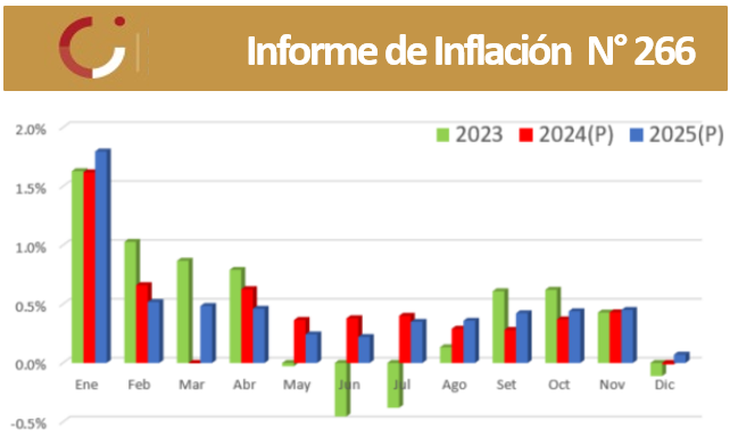

A report by Cinve predicted that the CPI will rise by 0.4% this month, reaching 5.87% year-on-year.

The inflation will rise 0.4% this month and reach 5.87% year-on-year, pushing towards the ceiling of the target range but staying within the target of the Central Bank of Uruguay (BCU), according to the projections of the Center for Economic Research (Cinve).

The content you want to access is exclusive for subscribers.

Beyond the factors that push the price upwards, CPI, he Cinve He anticipated that the indicator would remain between 3 and 6% during this year and the next, in line with the expectations of the BCU, beyond the fact that they admitted that “it can reach the ceiling or even surpass it in certain months.”

The projected increase of 0.4% contrasts with the CPI of July last year, when there was deflation by the same percentage, so the increase will be felt even more strongly. Thus, the interannual variation to July would be 5.9%, substantially above the variation for the same month last year, which was 4.5%.

However, Cinve anticipated that inflation will have lower monthly developments in September and October compared to the same months in 2023, so it could be sustained within the target range.

Looking ahead, Cinve predicts that 2024 will close with inflation of 5.5%, while 2025 will end with a value closer to 6% of the target range ceiling.

Grafinc.png

Risks that could push inflation higher

In its report, Cinve analyzed a series of risks that could lead to “inflationary impulses,” linked to climate volatility, exacerbated by the climate change. “This may bring surprises in some areas such as fresh food, as well as in the electoral process that will take place at the end of this year,” he warned about the elections.

To this he added “the influence of prices on Argentina” in the local CPI. Although it has moderated in recent months, “instability still persists and will continue over the next few months” said Cinve.

Finally, he referred to the existing tensions in Middle East, that drive prices of key commodities such as Petroleum and could lead to inflation increasing.

Source: Ambito