In the run-up to a new Copom meeting, projections about what will happen to the TPM take into account the recent history of the surprising cut.

He Central Bank of Uruguay (BCU) is on the verge of a new decision regarding the reference interest rates after, at the last meeting of the Policy Committee Monetary (Copom), made the decision to suspend the pause in the sick leave cycle that had been announced at the beginning of the year. What are the expectations of the financial market in this regard?

The content you want to access is exclusive to subscribers.

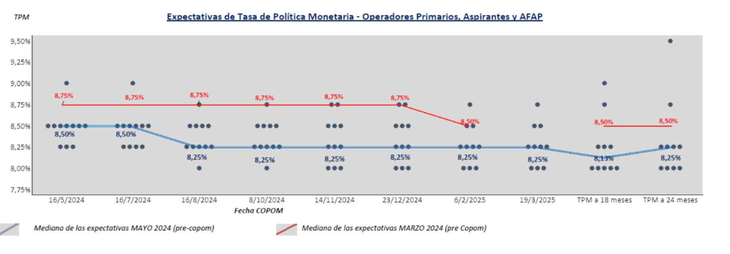

Copom will have a new meeting tomorrow and, as always, the projections regarding what will happen to the Monetary Policy Rate (MPR) are beginning to appear among different analysts and sectors. In that sense, the BCU published a few days ago, for the first time, the Survey on Monetary Policy Rates and inflation expectations in financial markets.

There, the agents consulted indicated that they do not expect changes in the MPR in tomorrow’s meeting, with a median response of 8.50%; current level of interest rates after the last cut of 50 basis points that functioned as a political sign for export sectors concerned about the exchange rate delay and the loss of competitiveness – although, for some analysts, it was also a signal from the Central Bank in order to control the inflation expectations business, still high.

Comparison_expectations_TPM_financial_agents_BCU-transformed.png

Comparison of the expectations of the financial markets before and after the last Copom meeting and the lowering of the MPR.

Central Bank of Uruguay

In the survey, the financial markets—primary operators, applicants and AFAP—project just one more drop in the MPR until the end of the year, of 25 basis points. However, it is interesting to note that this stability scenario at 8.25% it was not such before the previous Copom meeting: at that time, the expectation indicated a rate of 8.75% until, at least, February 2025. After the last cut, the agents point out that The next drop will occur in August, and it will remain there for the next 24 months.

Regarding the expectations of the economic market, meanwhile, in March these agents pointed to a MPR of 9% in April – the most optimistic scenario pointed to a cut of 25 basis points to 8.75% -; while the current 8.50% would only be reached in February 2025, along similar lines to what was expected by the financial sectors.

Concern about the electoral use of the TPM

Although general expectations point to a scenario of stability in the short term, with a first drop that would only occur in August, the background of the last Copom meeting makes it possible to think that, in any case, something could happen outside of what is expected from a political intervention like April.

In this, the key will be inflation —unlike last month where the exchange rate was the decisive factor—, since although currently the CPI It is consistent with the goal of 4.5% and has been within the goal range of 3%-6% for 11 months; The truth is that expectations remain unanchored in the relevant 24-month horizon, as pointed out, for example, by the economist José Licandro.

With a TPM level moving on the limits between a neutral and expansionary monetary policythere would be no room for a new cut if the aim is to sustain compliance with inflation objectives.

But during an election year, decisions are more lax and do not strictly follow technical issues; an issue that worries analysts, since the political pressure and the short-term margin could lead, despite being unexpected, to the BCU deciding to move forward with another cut after tomorrow’s meeting, thinking about more immediate results that could also bring long-term inconveniences.

Source: Ambito