The market bet throughout last year on this instrument, which moved transactions for US$409.7 million.

He future dollar recovered in 2023 and managed to operate a volume of 409.7 million dollars, giving an example of the clear growth of the market during the past year, after a 2022 in which this instrument failed to attract investors. investors.

The content you want to access is exclusive to subscribers.

The operations of future dollar They increased by 174.4% year-on-year compared to 149.3 million in 2022 and, although they are still far from the high levels of 2014 and 2015, they managed to mobilize the fifth largest volume in history, according to data from the Uruguayan Electronic Stock Exchange (Bevsa).

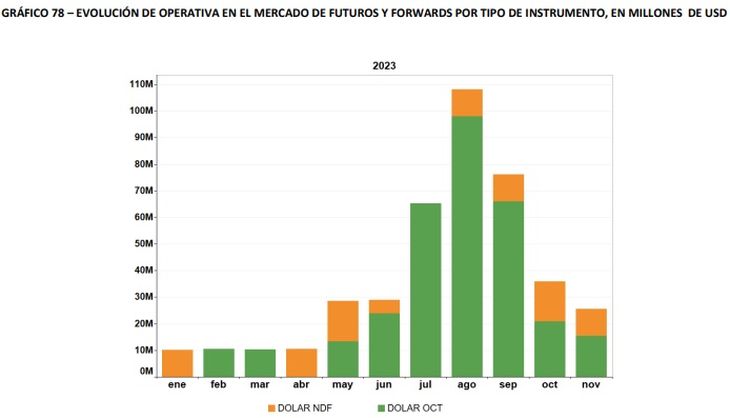

The month with the highest traded volume was August with monthly operations of 108.2 million dollars, while the lowest level of transactions was in January, when that amount reached 10.2 million.

When disaggregated on a monthly basis, the data for 2023 were as follows: January, 10.2 million; February, 10.4 million; March, 10.3 million; April, 10.4 million; May, 28.5 million; June, 28.9 million; July, 65.2 million; August, 108.2 million; September, 76.1 million; October, 36 million; and November, 25.5 million.

Meanwhile, December closed with 14 open contracts of dollar OCT, for a total of 227 million dollars, while on the 26th of that month a contract expired.

Also, the Dollar OCT was the exchange rate that contributed the most to operations (78.9%), operating a volume of 323.3 million, while the remaining 21.1% corresponded to the NDF dollar, which operated 86.4 million and grew strongly compared to 2022, when it operated only 0.4 million dollars.

Bevsa Graphic.jpg

Spot Dollar operations grew by 10.7% in 2023

For its part, Bevsa reported that the operation of the Dollar Spot It was 5,490.1 million in 2023, which means an interannual increase of 10.7% compared to 4,959.6 million in 2022, far from the historical record of 2019 (7,785.2 million).

At times when the analysts consulted by the Central Bank of Uruguay (BCU) expect a rise in the US currency in the exchange market, the price of the Dollar Spot It ended 2023 at 38.85 pesos, which is 0.66% less than the end of November (39.11 pesos).

Finally, Bevsa reported that the last participation of BCU in the market of Dollar Spot It was to buy 31.2 million in August 2021, meaning that the monetary authority has not intervened for more than two years.

Source: Ambito