The leader of Cabildo Abierto assured that they will seek a popular consultation for an eventual runoff, and that the reform will come into effect as of March 1.

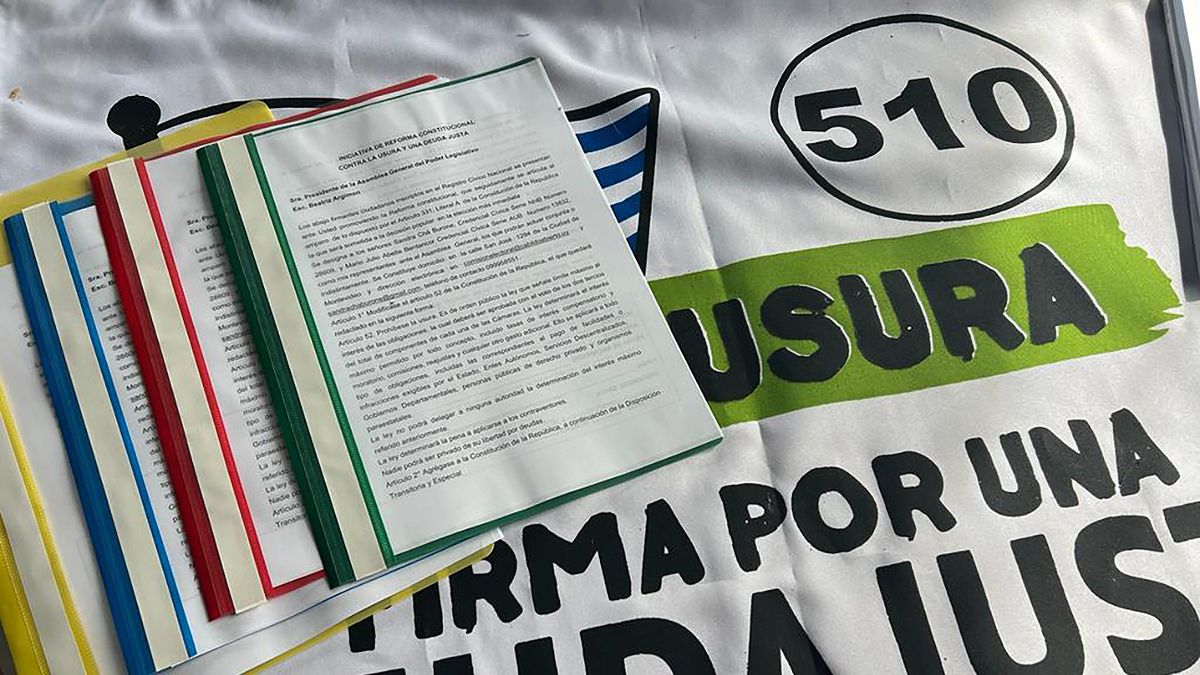

He plebiscite of debtors presented by Town meeting It will be presented on May 24 with the aim of voting in a runoff, because they did not manage to collect the necessary signatures to present it and for it to be submitted to popular consultation in the first round.

The content you want to access is exclusive to subscribers.

“We are in the order of 270,000 signatures,” said the leader of Open Town Hall, Guido Manini Rios, regarding the collection that will last until May 24 with the aim of holding a plebiscite in the runoff. The party had to rule out the October option because they were unable to gather the necessary signatures.

“After so many years of abuse of debtors, in which usury and very harsh conditions have been applied to them, four more weeks of waiting for the plebiscite is not going to be substantially different,” he explained.

If voted, the plebiscite will come into effect from March 1, 2025. “For this reason, I urge people to come forward and sign since there is still a chance before May 24,” he stressed.

The banks’ view of the Open Town Hall proposal

The banking sector of Uruguay always had in the calculations that Town meeting would obtain the signatures to promote the plebiscite, since the country has more than 700,000 people classified as debtors with difficulty in their ability to pay, according to the Credit Risk Center (CRC) of the Central Bank of Uruguay (BCU) which, as of May, had 1,905,155 people in the country registered as debtors.

In any case, the banks believe that the proposal will be rejected by citizens, relying on “international evidence” that proves the disadvantages of legislating around debt restructuring and interest rate limits.

The initiative aims to modify article 52 of the Constitution and establish the “prohibition of usury”, setting “the maximum interest for all concepts at an Annual Effective Rate of 30% on the amounts converted to Indexed Units (UI)“, while proposing penalties against the “contraveners” of the measures and pointing out that “no one may be deprived of their freedom for debts.”

However, the banking system clarified that institutions should not be required by law to refinance their clients, something they do voluntarily. They even warned that the usury cap proposed by CA will retract the credit.

Source: Ambito