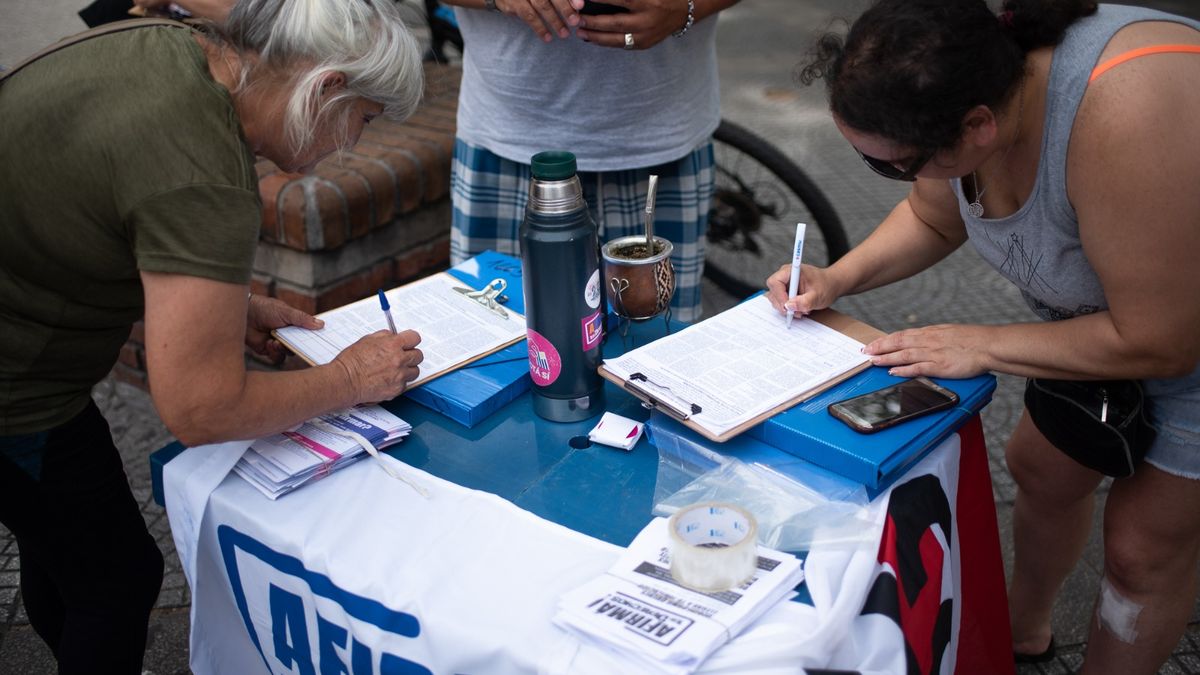

He PIT-CNT is getting closer to reaching the threshold of 270,000 signatures necessary to enable the plebiscite against social security reform in Uruguay, with a proposal that proposes a minimum retirement age of 60 years, a pension tied to the national minimum wage and the elimination of individual savings, the AFAP and profit in the pension system.

In this context, concerns are growing both from the government – and the political system, in general – and from specialists in social security and economics, who from the beginning warn about the negative consequences of a Constitutional reform like the one promoted by the union center; especially regarding the sustainability of the pension system, one of the priorities when moving forward with law 20,130.

This also happens due to the anchoring of the minimum pension asset to the national minimum wage: Both points result in greater passivities and, therefore, in a strong instantaneous increase in public spending, as warned by the partner of Exante, Pablo Rosselli.

In this sense, the director of the Center for Studies of Economic and Social Reality (Ceres), Ignacio Munyopointed out that “more than 1.1 billion extra dollars per year would be needed to equalize retirements and pensions to the national minimum wage,” arguing that they are resources that the country does not have and that they are equivalent to 1.5 of the Gross Domestic Product (GDP).

Likewise, lowering the retirement age to 60 years represents an increase in estimated spending of around 3,000 million dollars, including the B.P.S. now the boxes Military, Police and Parastatals, equivalent to 4% of GDP.

“Spending on retirements and pensions is going to skyrocket and we are not going to be able to attend to the priority, which is youth and childhood,” the head of the Ministry of Labor and Social Security (MTSS), Pablo Mieres.

Tax increases and regressivity

Economists agree in pointing out the regressive nature of the plebiscite of the PIT-CNT, while it would mean an increase in taxes like the Activity Income Tax Business (IRAE)he Wealth tax and the highest bands of the Personal Income Tax (IRPF). Although it is about charging more to those who earn more, for Munyo this would mean “serious damage to private investment and the future growth of the economy.”

For his part, Rosselli pointed out that the reform promoted by the union center “acts to the detriment of the younger generationswho are the ones who suffer the most from poverty and unemployment and who will have to endure greater tax pressure” to sustain a pension system expanded by the minimum retirement age of 60 years.

Legal uncertainty and trials of the State

Another consequence of an immediate rule change of such magnitude as a constitutional reform in security matter social would be the legal insecurity that would be caused, “not only by the confiscation of the savings managed by the AFAPS but because it also calls into question the 1996 reform,” Rosselli warned.

Mieres also pointed out that the project PIT-CNT It would mean “failing to comply with its obligations to almost 1.5 million Uruguayans who have personal accounts in their name and they would be confiscating them improperly and illegitimately.” This could also lead to a huge amount of trials to the State.

“It is feasible that members will file lawsuits for the confiscation of the savings managed by the AFAP (22,000 million dollars),” considered Munyo, in this sense. He even anticipated that “the AFAP could do the same, claiming lost profits for the commissions provided until the members retire.”

Loss of international confidence

All of the above would undoubtedly lead to a loss of international confidence since Uruguay’s greatest advantage compared to the world is, precisely, its legal security. Furthermore, the unsustainability of the pension system would raise doubts in most—if not all—potential investors.

In this regard, the same investor grade of the country would be at risk, as even Mieres warned.

Regarding this, Munyo recalled that “Uruguay It was obtained after the pension reform of 1997, it was lost with the crisis of 2002, it was recovered a decade later and it was only now solidified thanks to the pension reform underway”, which is why it is a complex process.

Reduction in private savings and complications in income distribution

The approval of the plebiscite would also lead to a reduction in private savings, due to the ban. “People with higher incomes will look for alternatives abroad, as shown by international evidence,” Munyo anticipated.

In parallel, it would represent regressive effects on the income distribution, since “higher-income contributors will have incentives to reduce their contributions and benefit disproportionately from the minimum benefits of the new system.” “Inequalities” are also reintroduced to the system, with the reversal in the unification of funds with different benefits for similar contributions.

Likewise, Rosselli considered that “the indexation of minimum passivities to the National Minimum Wage “It will end up encouraging future governments to delay the minimum wage, as happened until 2005.” While “it is the people with better careers and higher incomes who can accumulate 30 years of service at the age of 60”, while “those with lower incomes will have to work beyond the age of 60, even if this reform is approved.

Source: Ambito