And it is plausible that higher tariffs and the policies of “Make America great again“generate some upward pressure on inflation, which could then lead to a slower pace of interest rate cuts. In the immediate days after Trump’s victory, as expected, the us dollar strengthened, which was reflected, in turn, in a weakening of the currencies of emerging countries.

It is worth remembering that, during his first term, Trump adopted a protectionist stancein particular, through the trade war with China and its approach towards more unilateral trade agreements. A second presidency could mean the continuation of these (overloaded) policies, generating volatility in emerging markets due to uncertainties around tariffs and global supply chains. Countries dependent on exports to the US, such as Mexico and Brazil, could suffer great difficulties.

Emerging markets outside China

It is important to remember that Trump is expected to be fiscally more expansiveincluding tax cuts and spending aimed at reindustrialization, which should boost US growth. And, in general, faster growth in that country tends to drive global growth through the export channel to other countries. It is also true that higher tariffs could dampen this trend, but it should be positive for most other countries.

Mario Aguilarsenior portfolio strategist at Janus Henderson comments in dialogue with Scope that current account deficits could play a key role, due to their significant impact on currencies, which, in turn, affects yields denominated in those currencies.

“This is relevant when investments depend on imported goods in US dollars,” analyzes Aguilar. Given that these dynamics are closely linked to the dollar and US policies, the uncertainty surrounding Trump’s decisions “adds an element of unpredictability to the economic outlook,” he maintains.

For its part, Pedro Moreyradirector of Guardian Capitalcomments in statements to this medium and, in line with Aguilar, that the main uncertainty of the matter lies in Trump’s protectionist policies and the effect that its tariffs could have, both in the US and in global markets.

It happens that an increase in tariffs against China could raise the prices of imported productswhich would lead to a rise in US inflation. This could reactivate expectations of interest rate increases by the Federal Reserve (Fed).

“The latter could have an adverse impact on global sovereign debt, including that of Argentina. In that scenario, there could be a ‘fly to quality’ and the funds could leave emerging markets again and go to Treasury bonds,” warns Moreyra.

How Argentina looks before Trump 2.0

The United States is the main investor in Argentinawith US$30,000 million and a participation that exceeds 18% of the total. It is also the third trading partner, behind Brazil and China, with an exchange of US$12 billion, a balance that is structurally in deficit for the country, according to a report released in the last few hours. ABECEB before Trump’s inauguration.

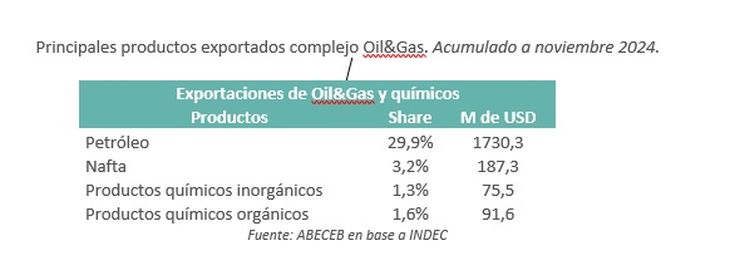

The document mentions that the main export complex to the US is Oil & Gasalong with the chemical industry. “Notable products include crude oil, naphtha and organic and inorganic chemicals, which together represent 36% of total exports, worth US$2,084.7 million accumulated as of November 2024“, he mentions.

“Crude oil exports from Argentina to the US are driven by the growth of Dead Cow. This development has been key to strengthening Argentina’s position as an energy supplier in the US market,” mentions the study, which highlights the important commercial relationship between both countries.

ABECEB.jpg

Foreign direct investment from the US. Source: ABECEB.

Added to this, as Aguilar explains well, is that politics will play a key role in this scenario. “As the policies of Javier Milei model a new Argentina, it is likely that other countries will begin to adopt similar approaches, which could benefit the region by encouraging the creation of a broader market for raw materials and finished products,” he maintains. However, this impact is likely take at least five years to materialize.

For Aguilar, energy is emerging as a promising sectorespecially in countries that have not yet developed new oil or gas fields, which will require significant investments in the future. Furthermore, technologies such as biogas, solar energy and even wind could play a crucial role in energy development in the medium and long term, promoting sustainable growth in the region.

Abeceb Oil&Gas.jpg

Main exported products. Source: ABECEB.

For Aguilar, demographics play in favor of Latin America, in contrast to regions such as Europe, China or Japan. “Argentina could consolidate itself as an attractive destination if it maintains its path of transformation, although a large part of its assets have already been auctioned,” he analyzes.

Meanwhile, Moreyra points out that Trump remains the candidate who offers further deregulations for the financial industry and that it is more “friendly” with the traditional energy sector, which could be positive for the energy potential that Argentina has, which “is positioned as one of the great drivers for local strengthening.”

Thus, from Guardian Capital, they consider papers such as Pampa Energía (PAM), YPF, Vista Oil&Gas (VIST) that they will have great potential, beyond the great increases they recorded over the last three years.

How possible is an agreement with the IMF under Trump?

Moreyra recalls that it is key to remember that the United States has an important participation in the International Monetary Fund (IMF) and “the affinity between Trump and Milei could be key to putting together a plan with the creditor, which would be beneficial for the country’s macro expectations.”

However, he warns that our country’s response “depends more on Argentina itself than on the global context and the consequence, to a large extent, will be due to the local macroeconomic situation itself.” And remember that the latter could be seen in the last weeks of 2024, when, given the volatility of global marketsthe Argentine market remained firm due to its own solid macroeconomic drivers.”

Moreyra and Aguilar recommend that, given this panorama, Investors should exercise caution and evaluate if their strategy is oriented to the short term, to take advantage of opportunities in exporters and companies with access to strong currencies, or if they opt for long-term investments linked to infrastructure or an eventual economic recovery, which could arrive after a period of important difficulties.

Source: Ambito