The total amount was US$16.5M and investors value the country for the stability and direction of the economy, according to a study by CPA Ferrere.

80% of the investments of private capital Uruguay They concentrate on ventures linked to technological innovations, in tune with what is happening internationally, according to a study carried out by CPA Ferrere.

The content you want to access is exclusive to subscribers.

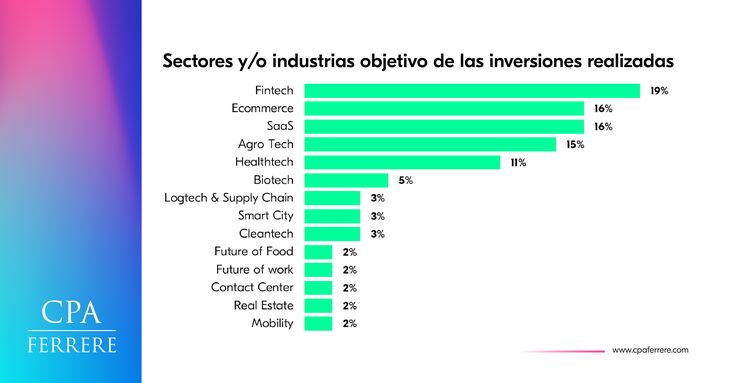

The total capital invested was 16.5 million dollars, with an average ticket of about 380 thousand dollars, while 8 out of 10 investors decided on investment firms. fintech, E-commerce, IT companies with SaaS, Agrotech, Healthtech and Biotech models. Meanwhile, they value the country for the stability institutional and the direction of the economy.

This is clear from the CPA Ferrere survey among the partners of Urucap, an institution where venture capital firms, seed companies, angel investors and companies from various fields come together. These investors participated in 72 investment rounds between 2020 and July 2023, with 2022 being the most active year, totaling 28.

Regarding the profile of each one, institutional investors bet mostly on Venture Capital, implying investments of capital in emerging companies with high growth potential, which raise funds for their expansion and growth stage. Instead, individual investors turned to the Seed Capital, That is, the first financing that companies receive in their initial stage.

Regarding duration, the majority demonstrated their interest in long-term investments. medium term, between 3 and 7 years. In turn, a third of investors declare having made impact investments, with environmental focus, while 1 in 6 have a strong tendency to invest in projects led by women.

CPA inver.jpg

What attracts investors to Uruguay?

The business environment in the country has desirable characteristics for investors, according to CPA Ferrere, among which institutional stability stands out, with issues such as a low level of corruption, a regulated banking system and the GDP highest per capita in the region.

Another important issue is the free flow of capital and investment promotion regime, with fiscal benefits and tax exemptions, as well as a high credit rating that took it to investment grade.

The growth of the Foreign direct investment (FDI), which explains 4% of the total Latin America, success stories such as the development of dLocal and the growing interest in Uruguayan ventures are other points to highlight.

Source: Ambito