Let’s do a little history first. During the last years, China has gone through a difficult period. The problems in the real estate sector, the high indebtedness of local governments and the lack of consumer confidence were just some of the reasons that led the Chinese stock market to be in free fall.

Since 2020, the Chinese economy has been hit by the pandemic, but also by the intensification of the trade war with the US and the regulatory tightening of its own government, which increased the perception of risk.

In this context, it was not advisable to invest in Chinese stocks, since the trend was clearly bearish.

china1.png

Why did it make sense to invest in China recently and not during 2022 and 2023? First and foremost, the recommendation is never to buy what falls. And until October 2022, China was in free fall. Then it had several fakes, but at least it stopped making new lows and began a lateralization that lasted many months.

And now what happened? This lateralization zone was broken and prices indicate signs of recovery. Is there certainty? No, but the trend is now in favor, so, in probabilistic terms, in recent days it has only become attractive.

Also, let’s remember that China’s valuations are very interesting. Let’s look at the Price-to-earnings ratio of the MCHI ETF:

china2.png

China stocks represent a little more than 10 times the earnings they generate. In the US this ratio is above 20, meaning that Chinese stocks look much “cheaper” than American stocks.

This scenario, which combines an attractive valuation with positive price signals, made China begin to be seen as an investment opportunity again.

The trigger: stimulus package

The decisive factor that consolidated this recovery was the stimulus measures of the Chinese government. The government decided to implement a series of more forceful actions to stop the decline of the real estate market and restore confidence among consumers and investors. Among the most important measures are:

- Mortgage Rate Reduction: The Chinese central bank announced a reduction in mortgage rates, which eased the financial burdens of households.

- Subsidies and consumer vouchers: The government began distributing consumer vouchers and subsistence subsidies, which incentivized spending in sectors such as tourism, entertainment, and hospitality.

- Recapitalization of state banks: A plan was announced to recapitalize the six main state banks with around US$142 billion, which increases the banks’ ability to offer loans and encourage investment.

- Support for the stock market: The creation of a stock market stabilization fund is being studied, with a promise to inject more than US$100,000M.

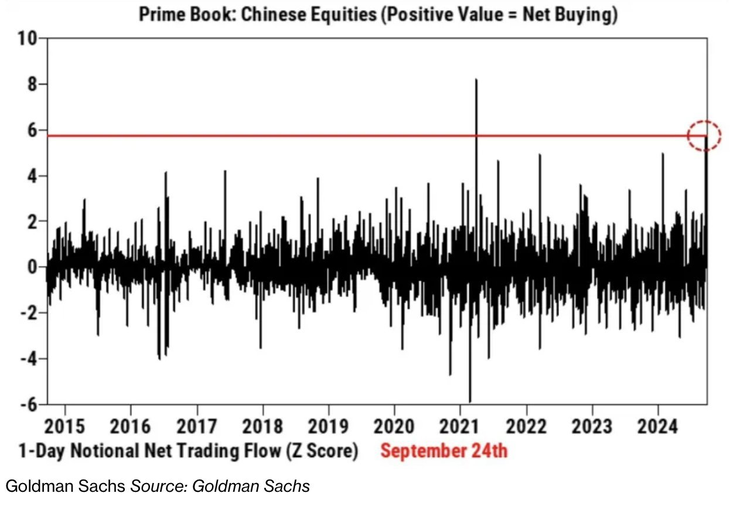

What generated this? The highest demand for Chinese stocks in the last 3 and a half years:

china3.png

What actions were favored? Let’s look at the most recognized examples on Wall Street:

- Alibaba (BABA): e-commerce and technology platform, which also offers cloud services and digital payments.

- com (JD): e-commerce and logistics company, specialized in online sales and product delivery.

- Pinduoduo (PDD): Online social commerce platform that connects users to buy products at lower prices in groups.

- NIO Inc. (NIO): premium electric vehicle manufacturer with a focus on developing advanced technology and car batteries.

- Baidu (BIDU): main search engine in China, with investments in artificial intelligence and autonomous driving.

These measures not only boosted Chinese stocks, but also had repercussions on global commodity markets such as copper. China consumes about half of the world’s copper and recent measures fueled a rise of more than 12% in the last week.

The Chinese market is showing clear signs of recovery. After years of being battered, it appears that the bearish trend wants to reverse, and both stimulus policies and attractive valuations present an interesting opportunity for investors.

If you want to learn more about investments, I invite you to our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito