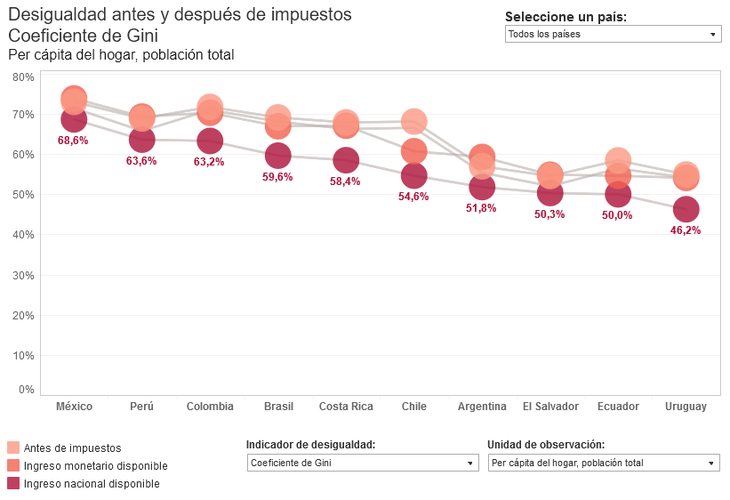

The country came last in the measurement that includes the distribution of income before and after taxes, with 46.2% of disposable income in the hands of the richest 10% of the population.

Uruguay has the smallest inequality of Latin America in the comparison of household per capita income before and after the application of the taxes. However, economic concentration remains high—although it is also the lowest in the region—with 46.2% of income in the hands of the richest 10% of the population.

The content you want to access is exclusive to subscribers.

A study of the portal distributions.info, by economists Mauricio De Rosa, Ignacio Flores and Marc Morgan, on distribution of economic growth in Latin America, recorded that Uruguay It is the country in the region that has the lowest level of inequality. In this sense, if the per capita household income is measured in the total population, the national disposable income in the hands of the richest 10% is 46.2%.

The report particularly analyzes household disposable income once taxes are subtracted and social transfers monetary, such as assistance programs for the poorest sectors of the population. And the general conclusion is that the impact of monetary redistribution It is marginal in almost all Latin American countries, something that is observed by the minimal variations between income before taxes and available monetary income.

National disposable income.png

Uruguay has the highest income distribution in Latin America.

In any case, and despite the fact that inequality remains high – considering that almost half of the national income is concentrated in just 10% of the population -, Uruguay is the best in the measurement that also includes Mexico (68.6%), Peru (63.6%), Colombia (63.2%), Brazil (59.6%), Costa Rica (58.4%), Chili (51.8%), Argentina (50.3%) and Ecuador (fifty%).

More distribution but more taxes

According to a study by Inter-American Development Bank (IDB) to establish the Equivalent fiscal pressure (PFE), Uruguay It is the third country with the highest tax burden in Latin America, ranking only below Argentina and Brazilcountries that have a significant tax burden, which many economists consider excessive.

In the case of the country, the State does not have additional income from the exploitation of natural resources, but it does establish mandatory contributions to the social Security for the individual savings pillar, which are added together to establish your own PFE level.

In fact, even excluding the additional income, Uruguay is close to the podium (disputes third place with Barbados, small Caribbean nation). The PFE is almost at 35%. Without the additional income, the tax burden still exceeds 31%.

Source: Ambito