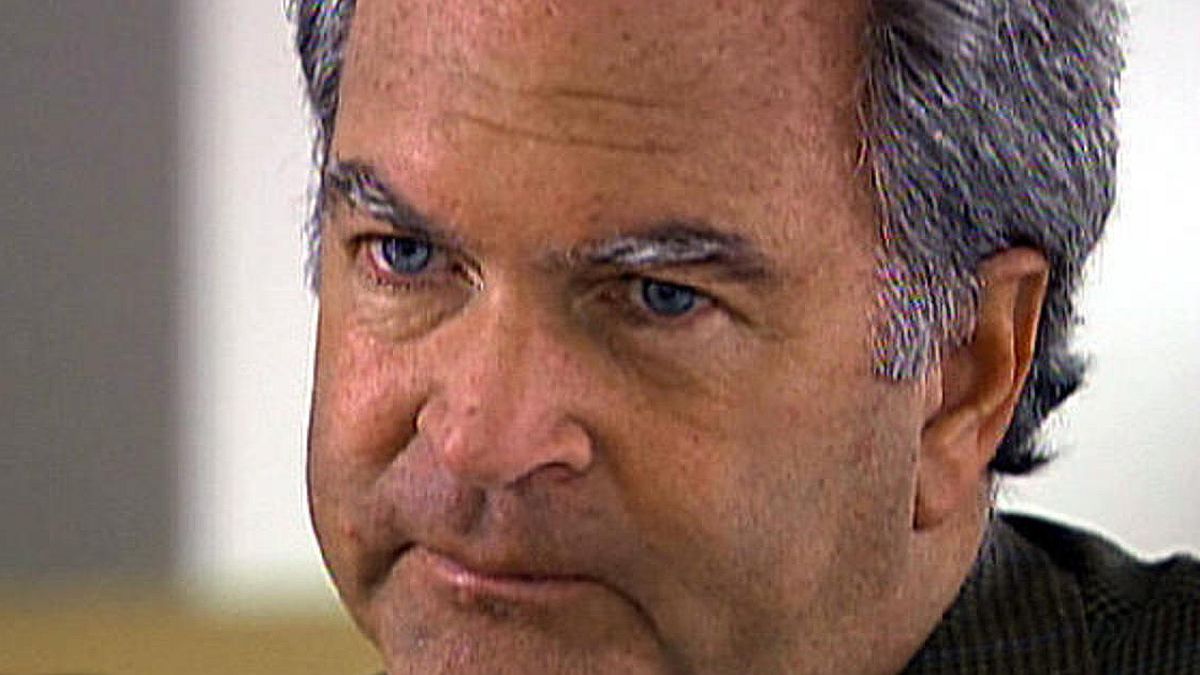

The story of Marc Dreier Stuart is one of the most surprising and complex in the financial world of the United States. Her case, however, was somewhat overshadowed because it was very close to that of Bernie Madoffthe billionaire who ran the largest Ponzi scheme in history and deceived even his own children

A lawyer by training and a successful professional in his field, Dreier went from leading a prestigious law firm to becoming one of the most notorious scammers in the world. Wall Street, with a fraud scheme that exposed weaknesses in the financial system and had devastating repercussions for its victims.

His fall from grace not only shook the financial world, but also exposed how unbridled ambition and lack of scruples can lead an individual to total collapse.

The Beginnings: From Promising Lawyer to Legal Magnate

Marc Dreier was born on May 12, 1950, in Long Island, New York, to a middle-class family. His intelligence and dedication allowed him to enter Yale University, one of the most prestigious universities in the United States, where he graduated with honors. Dreier later attended Harvard Law School, consolidating his academic training in law, which opened the doors to important law firms in New York.

During the first decades of his career, Dreier distinguished himself as a successful lawyer, specializing in corporate law and litigation. In 1996, he founded his own firm, Dreier LLP, which quickly grew into a renowned firm with more than 250 lawyers. The firm was known for its luxurious offices in Manhattan, its high-profile clientele, and its ambition to become one of the most influential in the city.

However, behind this façade of success and opulence, there was a growing financial problem. Dreier LLP, although seemingly prosperous, was deeply in debt. Dreier’s extravagant spending, including luxury properties, expensive artwork, and a lavish lifestyle, began to outstrip the firm’s income. It was against this backdrop that Dreier devised a fraudulent scheme to keep his business afloat and fund his personal life.

The beginning of the fraud: a web of deception

Marc Dreier’s fraudulent scheme began in 2004 and ran for approximately four years. Dreier used his position as a trusted lawyer to sell fake bonds to unsuspecting investors, promising high returns and using the prestige of his firm to legitimize the transactions.

These bonds, supposedly issued by real estate developers and other companies, were completely fictitious, and Dreier was responsible for falsifying documents, signatures and financial statements to make them appear legitimate.

To ensure investor confidence, Dreier even arranged meetings at the offices of real companies, where he would gain access by posing as authorized representatives. He used manipulative tactics and leveraged his legal knowledge to convince victims that they were making a safe investment. Its main victims included hedge funds, financial institutions and high-net-worth individuals.

One of the most astonishing aspects of Dreier’s scam was its audacity and the way it operated almost alone. Unlike other fraudulent schemes, such as Bernard Madoff’s, Dreier did not have a team of accomplices working with him; he handled every aspect of the operation himself, from falsifying documents to arranging meetings with investors.

The Collapse: The Fall of Dreier’s Empire

Dreier’s scheme finally began to unravel in late 2008, when one of his investors became suspicious of the authenticity of the bonds he had purchased. Doubts grew when the investor attempted to verify the legitimacy of the bonds with the issuing companies, only to discover that they had no knowledge of such issues. This was the beginning of the end for Dreier, as word quickly spread among other investors and the authorities.

In December 2008, Dreier was arrested in Canada after attempting to perpetrate a similar scam on a Toronto company. Following his arrest, the extent of his fraud was revealed, amounting to more than $700 million.His arrest in Canada was followed by his extradition to the United States, where he faced charges of fraud, money laundering and conspiracy.

During the trial, Dreier admitted his guilt and expressed remorse for his actions. However, his words were not enough to mitigate the devastating impact his fraud had on the victims. In 2009, he was sentenced to 20 years in prison, a sentence that reflected the gravity of his crimes.

The Impact of the Dreier Case

The Marc Dreier case left deep scars on the financial world. His actions not only bankrupted his law firm, but also ruined numerous investors, who lost millions of dollars in the fraudulent scheme. Furthermore, his case exposed the vulnerabilities of the legal and financial system, demonstrating how even a respected and seemingly trustworthy figure can manipulate the system for personal gain.

Dreier’s fraud also had broader repercussions on public trust in lawyers and the financial system more broadly. His case was one of several financial scandals that rocked Wall Street during the 2008 financial crisis, contributing to a climate of distrust and skepticism toward financial and legal institutions.

The story of Marc Dreier is a reminder of the dangers of unbridled ambition and lack of professional ethics. Dreier, who began his career with success and promise, ended up becoming a symbol of corruption and deceit. His downfall is a warning about how greed can lead to destructive decisions, not only for oneself, but also for those who trust us.

The case also raises questions about the nature of justice and accountability. Although Dreier was convicted and is serving his sentence, the damage he caused is irreversible for many of his victims. His story is a lesson in the importance of integrity and honesty, especially in professions where trust is a fundamental pillar.

Today, Marc Dreier is still serving his sentence, and his name has been branded as one of the biggest fraudsters in recent Wall Street history. His legacy is an example of how power and influence can be misused for personal gain at the expense of others, and how justice eventually catches up with those who choose the path of fraud and corruption.

Source: Ambito