The insurance market regulator has issued three warnings to different companies. This is part of a stricter policy on the compliance of insurers.

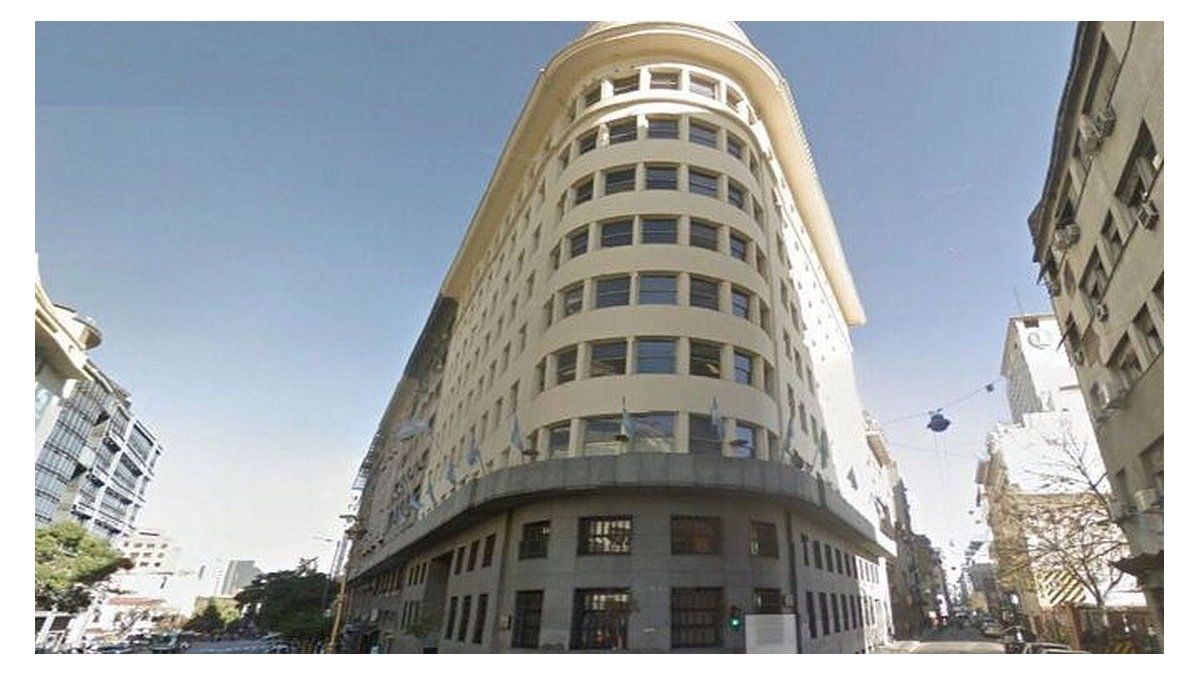

The National Insurance Superintendency (SSN) has a close eye on the behavior of insurers in regulatory matters and applied Three companies have been warned this week: Management, Testimony and Mutual Guarantee of Passenger Transport InsuranceThe measures follow the recent ban on two companies, Boston Seguros and Caledonia, which were prohibited from generating new coverage contracts.

The content you want to access is exclusive for subscribers.

The warnings were made through resolutions 446/2024, 447/2024 and 448/2024which were published this Wednesday, September 11, in the Official Gazette. And they are framed within the provisions of article 58 of Law 20,091 (on Insurance Entities and their Control), which establishes the sanctions that will be applied when an insurer violates the provisions of that law or the regulations provided for therein or does not comply with the measures ordered as a consequence by the control authority.

Among its sanctions, the law provides that, when “this results in the abnormal exercise of the insurance activity or a decrease in the economic-financial capacity of the insurer” or a real obstacle to the inspection, will be subject to a warning, as provided in these three cases.

Other more serious sanctions provided for by the regulation

However, this is the mildest penalty they could receive, given that, in more serious cases, it provides:

- Warning;

- Fine of up to $100,000.

- Suspension for up to three months from operating in one or more authorized branches or revocation of the authorization to operate as an insurer, in cases of abnormal exercise of the insurance activity or decrease in its economic-financial capacity.

“The insurer may not allege the fault or fraud of its officers or employees to excuse its liability.”the rule states.

One of the issues that several market voices are observing is that there are many companies with financial problems on the market at the moment, which could imply that, shortly, there may be new developments regarding more serious sanctions by the Superintendency. A trend towards greater market concentration is also expected in the future.

Source: Ambito