The inflation It has been 10 months within the objective established by the Central Bank of Uruguay (BCU) and the different projections suggest that the year will close in that target range between 3% and 6%, so some economic agents are beginning to wonder if there is the possibility of setting a more ambitious goal.

The downward trajectory of CPI was linked to a dollar which, beyond some upward movements this month, does not expect major shocks in its value this year. In fact, criticism is mounting against the government for the exchange delay.

Against this background, elements appear such as the increase in the prices of non-tradable, defining guidelines for the next round of salary negotiation and the discussion about what is the optimal level of inflation for Uruguay, beyond the models of developed countries.

The dollar and non-tradable inflation

The researcher of Economic Research Center (Cinve), Adrian Fernandez, drew attention in dialogue with Ambit about “an important error” when analyzing the results of inflation when considering that “they were achieved by indirectly putting downward pressure on the dollar with the interest rate differential,” which “repressed the tradable prices, the goods we export and import.”

Fernández focused on core inflation and highlighted that “in the last 12 months the increase in tradables was 1.3% for the simple reason that the dollar fell 1.8%.” On the other hand, he noted that “the prices of non-tradable increased by 6.7%, outside the target range” and claimed: “These prices should be the main objective of the monetary politics. It is true that they have shown a downward trajectory in the last year, but it must be taken into account that there is also a deflationary effect of the dollar on some non-tradable items, such as transportation and health.

Exante Chart.png

An auspicious projection and the importance of Salary Councils

In turn, the founding partner and economist of Exante, Florencia Carriquiryexplained to this medium his agreement that “the moderation of the non-tradable component of the CPI is key to giving sustainability to the reduction in inflation,” while he assessed that “the disinflation of the last year has been faster and more marked than what was expected.” anticipated”, although he warned that “it is undeniable that it occurred fundamentally at the behest of a low dollar.”

In any case, Carriquiry anticipated that Exante’s projections “point to an inflation that would close 2024 comfortably within the target range, around 4.5%”, beyond a possible rise in the exchange rate, today below what its fundamentals indicate.

To consolidate the CPI in the BCU objective, the economist considered a relevant factor “the moderation of expectations for the next round of salary negotiation.” Regarding this situation, he observed that “it should incorporate a nominal dynamic more consistent with inflation on the 4.5%/5% axis than the 6%/7% considered in the last negotiation.”

The comparison with developed countries and the internal debate

A different angle contributed Giuliano Cantisani, supervising economist at CPA Ferrere, who proposed to Ambit that “a perhaps more relevant question is what would be the optimal level of inflation in an economy like Uruguay’s.”

With the current goal of 4.5% and a tolerance of 1.5% in both directions, Cantisani reviewed that “it is similar to countries in the region, such as Paraguay (4%) and somewhat higher than that of Chile and Brazil (3%)”, while more than doubling the 2% that most developed countries propose as USA or members of the Euro zone.

When delving into this debate, he indicated that “unfortunately, empirical evidence and theoretical work on the subject are scarce in the country” and highlighted among them those carried out by Carrasco Silva and Rosas (Udelar) and Ibarra and Trupkin (UM) and indicated that studies “suggest that levels above 8% threaten the growth long-term, although levels below 3% would also be problematic.”

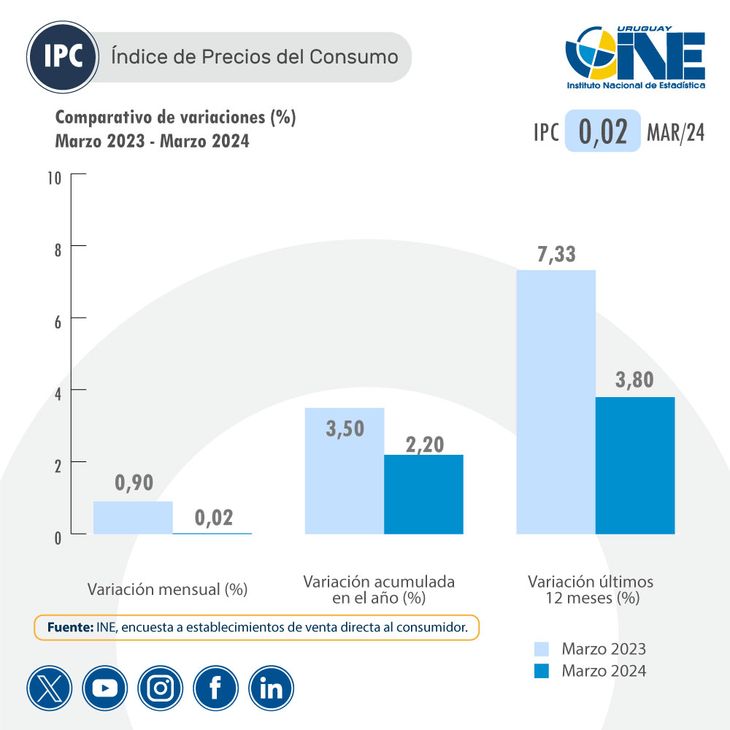

CPI Chart.jpg

With these considerations, can the target range be reduced?

Specifically regarding the possibility of setting a more ambitious goal, Cantisani observed that “although more evidence is lacking, it appears that the current range would look appropriate” and contrasted: “It does not seem like a good justification to propose taking inflation to a lower level just because that is what developed countries do.”

“In addition, we must bear in mind that reducing inflation is expensive, at least in the short term, where there is a tension between inflation and unemployment or economic growth”, reviewed and admitted that “disinflation in Uruguay It was not very costly in terms of activity or employment, but it has had its effects on the competitiveness”.

For this reason, the economist stated that “before proposing an additional reduction, it should be studied in depth what the optimal levels of inflation are in an economy like Uruguay’s so that the costs of the transition are offset by the longer-term positive effects.” .

For its part, Rodriguez agreed with the idea of not modifying the target range by stating that “a permanent and sustainable change in inflation has not been achieved,” after which he warned that doing so with the current monetary policy “would have even more consequences.” “negative.”

At the same time, Carriquiry recognized that “the succession of records within the goal opens for the first time a clear opportunity to operate on the inflation expectations, that are moderating, but are not yet anchored in the target range”, although he noted that “it seems premature think about lowering the target.”

“The focus should be on consolidating inflation in the range and ensuring that expectations are anchored in that reference,” said the Exante partner, in line with the BCU’s position.

Source: Ambito