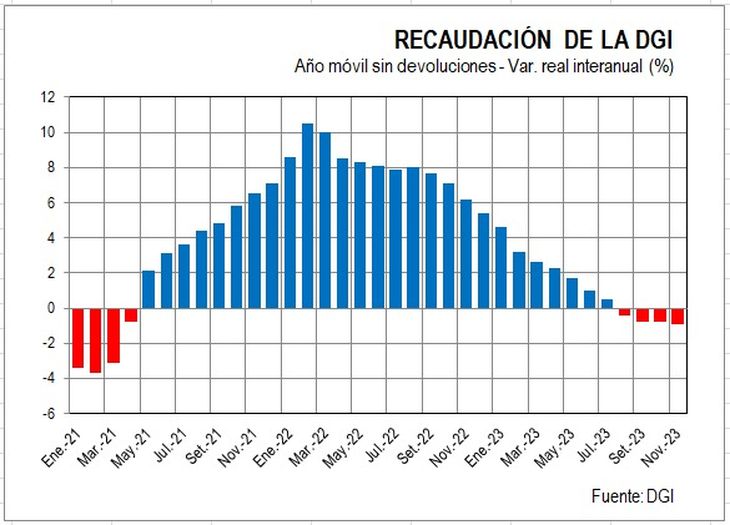

The accumulated decrease responds to a decline in income from all taxes, except for personal income tax and Wealth Tax.

After a year-on-year recovery in October, the collection fell 0.9% in November, compared to the same month in 2022. The decrease occurred mainly in the collection of Specific Internal Tax (Imesi) by 10% and Tax on Income from Economic Activities (IRAE) by 11%. On the contrary, the collection of Value Added Tax (VAT) improved 3.7% compared to November 2022.

The content you want to access is exclusive to subscribers.

Since the taxes They may have monthly movements due to special situations, it is illustrative to analyze what happens with the accumulated data so far this year. In this calculation, collection fell 0.9% in real terms (discounting inflation) compared to the same period last year (coincidentally, the same variation as in the monthly year-on-year).

In the accumulated, all taxes showed declines, except for labor income tax, which increased 2.8%, and Wealth tax, which grew 3.4% in real terms in its collection. VAT collection fell 1% in real terms, and IRAE collection fell 4.5%. Revenue collection also fell sharply (31%). Tax on the Disposal of Agricultural Assets (Imeba) which is applied as tax to agricultural sales and that—in most cases—is an advance from the IRAE. The drought is the explanation for the fall, as well as the drop in several prices, especially for livestock producers.

DGI.jpeg

Imesi

In the case of the Imesi, the drop is 3% compared to 2022, with a significant decrease in the collection of the Imesi for fuels of 4.7% and in the Imesi for automobiles of 4.9%.

The latter may be contradictory with the increase that has been registered in sales of zero-kilometer vehicles (almost 10% higher than last year), but it must be remembered that automobiles are sold in dollars, and the US currency fell almost 12% in its real value in the first 11 months of the year in Uruguaycompared to the same period in 2022.

Structure

55.6% of the collection corresponded to VAT and Imesi, 36.4% to income taxes (IRAE, IRPF, IASS) and 6.4% to property taxes (mainly Heritage). It is a structure that has not changed much compared to 2019, although there is a drop of more than 1 point in the collection of income taxeswhich is explained by the fall of the IRAE and Imeba, mainly.

Source: Ambito