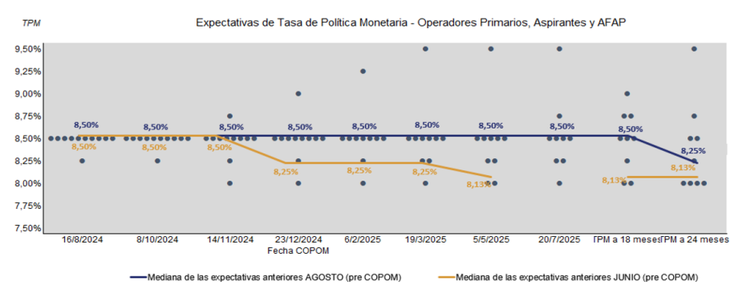

The Central Bank of Uruguay’s Monetary Policy Rate survey foresees a slight change only for August 2026.

The interest rates would remain at 8.5% for at least 18 months, according to the expectations of the financial market, emerging from the latest survey of the Central Bank of Uruguay (BCU) published this Wednesday.

The content you want to access is exclusive for subscribers.

Two days before the meeting Monetary Policy Committee (Copom), which last month left unchanged the Monetary Policy Rate (TPM), the median of the responses of the specialists consulted by the BCU showed a drop of 25 basis points only for the 24 months.

In this way, the financial market modified its forecasts compared to the June survey, which predicted a reduction of up to 8.25% for December of this year and contemplated that the rates will reach 8.13% in May 2025.

Looking at the variety of responses from specialists, we can see an increase in the gap between minimum and maximum levels, which go from 8.25% and 8.50% this month to a range of between 8% and 9% by the end of the year. The minimum responses do not fall below this level, although the ceiling reaches 9.5% for March/May of next year.

tpmm.png

What does the market expect regarding inflation?

When observing the inflation expectations of the sector, forecasts indicate that this month the CPI 0.45% and the calendar year closes with inflation of 5.45%, within the target range established by the government.

Similarly, analysts anticipated that the CPI will reach 5.84% annually in the next 12 months, reaching 5.91% in all of 2025. On the other hand, for 2026, the outlook is just above the target range, with 6.21%.

As with the TPM, The disparity between responses is growing as time goes by. By 2024, the minimum inflation The expected rate is 5% against a maximum of 6%, while for 2025 and 2026 the floors are the same, but the ceilings reach 6.90% and 7.20%, respectively.

Source: Ambito