The Customs Collection and Control Agency (ARCA) reported that in December there was a tax collection of $13 billionwhich implies a real growth of just over 1%. In nominal terms, treasury income grew 119.8% compared to December 2023.

This is the second consecutive monthly tax collection that improves year-on-year, since in November there had been an increase of 4.2%. They have to do with the result improvements in real terms of Income Tax and VAT, which are two of the most important taxes in the tax structure.

In addition to that, Treasury accounts are receiving a favorable impact of the extraordinary income from the special tax of the money laundering and the 2024 moratoriumwhich this year contributed about $300,000 million.

IARAF-REC-DIC.jpeg

As reported by ARCA, the Net Value Added Tax collected $4.47 billion and had a year-on-year variation of 115.2%. The cTax component, related to consumption, increased 126.2%while the Customs VAT increased by 105.5%. It must be taken into account that during the period an iyear-on-year inflation of 117%according to estimates of the Freedom and Progress Foundation.

Meanwhile, the Income Tax presented an improvement of 144.6% real year-on-year, adding $2.55 trillion. Among other elements that explain the result, ARCA mentions that during the month it received the first advance for companies with a fiscal year end in June, which is the second largest in the year. In addition, the second advance payment of human persons was made for the fiscal period 2024.

On the other hand, the collecting agency points out, for the Tax on Bank Debits and Credits reached $1.01 billion, with a year-on-year increase of 137.5%while Social Security income increased 175.9%, totaling $3 trillion.

On the side of foreign tradein Export Rights were obtained $591,544 million, with a nominal interannual variation of 43.3%, while Import Duties and others received $400,468 million with an increase of 119%.

On the other hand, due to the Tax on Personal Property The treasury obtained resources for a total of $91,673 million with a year-on-year variation nominal negative of 39.3%, compared to December 2023

Meanwhile, the COUNTRY tax He continued making contributions to the treasury even though it has been concluded since December 24. During those days that it was in force, they entered $107,157 millionwhich marked a nominal decline of around 65% year-on-year.

The view of the taxpayers

As pointed out by the Argentine Institute of Fiscal Analysis (IARAF)in the last month of the year national tax collection would have increased by 0.8% in real terms compared to the same month last year. If the extra income due to moratorium and money laundering is excluded, the total collection would decrease by 1.4%. If foreign trade is excluded, it grows 9%.

The collection that would have increased the most in real terms would be that of fuel tax with 233%, followed by Social Security (+26.6%) and Profits (+12.2%).

At the other extreme, the collection that The most would have fallen would be the PAIS tax with a drop of 84%, followed by Personal Assets (-72%) and export duties (-34.3%).

The 2024 collection

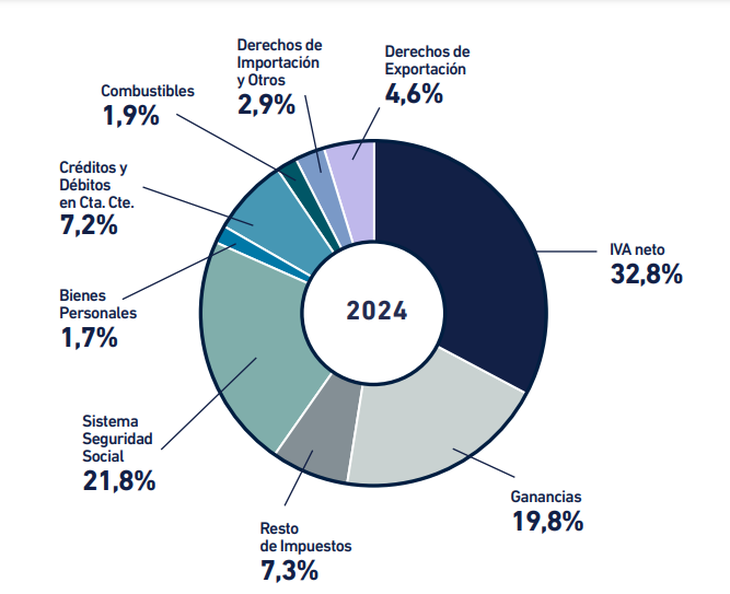

arca2024.png

At an annual level, ARCA’s revenues totaled $131.3 billion, which marks a nominal growth of 205%. “Discounting the inflationary process, it implies a real decrease of 5.5%. By discounting the extraordinary income from Laundering, Moratorium and Personal Assets, the real year-on-year decrease would be 7.5%. Without foreign trade, the drop amounts to 8.8%.

In terms of real interannual variation, In the accumulated of these twelve months, the taxes with the greatest drop would have been Personal Assets (32%), Internal Co-Participating (16.4%) and Profits (10.4%). The taxes with the greatest increase would have been COUNTRY tax (56%), Fuels (33.8%) and export duties (31.7%)

Source: Ambito