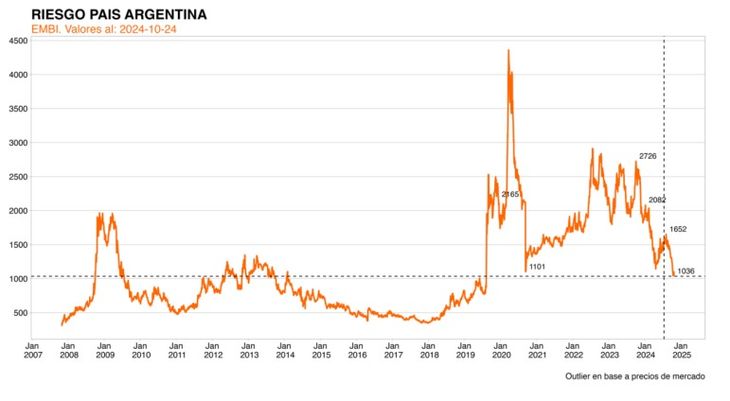

In that sense, different reports circulating this Friday in the city ratify its position of “optimism” compared to Argentine values. It is even commented a jump from “hard dollar” sovereign debt to equity for the most speculative profiles, given that the analysts of the consulting firm Outlier, by Gabriel Caamaño, They estimate that once there are no doubts about interest payments, the compressions may be much more subdued.

Juan José VázquezHead of Analysis at Cohencomments in a talk with Scope that the progress in obtaining sources of financing in dollars, together with the purchase of reserves via the Single and Free Exchange Market (MULC), contribute to flattening the country risk curve. In addition, these measures bring the Treasury closer to the possibility of obtaining financing in dollars straight from the marketbeyond the planned operations with banks such as Santander, among others.

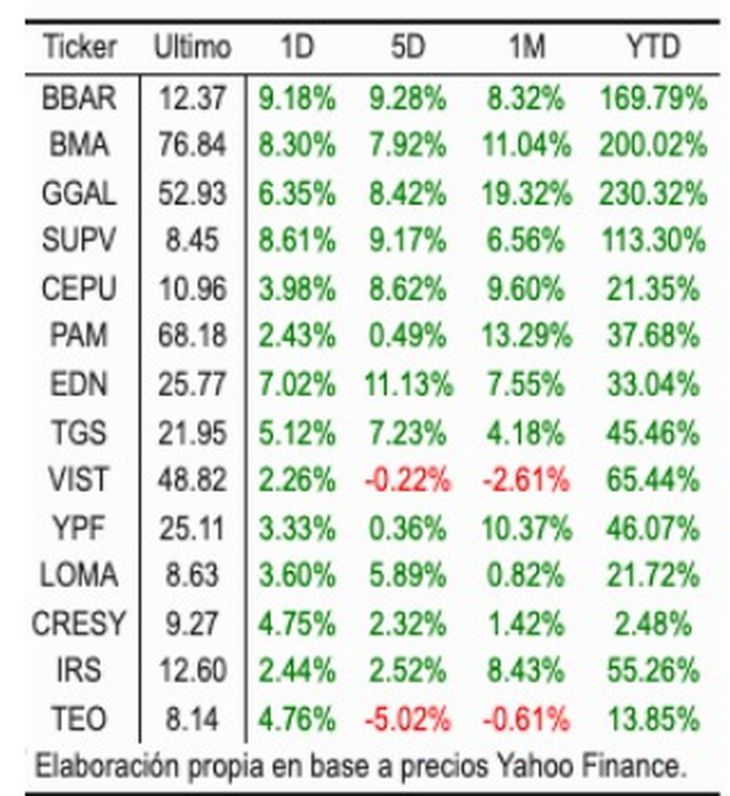

“Clearly, it was a great day for Argentine assets,” they said. For the consulting firm, it seems that the market came out to buy anything that smelled like Argentina. “The S&P Merval measured in the Cash With Settlement dollar (CCL) was at 1,570 (+5.37%)”, to find that value you must first go back to March 26, 2018, remember.

Global Vs Emerging.jpeg

And, as he points out PxQ, by Emmanuel Álvarez Agisthe Government is going through its best moment since it took office, with an exchange gap in the area of 20%, the country risk close to 1,000 basis points, an October inflation that may start with a 2 (that is, it will be below 3 %) and “activity is beginning to show signs of recovery.”

Added to that is that the main macro-financial variables have the exchange rate calm as their main protagonist, private deposits in dollars are recovering after the falls at the beginning of the month, and the market still believes that there is room for loan increases that temporarily strengthen net reserves of the Central Bank (BCRA). Although PxQ considers that “The current situation is not sustainable over time“.

In this regard, the Investing in the Stock Market Group (IEB) notes in its report this Friday that “a recomposition of net reserves is essential to push the country’s risk downwards”, it may even be the last point it needs, both looking at it from the side of the availability of dollars for face debt payments, as well as on the side of the expectation of leaving the stocks.

“If the Government uses this period as the previous period for a program to relax existing exchange controls, There are chances that Argentina will consolidate a period of low inflation, with accumulation of reserves and economic growth,” adds PxQ.

The investment strategy, according to the city

As the latest report of the Consultant 1816, the performance of Argentine assets in general and debt denominated in dollars “was as spectacular as it was justified by the improvement in fundamentals that took place in September“.

And they justify their position by highlighting that not only is there a fiscal surplus, but that, thanks to money laundering and corporate emissions, the prospects for reserves have improved for 2025. In this framework, the fixed rate in pesos was invested, which is a reflection of a market “increasingly optimistic about disinflation”.

But be careful: this No It means that investors have incorporated the most optimistic possible scenario into prices. “If the Government decided to lower the pace of the crawl in the coming months and inflation slowed in sync, the yields of Lecap and Boncap could compress even more in the medium term,” warns 1816.

Country Risk.jpeg

However, before the medium term there is the short term. In this framework, in the daily report of the SBS Group, Juan Manuel Francochief economist, maintains that in terms of strategy, the fixed rate in pesos remains the undisputed star and highlights different options to bet within this “asset class”, without leaving aside the CER papers.

Regarding the Global bonds and the S&P Merval, Franco maintains the “view” of the group, and emphasizes that, in the short term, external factors could weigh. However, in terms of investments in hard currency, it maintains Global 2035 (GD35) and Global 2041 (GD41) as “top picks” in Globalesalthough the relative performance once again put value in Global 2030 (GD30).

That said, Franco maintains that both GD35 and GD41 “would provide better protection if the optimistic scenario does not materialize.”

Finally, Franco confirms his “bullish” position in the Oil & Gas and utilities sectors, with our valuation models pointing out that there is still value in Vista Energy (VIST), Pampa Energía (PAM), YPF, Edenor (EDN), Tansportadora of Gas del Sur (TGS) and Transportadora de Gas del Norte (TGN).

That said, although Franco highlights the value of equities, both here and in the rest of the world, he remembers that they are subject to volatility due to the elections in the US, while highlighting that the index has already experienced an impressive rally that could contain general short-term upside.

Performances Leader Panel.jpeg

Finally, the IEB document ensures that the debt rally has fundamentals given that the outlook for 2025 improved substantially. And it is that The laundering and placement of debt in dollars by corporations generated a good foreign exchange incomewhich adds to better prospects for the agro-export and energy sectors in 2025.

“Even so, the potential upside that remains if it converges to the internal rates of return (IRRs) of comparable countries is still important. We continue to prefer be longwhich would allow us to capture a greater upside,” recommends the city broker.

For those looking to diversify their portfolio, IEB sees opportunities in incorporating Bopreal Series 1A which currently yields 16.2% or through Negotiable Obligation (long) to 2031, among those who like TLCMO, MGCMO and YMCXO, which offer returns around 7.8/8.2%.

Source: Ambito