The state oil company is still feeling the impact of the stoppage at the La Teja refinery, which will return to operation in these weeks.

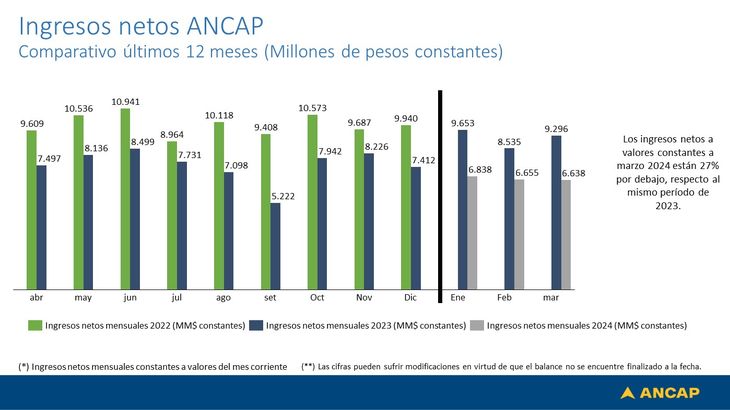

The net income of the National Administration of Fuel, Alcohol and Portland (Ancap) They fell again in March compared to the same month in 2023, and fell 27% year-on-year. The impact of the stoppage at the refinery The Tile, the main of Uruguay, could begin to decline in the coming months.

The content you want to access is exclusive to subscribers.

Ancap reported net income of 6,638 million constant pesos in March, a drop of 27% compared to the 9,296 million pesos obtained in March of last year. So far in 2024, minors have been registered every month income in comparison with the same periods of the previous year, while this is at least the 12th consecutive drop in interannual terms.

Likewise, it is the fifth consecutive drop in income compared to the previous month: in November of last year it registered net income for 8,226 million pesos; in December, for 7,412 million; in January, 6,838 million; in February, 6,655 million; and in March, it fell below again, although just barely, with 6,638 million pesos.

Ancap March Income.jpeg

A complex present for Ancap

The truth is that, despite the constant losses, Ancap still have positive results: in 2023, closed the year with Profits for 85 million dollars, despite different obstacles such as lower fuel sales on the coast, the fuel price subsidy for the final consumer – through the refinery margin that cushioned the sudden increases at the pumps -, the conflicts around the loss-making Portland and lime business and, finally, the technical stoppage in La Teja, since September.

In this last point we can find the main reason for the decline in income of the state oil company that, however, could soon begin to reverse. This is because in the coming weeks, the refinery will be fully turned on again, as maintenance tasks are completed, four months later than originally projected.

To the improvements that the reopening of La Teja brings, the best fuel sales on the coasta serious problem for the oil company dragged by the exchange difference and the price gap with Argentina that maintained the levels of gasoline and diesel consumption in the border departments at levels similar to those of the full pandemic, with circulation limitations.

In this regard, sales improved by 80% and, as the price gap closes—based on devaluation, rate adjustments and inflation in the neighboring country—they could recover “normal” levels.

On the other hand, the Portland business continues to be a problem for the Ancap finances, as a deficit activity; while April will imply, in total, 7 million pesos less in the accounts of the public company after fuel remained frozen.

Source: Ambito