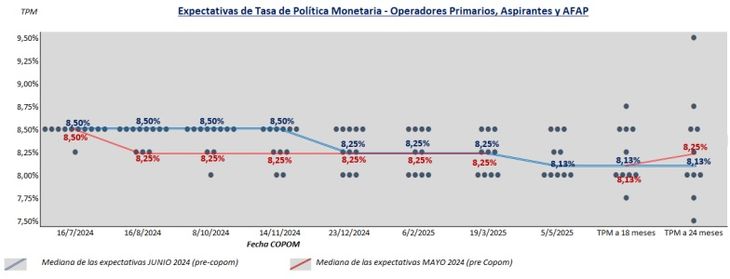

According to a survey by the Central Bank of Uruguay, the sector’s expectations project a single reduction at the end of the year.

He financial market provides that the interest rates will remain unchanged, according to a survey by the Central Bank of Uruguay (BCU), days after the Monetary Policy Committee (Copom) come together to provide a new definition.

The content you want to access is exclusive for subscribers.

Economic agents are waiting for the Monetary Policy Rate (TPM) will remain at 8.5% this month and they project only one reduction until the end of the year, which would be 25 basis points and would leave the TPM at 8.25% in December, according to the median of responses from the specialists consulted by the BCU.

However, if the total number of responses is analyzed, a divergence is observed, with some analysts projecting that the 0.25% drop could occur this month. They even warn that the rates could end 2024 at 8%.

Thinking in the long term, economic agents estimate that the TPM would be around 8.13% for May and would remain that way until July 2026. Thinking about the next 18 months, The responses range between 7.75% and 8.75%, while 24 months, vary between 7.50% and 9.50%.

taasagraf.jpg

Market inflation expectations

On the other hand, the financial market projected a inflation expectations which remain within the target range both on an annual level and looking ahead to the next 12 and 24 months.

Thus, the agents consulted by the BCU agreed with the decline of CPI, which has been within the target for 13 months. Thus, despite a possible rebound in the second half of the year, inflation is expected to reach 5.30% for the calendar year.

This figure grows to 5.60% for the mobile year ending in May 2025, while for next year they predict an inflation of 5.90%. Meanwhile, the median of the responses reaches 6%, the ceiling of the target range, for the Monetary Policy Horizon (HPM), set at 24 months. Finally, the forecasts for 2026 reach 6.10% and slightly exceed the target set by the BCU.

Source: Ambito