The DGI reported that the net perception, already deducting the tax refund, reached $49.378M.

The General Tax Directorate (DGI) reported that the net collection It grew by 5.8% in real terms and reached 49,378 pesos in April, improving after the pronounced fall in March, which was 11.2%.

The content you want to access is exclusive to subscribers.

Meanwhile, the gross total perception reached 59,105 million pesos, which implies a variation of 15.2% at current prices that, discounting the inflationary effect, results in an improvement of 11.2%, according to data from the organization dependent on the Ministry of Economy and Finance (MEF).

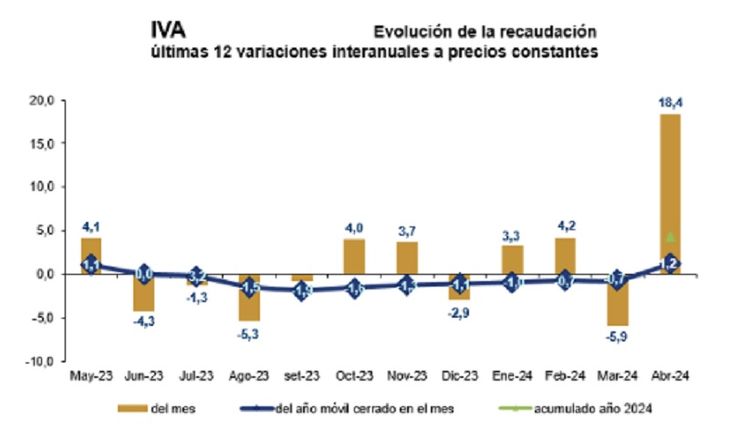

The collection of VAT was 24,493 million pesos and increased, after growing 18.4% year-on-year, with an impact of 41.5% on the gross total and achieving an improvement of 4.3% in the accumulated annual figure.

Something similar happened with the perception of Imesi, which reached 5,723 million pesos, representing 9.7% of the total. This tax had a year-on-year improvement of 22.2% and accumulated growth of 6.6% in the January-April period.

With respect to income taxes, the Personal income tax It raised 12,481 million pesos, with an improvement of 48.8% and representing 21.1% of the total gross collection. In the accumulated annual period, it had an increase of 5%.

On the other hand, it pushed down the perception of IRAE, which reached 9,959 million pesos and represented a decrease of 19.4% year-on-year, which was reduced to 9.4% in the first quarter. The tax represents 16.8% of the total.

grafic.jpg

The tax inefficiency of the DGI

The brand new collection report of the DGI, that contains the calendar effect that the Tourism Week, which took place in March this year and in April during 2023, occurs at a time when a study revealed that the organization could collect nearly double in VAT and IRAE.

Fernando Peláez, DGI official, echoed a working document recently published by the Inter-American Center of Tax Administrations (CIAT), where it speaks of a “political gap”, linked to preferential treatments that include exemptions, simplified regimes, tax benefits and extraordinary deductions, and the “non-compliance gap”.

Source: Ambito