The price of rentals fell almost 10% measured in terms of the purchasing power of the salary, according to data from the INE. The role of Promoted Housing and political proposals.

He real-estate market is key in the economy, both as a field of investment as by directly and indirectly determining an important part of the cost of living of families, such as the cost of housing. In the decades when Uruguay had interesting growth and improvements in quality of life levels – in the middle of the last century – the rental market It had a key role in enabling families to access housing. When the country went into decline, starting in the ’60s, the real estate supply began to decrease and measures also began to be taken that – with the intention of easing the burden of rent on tenants – ended up affecting and reducing investment in new housing, and with it the rental market itself. Associated this with the successive economic crises that the country suffered from those times, the real estate market of the Uruguay It began to be distorted, dollarized and – in popular housing – to show increasing levels of informality, something that still persists if historical data on settlements are looked at.

The content you want to access is exclusive to subscribers.

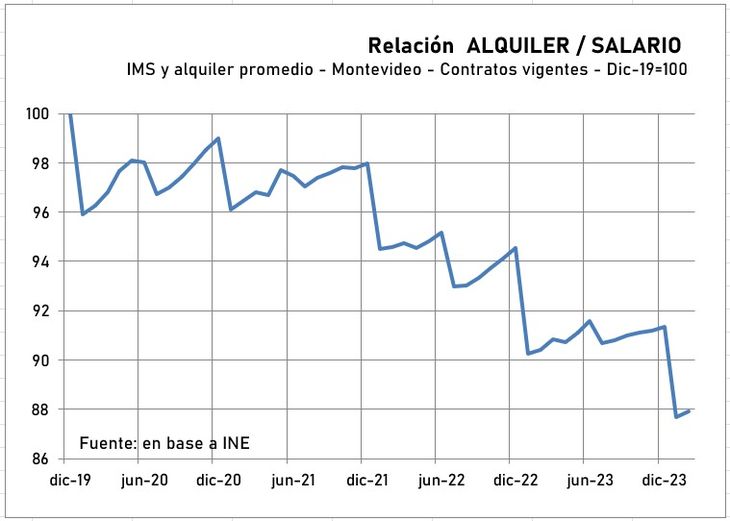

However, in the last 20 years – after the 2002 crisis – the Uruguayan economy improved, and along with it the salary levels and – consequently – the ability to access housing, both in terms of purchase and rental. This trend was interrupted by the pandemic and the decline in real wages in the immediate years, but was resumed again from 2021 to today, with a consistent increase in the purchasing capacity of the salary regarding rent. In fact, the attached graph illustrates the trend of the relationship between rent and salary observing a permanent drop, which in the last year is almost 3%. This means that – on average and according to data from the INE- 3% less salary is required for an average rental. Obviously, in current terms rents have had an increase that has been around 6%, but in that same period salaries had an increase of 9% or more, which results in the aforementioned drop of 3% in real terms. .

Data from one year says little about the general trend, so a broader comparison is of interest. If we take the current data compared to the situation in the months prior to the arrival of the pandemic, the rent/salary ratio had an even more pronounced drop, of 9%. Indeed, in that period of almost 4 years, rents rose 25% on average but salaries rose 37%, in current pesos. These are average trends and – of course – there are important variations depending on the neighborhood and locality, but the trends are conclusive.

Rental-Salary Chart.jpg

Surely due to a certain idiosyncrasy, and due to recurring crises, in Uruguay The goal of owning one’s home has been prioritized, even at the most modest levels. But in an economy that prides itself on greater stability, security and better performance (if it weren’t for Covid, we are already going 22 years without a crisis), rent It would seem to be the fastest and most reasonable way to access housing on a massive scale; even more so with the numbers shown. It is also a formal way and – in general – more integrated into the urban grid, which has its extra virtues (positive externalities).

The role of promoted housing

In it real-estate market Of course, various types of investment and participation operate. Cooperativism has historically been very active and continues to be so today, including the union housing plan. And the program of Promoted Housing.

This program includes investment projects who access tax exemptions, provided that they are located in certain areas defined by the departmental regulations in each municipality. It started in 2012 and has had undoubted success, despite some political discussions. The germ of these questions lies, surely, in their origin. Conceived in the APPCU (Association of Private Construction Promoters of Uruguay), was proposed as a program to increase real estate supply and urban development; but the government of the moment (Mujica, FA) It sought a social objective and associated it with housing solutions for middle or middle-low income families. Hence its original name (Social housing).

The program energized the market, mainly covering demand from medium or upper-middle households; but with indirect effect on the whole. Even so, its initial profile was not liked and the government of the moment and the next sought to impose measures to limit prices and force part of the supply to be allocated to social objectives. Result: retraction of investment. With the current government, these limitations were lifted and the program was reactivated, today being one of the pillars to sustain the construction employment. According to the latest data, the program has already approved 1,363 projects that include 36,593 homes; There are 98 projects under study that would add 3,811 more homes, bringing the total to 40,404, almost 4,000 per year, on average.

The program broke a record of projects last year and a good part of the investors have allocated the new properties to the rental market, to obtain an income. It can be argued with reason that this aggregate rental supply is one of the factors that explain the drop in the rental price compared to salary. The program has received criticism for the tax exemptions that investors have access to (broad exemptions, which include income tax, wealth tax, VAT and ITP). APPCU argues that what the State gives up in these projects returns in spades in terms of activity and employment.

In election year There are also proposals, particularly from the left, to establish subsidized rental programs from state investment. These types of programs are frequent in European countries and also in USA. They seek to give access to rent to certain homes or families; In general, they are programs that can have an impact if the base market is fluid and manages to articulate with general trends, although they do not usually have the scope or dimension of the general market. For example, recently the B.P.S. implemented a change in retirement housing program, leaving aside the specific construction for liabilities and proposing a direct rental subsidy. According to the BPS authorities themselves, our veterans are being better integrated into social life, interacting with families and other neighbors, and not placing them in “retirement” buildings. It is an interesting approach that could be reproduced in other areas.

To the extent that salaries maintain their purchasing power and real estate investments remain dynamic, renting will surely continue to be the most reasonable way to access housing, particularly if the real estate market in terms of values remains firm as it has been in recent years. years.

Source: Ambito