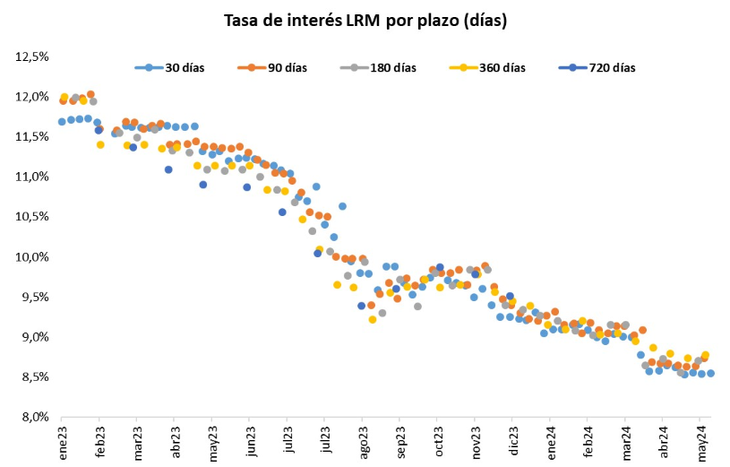

Between the improvement in the dollar and the need to lower private sector inflation expectations, the LRM cut-off rates are above 8.5%.

He Central Bank of Uruguay (BCU) You still have a month to observe the performance of the different variables of the economy before it is time to define, once again, what will happen to the economy. Monetary Policy Rate (MPR) at the beginning of the second half of the year, and with the general elections ahead with candidates already defined. With this scenario, some economists are already putting a magnifying glass on the cut rates of the Monetary Regulation Bills (LRM)which are usually a leading indicator in this regard.

The content you want to access is exclusive to subscribers.

“He BCU He doesn’t lose his wits. It is enough for the dollar to rise a little for it to begin to signal higher interest rates, raising the cut-off rates of the LRM in most of the latest tenders,” said the economist. Javier de Haedo in social networks. Eyes quickly fell on these rates to corroborate the data.

The truth is that the cut-off rate in LRM tenders has been fluctuating during June between 8.5% and 8.8% in the different terms of the titles, although mostly moving around 8.61%. Likewise, in two of the three weeks of the month, a slight upward trend was already observed, considering that the MPR is at 8.5%.

Embed

The BCU does not lose its tricks. It is enough for the dollar to rise a little for it to begin to signal higher interest rates, raising the cut-off rates of the LRM in most of the latest tenders.

— Javier de Haedo (@JavierdeHaedo) June 17, 2024

This evolution, according to de Haedo, occurs in parallel with the improvement in the exchange rate which, at the close of trading on Monday, was quoted at 39,338 pesos; and which has a monthly appreciation of 1.41%. For the economist, the BCU already shows signs that, given the increase in dollar, the reference interest ratesat least, would remain unchanged—unlike what happened two meetings ago, when the drop in the MPR was surprising and as a “political signal” due to the exchange delay.

Another reading of the increase in the cut-off rate and its correlation with the interest rate could be on the private sector inflation expectations that, even though the Consumer Price Index (CPI) It has been within the target range for twelve consecutive months and several measurements have even been below the 4.5% target; They continue to predict a price increase of around 6%.

Therefore, maintaining the MPR without major changes at the meeting of July 16, Monetary Policy Committee (Copom)would respond to the need to continue influencing the confidence of businessmen and markets so that they reduce their expectations and, thus, continue to maintain inflation within the range of 3%-6%.

How did shear rates evolve in June?

In the first week of June, the cut-off rates for the weekly LRM tenders ended at 8.54% for 30 days; 8.74% at 90 days; and 8.78% at 360 days. These values presented a slight increase compared to the previous week that was reversed as of Monday the 10th, when the rates closed at 8.55% for 30 days; 8.50% at 90 days; and 8.78% at 360 days.

Last week, the slight increase in tenders was observed again, while the cutting rates ended at 8.61% at 30 days; 8.55% at 90 days; and 8.76% at 360 days.

Evolution of cutting rates Puente.png

Medium-term rates are those that show the greatest upward variations.

Uruguay Bridge

The movements were not very large but they show a trend of, at least, maintenance in the current TPM.

Source: Ambito