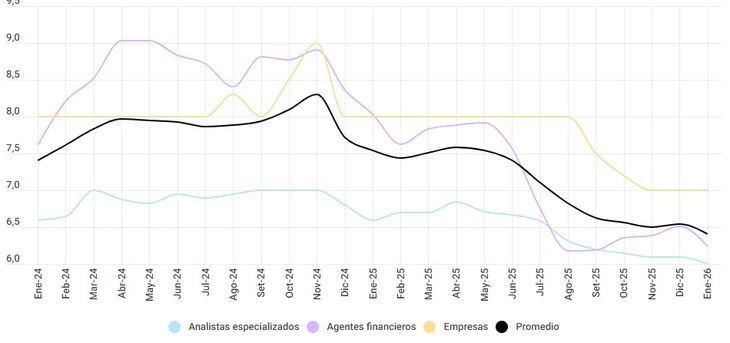

Economic agents expect an average CPI of 6.4% in the monetary horizon, above what the BCU predicts.

The inflation expectations of economic agents fell for the ninth consecutive month, but remain above the ceiling of the target range established by the Central Bank of Uruguay (BCU).

The content you want to access is exclusive to subscribers.

Despite the latest data from inflation, The average of the forecasts was 6.4% for the next 24 months, exceeding the maximum 6% that the government aims for and exceeding by 110 basis points the 5.3% that the BCU anticipates in the horizon of monetary politics.

Beyond the discrepancy between both projections, the expectations of the different actors improved for the ninth consecutive month. In the case of analysts, they fell 0.1% in January compared to last month and are in the minimum registration of the series.

The same happens with the forecasts of the businessmen which measures the INE, which remained at 7%, their lowest point in history. Meanwhile, the financial markets During the last month, they reduced their expectations by 27 basis points, implicit in the differential of returns of nominal and indexed securities, remaining at 6.24%.

Inflation expectations.jpg

Inflation remains consistent within the target range

Meanwhile, the CPI annual is 5.09% and is within the target range for the eighth consecutive month, after entering for the first time in June, when it fell from 7.1% in May to 5.98% that month

From there, it marked ups and downs, but always within the expected limits. At times it even approached the floor of the target range, with its lowest value recorded in September, with an inflation of 3.87%, the minimum of the indicator in 18 years.

Looking ahead, analysts agree that the CPI will trend downward in the first semester 2023, although it will begin to rise in the second part of the year. This situation could lead to it slightly exceeding 6%, according to some estimates.

Source: Ambito