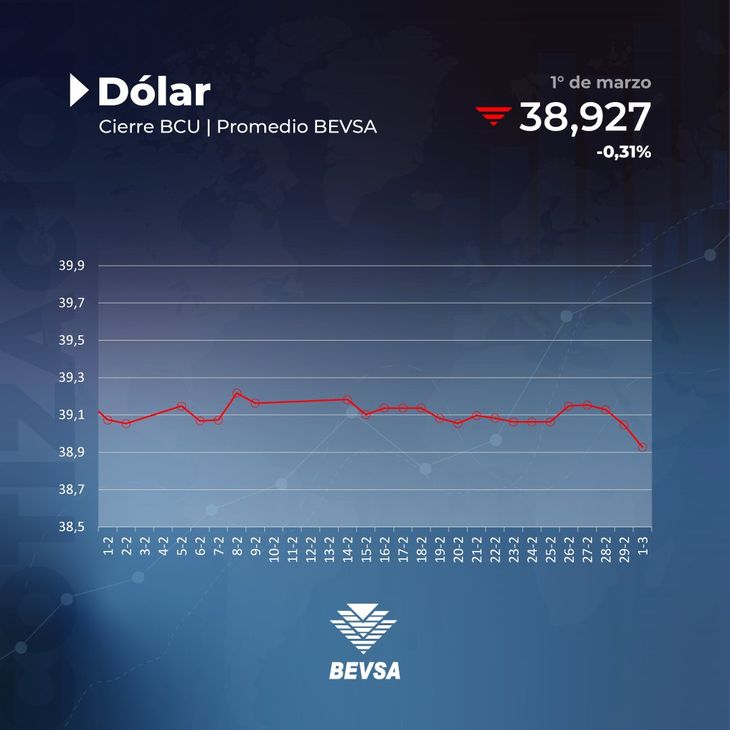

The banknote opened the month with a daily drop of 0.31%, which took it to levels it had not reached since the end of January.

He dollar fell 0.31% compared to Thursday and opened March at 38,927 pesos, completing its third consecutive decline and falling back to the range of 38 pesos after more than a month, according to the price of the Central Bank of Uruguay (BCU).

The content you want to access is exclusive to subscribers.

With this decrease, the US currency broke the positive trend in the accumulated year, remaining 0.24% below the price it was worth at the end of 2023. In this way, the dollar It continues to move away from the value expected by economic agents, around 39.20 pesos.

With respect to the reference board of the Republic Bank (BROU)he dollar Retail ticket was offered at 37.65 pesos for purchase and 40.15 pesos for sale. For its part, the preferential value of eBROU dollar It was at 38.15 pesos for purchase and at 39.65 pesos for sale.

The closing price of the day in the Uruguayan Electronic Stock Exchange (Bevsa) It was 38,920 pesos, while the maximum price was 39 pesos, and the minimum was 38,900 pesos. On this day, the number of transactions was a total of 28, with a transaction amount of almost 15 million dollars.

The crypto Tether (USDT)1 to 1 parity with the dollarwas quoted today at an average of 41.35 pesos for online purchases through a bank or with a card, and from 41.35 pesos to 43.13 pesos in the Binance peer-to-peer (P2P) market.

Bevsagra.jpg

Do investments impact the decline of the dollar?

The government recently sealed a memorandum of understanding with the company HIF Global to build a plant green hydrogen in Paysandu, which will represent an investment of 6,000 million dollars, the largest in the history of Uruguay.

However, in a context of dollar “ironed”, the injection of dollars into the economy could put downward pressure on the exchange rate and deepen the exchange delay, While the competitiveness He has been losing for 24 straight months.

Something similar had happened with UPM 2, when in 2022 the value of dollar fell 10.35%, amid the inflow of foreign currency by the Finnish company for the construction of its second plant, which is already operational today.

The dollar over the past five days

- February 23 — 39,063

- February 26 — 39,148

- February 27 — 39,153

- February 28 — 39,129

- February 29 — 39,047

Source: Ambito