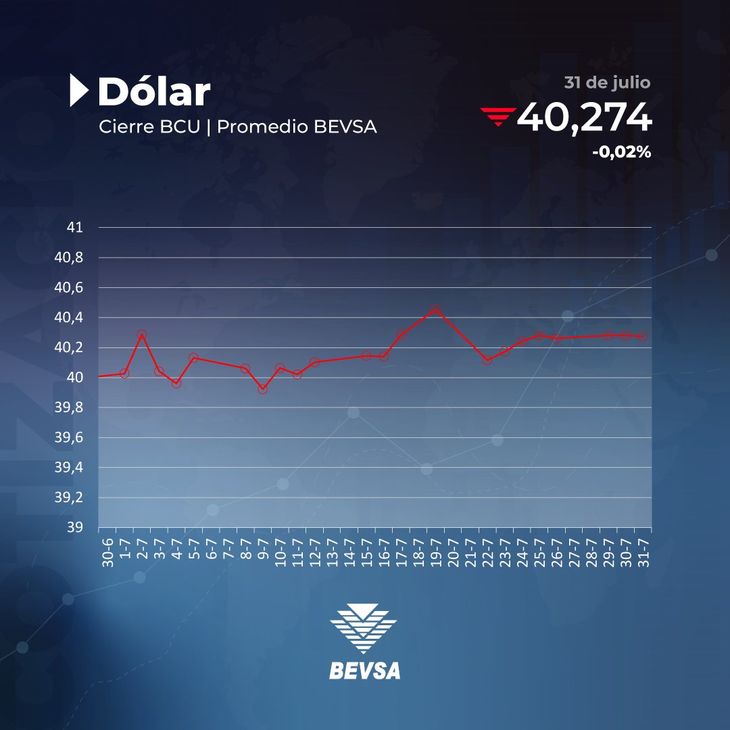

The US currency accumulated a monthly variation of 0.71% in July and reached an annual variation of 3.21%.

He dollar fell 0.02% compared to Tuesday, closing at 40.274 pesos, according to the official exchange rate. Central Bank of Uruguay (BCU), leaving behind two consecutive days of increases, but closing the month in positive territory.

The content you want to access is exclusive for subscribers.

The US currency accumulated a monthly variation of 0.71% in July, meaning its fourth consecutive monthly increase. On an annual basis, it has accumulated an appreciation of 3.21%, since its interbank rate is 1.25 pesos above the one registered after the closing of the last exchange day of last year.

On the reference board of the Republic Bank (BROU), he dollar The retail bill was offered at 39.05 pesos for purchase and 41.45 pesos for sale. For its part, the preferential value of the eBROU Dollar It was at 39.55 pesos for purchase and 40.95 pesos for sale.

The closing price in the Electronic Stock Exchange of Uruguay (Bevsa) The maximum price was 40,250 pesos, while the maximum price was 40,350 pesos, and the minimum was 40,240 pesos. A total of 95 transactions were carried out, with an operation amount of almost 47.5 million dollars. In turn, two NDF dollar operations were carried out (02/10/2024) for 10 million dollars.

BV.jpg

Crypto Tether (USDT)1 to 1 parity with the dollarwas quoted today at an average of 43.64 pesos for online purchases with a bank account or card, and from 41.98 pesos to 44.39 pesos in the Binance peer-to-peer (P2P) market.

The quote of the Prex dollar It was at 40.10 pesos for purchase, and 40.50 pesos for sale.

The interbank rate over the previous days

- July 24 — 40,243

- July 25 — 40,280

- July 26 — 40,261

- July 29 — 40,281

- July 30 — 40,282

Source: Ambito