Once fintech dLocal grew, to the point of going public in the Nasdaq and become the first unicorn Uruguay, Rodrigo Sánchez Prandiwho served as SVP of Product and remained linked to the company for almost six years, internally felt that a stage had ended.

In June 2022, Sánchez Prandi decided to leave the company to embark on his own path, in a quest to create something from scratch. In the same vein, the also exdLocal Michel Golffed He was partnered early last year to co-found Brintaa startup that seeks simplify tax payment in Latin America.

One of the things they both noticed when working together at dLocal was how complex the tax issue was throughout the region, generating recurring queries from clients. In dialogue with AmbitSánchez Prandi explained that it was then when they understood that “there might be an opportunity there.”

“We began to understand the system a little, to put together the team and look for financing,” says the now COO of Brinta. Between February and March, the startup raised an unexpected figure of $5 million in its first investment round, something that quickly forced them to consolidate the team and grow at the technology level.

The businessman acknowledges that “they did not expect” such an investment amount, since the original idea was based on two objectives: funding and finding the right partners to take the path.

“We were told that, luckily, we had very good receptions from the different funds, both regional and global, of USA, Europe and else. That allowed us to choose who to partner with,” she details. Kaszek Venturesa Latin American venture capital firm, led the funding.

“We said ok, let’s take advantage of it, because we can work more aggressively at a commercial and growth level,” says Sánchez Prandi. “Working with Kaszek was very good to be able to have partners who not only give you the money, but also help you with their experience in other startups“, he stated.

Tax Taxes Rates

Photo: Pixabay

The work of making the difficult easy

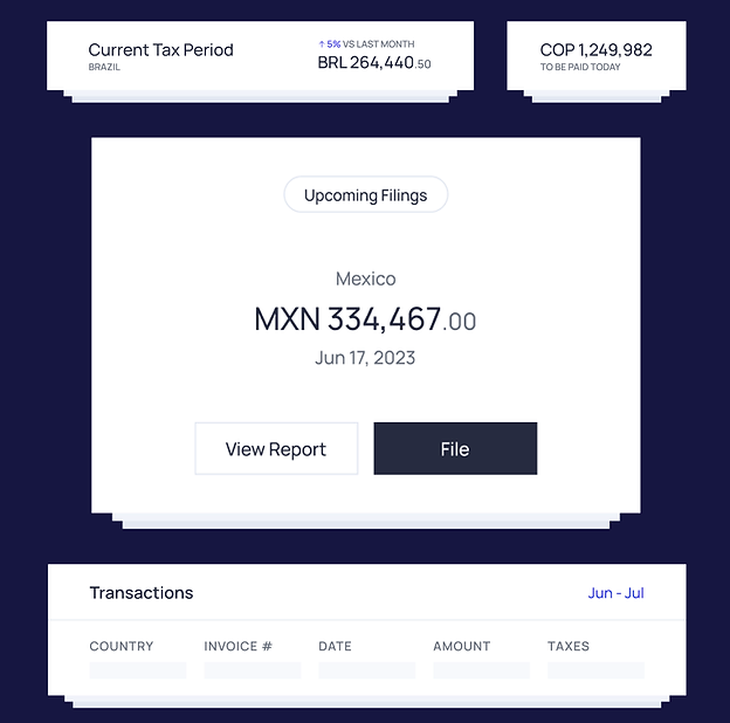

For Sánchez Prandi, developing a platform that allows calculating taxes in real time using a single API—Application Programming Interface—for all countries, in addition to tax returns, billing and customizable reports, was an attractive challenge, mainly due to the “unsexy” nature of Latin American tax systems.

Brinta’s goal is to be able to synthesize this tax tangle into something “much more standardized, so that they can work in the same way in Mexicoin Brazil and in Chili“he noted.

The development process changed a bit from the beginning, since what the two partners first thought of was more oriented towards calculations of taxes in real time via app. However, they saw that there was greater reception “in the automation of the creation of forms and obligations towards the treasuries.”

This tool, highlights the interviewee, allows “to present them in an automated way to the AFIP (Argentina)the DGI (Uruguay)the DIAN in Colombia or the SAT in Mexico” and “it is growing a lot among our clients.

“You do that, growing and understanding each country, abstracting the core of each tax return and giving that flexibility to the platform so that it can get into every smallest detail, to be able to pay a commercial rate of Cordova (Argentina) in the same way that you can present a declaration in Mexico,” he pointed out in this regard.

One of the company’s main virtues is the ability to automate tax reporting processes in minutes or seconds, when traditionally it takes several hours or days. “Being able to create that form and have it ready to present it to the treasuries; being able to generate cross controls at the accounting level and at the tax level so that there is no discrepancy at the level of information,” he explains.

Currently, Brinta, whose headquarters are located in Uruguaybut was born looking at the continent, it works mainly in the six main Latin American markets: Argentina, Brazil, Chile, Colombia, Mexico and Peru; although also in Bolivia, Uruguay and several countries Central Americawhere they have specific clients.

Although each country presents different degrees of complexity, Sánchez Prandi assures that “Brazil is hyper-complex because of how the tax structure is being set up at the national, state and in each prefecture level. You can see all the changes that are being made to bring that to something more standardized and more similar to the VAT that exists in other countries”.

Brinta Tax.webp

Image: Brinta

“The product is something alive, that matures”

Sánchez Prandi affirms that, in the search for excellence when providing a service, “the product is something alive, that matures”, since it is always “changing and looking for how to give value to customers in different ways” .

“Going forward we see it very focused on customers and led by customers. There we have to try to understand where the product-market fit is, where we can grow in that sense. I think the market gives you the answer,” he stressed. .

The operations director also stated that they put more focus on what they themselves are doing, rather than on the competition to face, based on a back-and-forth with their own clientele, something that allows them to better diagram where the product will go. in the future.

Source: Ambito