Approximately 800 thousand people are in “default” and they will not be able to pay their debts with the financial system, according to an investigation carried out by the University of the Republic, made based on data provided by the Central Bank of Uruguay (BCU) and the Ministry of Social Development (Mides).

In the study, which is called “Consumer Debt and Poverty, the Default Risk Gap,” the researchers propose “curbing it” with a debt reporting system. “bankruptcy” for the affected people, which includes social credits granted by the You measure.

Graciela Sanroman, member of the Department of Economics of the Faculty of Social Sciences of Udelar and one of the authors of the study, considered in dialogue with Ambit that “we consider default when the person has a backwardness of more than 90 days in the payment of your credit”.

“We do not observe whether the non-payment originates from a problem of willpower or lack of ability. But we do see that they are people who are receiving aid from two subsidy programs. He Equity Plan, which is for those who have children, and the Uruguay Social Card, which is for the population in a situation of poverty directly,” observed the expert.

And he explained: “About 200,000 people, of those 800,000 total that are in default, have repayment problems due to their economic situation, because they earn very low income.”

Reduce usury limit

In addition to the diagnosis, the authors of the research propose some solutions such as reducing the limit of usury. “In Uruguay The usury limit was established by law in 2007 and is 90% above the average of the interest rates of the corresponding segment in the last three months,” highlighted Sanroman.

The specialist specified that “from 2009 onwards, what was observed was that interest rates began to grow” and added: “We think that this is associated with the way the system operates, where the interest rate did not increase.” inflation and did not increase the cost of credit for the country. However, interest rates increased and with them the usury rate.”

In line with this proposal, Sanroman stated that “an alternative would imply a decrease of several dozen points in the usury rate and that it be reviewed in case there is an economic event, whether an increase in the inflation rate or a increase in the cost of financing from the country”.

Another alternative has to do with promoting the financial education at various levels. “I think that in all countries efforts are being made and promoting it, seeing that it is very important for people to learn to manage their finances and have financial knowledge, perhaps not to get into more or less debt, because credit is a good tool,” the expert assured.

WhatsApp Image 2024-05-24 at 18.53.35.jpeg

The Open Council proposal on debtors “is very bad”

consulted by Ambit about the different solutions proposed by the political system and especially the one related to the collection of signatures proposed by Town meeting, Sanroman was emphatic and considered it “very bad, since it proposes lowering the usury limit to 30%, which would dynamite the financial system.”

“Credit would be priced so low that all financial institutions would become unprofitable. But it also establishes in the Constitution things that should not be there, but in a law,” he maintained and stated that “a legislative solution “It would be the way, seeking the reduction of rates, for example.”

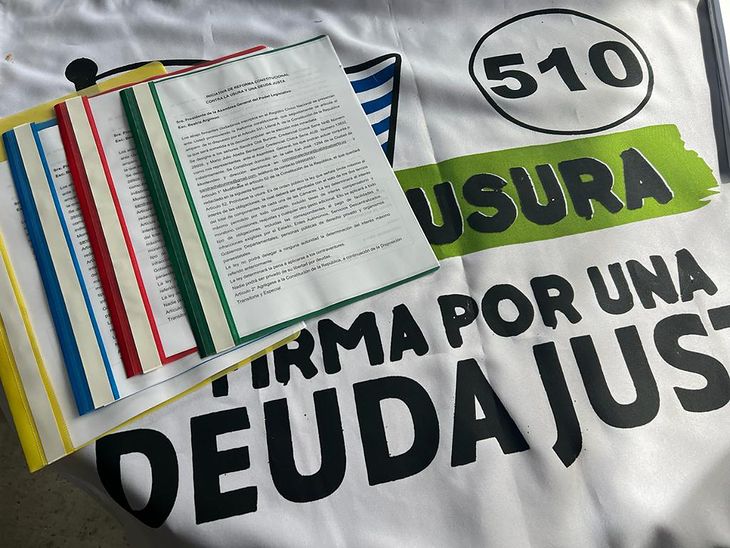

Open Council Plebiscite Debts Fair Debt

Photo: @lista510

Subsidies and regional comparison

At the time of the report’s comments, the notable participation was that of the economist Ana Inés Zerbino, director of the credit company Incapital, who raised the possibility of installing “a kind of subsidy where guarantees can be given from the public system so that these most vulnerable people have a subsidy on the interest rate.”

He also proposed addressing the situations of people who had difficulties as a result of the pandemic with some “punctual” measure of “voluntary restructuring” of debts by companies, including recovery companies, since “financial companies tend to sell those overdue portfolios,” he explained.

Zerbino pointed out: “We must not forget, since in 2020 the pandemic affected everything, obviously employment, to the income and especially the most vulnerable populations that did not have access to a unemployment insurance “which contributed to softening a little the effect of the lack of income of a very important part of the population.”

“This generated, at the level of not only Uruguay, but in many countries, a very significant increase in the number of people in a situation of default,” he argued.

The economist reported that, according to regional data, “in Brazil, Some 70 million people are in default with the financial system.” “That is 32% of the population, when the 800 thousand people in Uruguay They represent 28% of the population. In other words, we are a little less better than the situation in Brazil,” he warned.

Source: Ambito