The first stage of bleaching ends next Monday, September 30, this marks the limit for declaring cash. Although the regime will continue to be in force for declaring other assets, the rate will rise from 5% to 10% until December and then will increase to 15% in the third phase. Given this first closure, Scope consulted with experts on which instruments to add to the portfolio for investors who regularized assets for less than US$100,000, for example, US$10,000.

The global market is showing high volatility and any excuse causes corrections. The US elections could add to the fears, as Growing polarization is worrying for investorsFor city strategists, money laundering is boosting some assets, but their price could be inflated by funds seeking placement.

There, the doubt is What will happen in the market in the second week of October?once the whitening process ends and new buyers decrease. If there is no correction, new applicants will have to be considered with fresh capital to sustain these pricesthe investment adviser said in the spring report, Gaston Lentini.

Portfolio recommended by experts

“The money laundering benefits the country, but it has led to an increase in the prices of some assets, driven more by the arrival of legalized funds than by genuine demand”, says Lentini. And he raises the question of what will happen with Reserves, the dollar and the demand for financial assets after the second week of October, “when the money laundering is over and there are fewer buyers. If the market ceiling is not reached, it will be necessary to consider other buyers with fresh capital to sustain the price increase,” he analyses.

In dialogue with this medium, Isabel Bottaproduct manager at Balancebelieves that for laundered amounts less than US$100,000, the objective is “optimize your diversification”. Thus, and taking as an example a “moderate” portfolio of US$10,000, the strategist proposes the following: 30% of the portfolio could be invested in the Balanz Ahorro Dólares fund, which offers access to private Negotiable Bonds (these usually require high investment amounts, But with this strategy the investor achieves good diversification with reduced capital).

Besides, suggests investing US$2,000 in Telecom 2031 Bondswhich currently yield approximately 8.5% Internal Rate of Return (IRR) and stand out for their attractive return performance. “Another $2,000 could go to PNXCO, with a yield close to 7%.%”, he analyzes.

The remaining amount could be invested in BPY26 (Bopreal), which offers an estimated return of between 13% and 14% per year. “Overall, this portfolio generates a return of approximately 9%, which, for a portfolio with a moderate profile, is a very attractive return and the risk and return would be well diversified and balanced,” concludes Botta.

Lecaps: this is the scenario

For Lentini the dollar is too low to invest in Lecaps (Treasury capitalizable bills), which could be a good opportunity if it remains stable, since the monthly yield of 4% in pesos would translate into profits in dollars.

However, if the dollar adjusts due to some market nervousness, there would be a risk of losses. Therefore, the safest recommendation is to diversify and allocate only a part of the portfolio to this strategy. Although the risk is high, if the scenario is favorable, performance can be similar to that of an ON, which is currently overvalued.

Therefore, for a portfolio of US$10,000, the strategist would structure it today as follows:

- would allocate 30% to a long-term Argentine bond under New York law, such as the GD35,

- 20% to a short bond (LNY), such as the GD29

- To this I would add 10% in an even shorter bond, such as the BPI6D (BOPREAL26), under the assumption that the country’s situation will improve and normalize.

The remaining 40% would be distributed as follows:

- 20% in a foreign fixed-income asset investment fundwhich could offer between 4% and 8% annually, thus reducing Argentina’s risk, “instead of opting for a negotiable obligation,” he says.

- The other 20% would be allocated to Cedears of the EEM Emerging Markets ETF (EEM), some to the Small Cap Companies ETF (IWM), and “I would take advantage of current prices to include a large technology company, such as Google,” Lentini suggests.

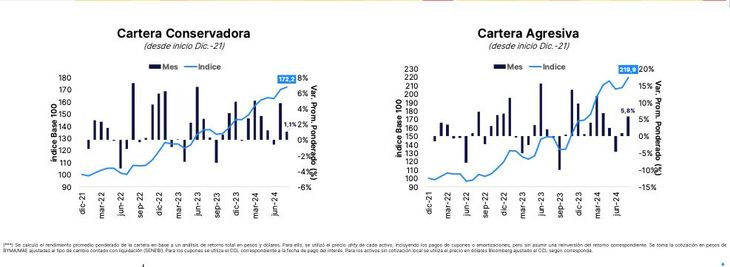

Conservative and aggressive portfolio

From Personal Investment Portfolio (PPI), recommend, for a profile that seeks less volatility in its exposure to the country, a more defensive portfolio “in a negative scenario and proposes to prioritize good credits”, composed as follows:

- sovereign bonds in dollars: 15%.

- bonds in pesos: 5%.

- Provincial bonds in dollars: 30%

- Corporate bonds in dollars: 50%.

PPI 1.jpeg

Meanwhile, for an investor seeking greater exposure to “more volatile instruments, but with greater potential “upside” in the event of a scenario constructive/optimistic “forward,” that is, an aggressive portfolio, PPI puts it together as follows:

- Provincial bonds in dollars: 30%.

- bonds in pesos: 15%.

- sovereign bonds in dollars: 15%.

- shares and Cedears: 30%.

So, if fiscal consolidation is the pillar of the economic plan, the reduction of inflation is the central driver of the strategy. Therefore, investors must be attentive to the evolution of economic variables in order to make the right decisions. And the fear that a greater pass through than expected could compromise the achievements made so far is driving the economic team to postpone the decision to lift the restrictions while waiting for a more favorable context, as noted on Monday on Wall Street. Javier Milei.

PPI 2.jpeg

However, delaying this measure does not guarantee that the situation will improve on its own. “Partial reduction of the PAIS Tax For certain goods, the coexistence of different schemes for importers to obtain dollars and the weak economic recovery predict a decline in the BCRA’s net reserves in the coming months,” PPI analyzes.

This makes the decision to maintain exchange controls more complicated. With the information available, the outlook is difficult, but there is still room for improvement. for an element to emerge that changes the situationThe city broker asks: “Will it be the Whitewashing or the RIGI? Or perhaps an agreement with the International Monetary Fund (IMF)?” And he concludes that, “in short, although uncertainty gives the Government some room, the clock is still ticking against them in an election year.”

Source: Ambito