promoted covering 33,812 homes. To that we must add 101 more projects under study, which involve 3,714 additional homes. So the program would already be reaching an offer of almost 38,000 homes From his beginning. Of that total, more than half have already been marketed. It should be noted that the developer keeps many of the homes on his property to put them on the rental market.

The program had experienced some stagnation after some additional conditions were imposed on the projects in 2017, such as price caps and the obligation to offer a portion of the homes to government programs. Ministry of Housing. These changes were reversed at the beginning of the current administration, also making the type of construction covered more flexible (for example, the promotion of studio apartments is accepted). According to investors, this determined a reactivation of the program: About 180 projects are presented per year, double what was happening before the changes.

According to information from the ANV, the average sales price for homes in promoted projects is in 2,377 dollars per square meter, 12% higher to that recorded a year ago. When measured in UI (inflation-indexed units), the increase is modest (1-2%). And if we consider that in the last year the salary rose above inflation, it can be said that – on average – employees have improved their ability to purchase homes.

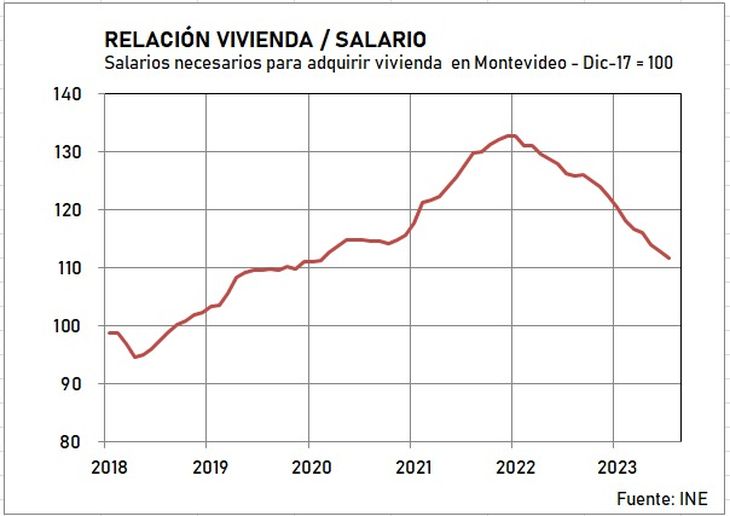

The attached graph shows the evolution of the relationship between housing price and salary, taking the INE Average Nominal Wage Index (IMSN) and the median price of homes in Montevideo (also from INE). It is observed that the purchasing power of the salary with respect to housing has improved and returned to the pre-pandemic level.

IMG-20231109-WA0153.jpg

Evolution of the relationship between housing and salary in the Uruguayan capital.

Demand improves, credit improves

The improvement in demand has its correlation in credit. With the aforementioned improvement in salary and employment, credit for home purchases has been increasing. According to the latest data from Central Bank (BCU) active mortgage credit amounts to 133,000 million pesos figure top 10% -in real terms- to what was registered in 2019. Almost all mortgage credit is granted in pesos indexed to inflation (UI) with strong competition between the different banks. When measured in dollars Mortgage credit exceeds 3.32 billiona figure 30% higher than that of 2019.

In fact, mortgage credit is granted almost entirely in Uruguayan pesos, the currency in which the vast majority of Uruguayans earn their income. But real estate market for buying and selling properties is nominated in its entirety in Dollars Americans. This monetary dissonance is classified by many analysts and market agents as a problem that implies costs for the market, and that it would be very good to overcome. In markets such as Brazil or Chile, real estate sales are made in the local currency.

Even in an auspicious context, the prospect of long-term debt is not for everyone and the option of rent it’s key. According to data published by the INE, the new rental prices rose 8.6% year-on-year in September, slightly below the salary (8.9%). Taking current contracts, the year-on-year increase is 6.3%.

Source: Ambito