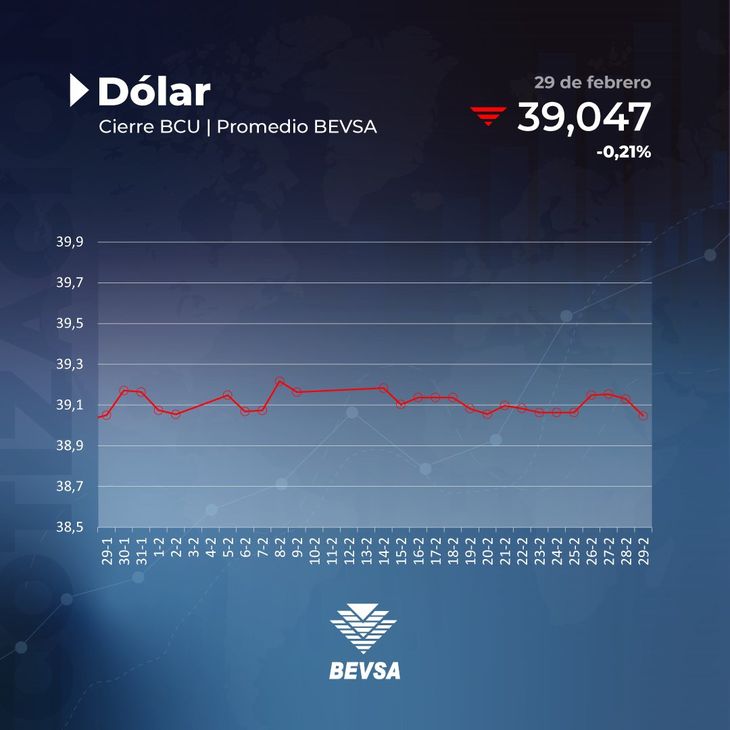

The bill fell 0.21% this Thursday and consolidated a negative month, according to data from the Central Bank of Uruguay.

He dollar fell 0.21% compared to Wednesday and closed at 39,047 pesos, according to the price of the Central Bank of Uruguay (BCU), so that the US currency was one step away from falling back to the range of 38 pesos.

The content you want to access is exclusive to subscribers.

With this fall, the note culminated a negative February, in which it depreciated 0.30% and moved away from the value expected by the market. However, thanks to the increase accumulated in January, the dollar It maintains an appreciation of 0.06% so far in 2024.

On the reference board of the Republic Bank (BROU)he dollar Retail ticket was offered at 37.85 pesos for purchase and 40.25 pesos for sale. For its part, the preferential value of eBROU dollar It was at 38.35 pesos for purchase and at 39.75 pesos for sale.

The closing price of the day in the Uruguayan Electronic Stock Exchange (Bevsa) It was 39,030 pesos, while the maximum price was 39,150 pesos, and the minimum was 39,030 pesos. On this day, the number of transactions was a total of 23, with a transaction amount of 12.3 million dollars.

The crypto Tether (USDT)1 to 1 parity with the dollarwas quoted today at an average of 41.20 pesos for online purchases through a bank or card, and from 41.20 pesos to 43.06 pesos in the Binance peer-to-peer (P2P) market.

Bevsagrafi.jpg

Inflation fell in the United States and could put pressure on the dollar

The inflation in USA fell in January in the annual measurement, reaching 2.4% according to the index PCE, the one preferred by Federal Reserve (Fed), that in this way it could accelerate its decision to cut the interest rate, which would weaken the dollar on a global scale and cause a logical impact on the Uruguayan exchange market.

The Fed aims to lower inflation to 2%, at a time when it took rates to their highest level in the last 20 years, leaving them in the range of 5.25-5.50%. “Inflation is close to the target,” he stressed. Rubeela Farooqi, chief economist at High Frequency Economics, echoing the new data.

“PCE inflation has not risen as much as other inflation measures, indicating that the Fed could begin its long-awaited rate cuts this spring or early summer,” the economist said. Robert Frick, of Navy F, referring to the coming months.

The dollar over the past five days

- February 22 — 39,083

- February 23 — 39,063

- February 26 — 39,148

- February 27 — 39,153

- February 28 — 39,129

Source: Ambito