Although the economy has already left the recession floor behind, and is showing symptoms of reactivation, there is still a strong sectoral heterogeneity, with clear winners and losers. In this framework, specialists warn about a possible deepening in the primarization process and they wonder if the activities that drive growth are enough to improve the well-being of the majority of the population and to absorb the jobs that were lost in the first year of Javier Milei’s government.

A report of the CP consulting stressed that this trend towards primarization is supported by a recovery driven by “the resilience that the agricultural sector showed after overcoming the drought and the dynamism of the hydrocarbon sector“.

Agro, energy, and their industries, the winners of the model

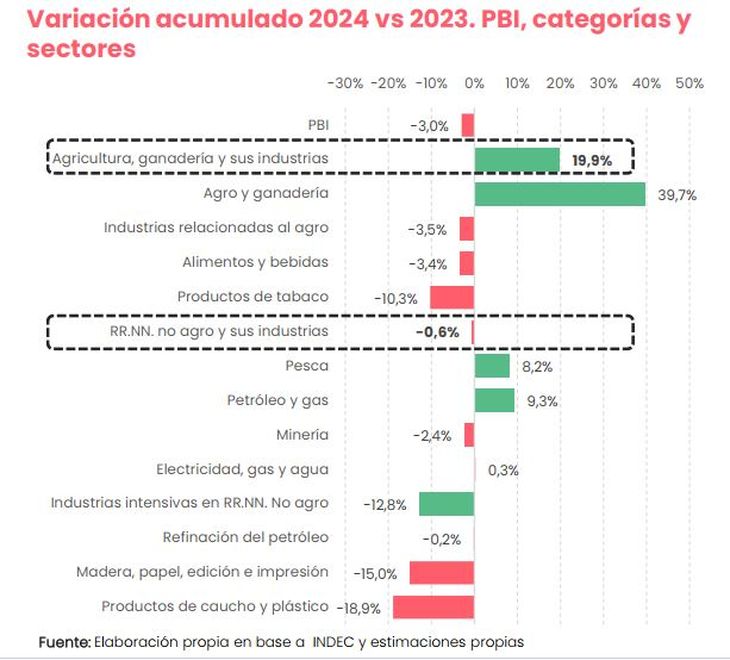

In that sense, it reflected that, between January and September 2024 (latest data available), only the category “Agriculture, livestock and their industries” had higher production than in the same period of 2023 (+19.9%). This improvement was explained by the performance of agriculture and livestock.. For industries related to agriculture, a contraction was verified, although they were among the industrial divisions least affected by the libertarian model.

Sectors CP.JPG

Noelia AbbateMaster in Political Economy from the UBA, stressed in dialogue with Scope that The only two industrial sectors that managed to exceed the level prior to Milei’s inauguration as president (according to the most recent data from the INDEC IPI) were precisely food and oil refining, two export activities.. On the contrary, those linked to the domestic market were the furthest behind.

Likewise, within the categories that showed falls, the one with the most limited variation was “Non-agricultural Natural Resources (RRNN) and their industries” (-0.6%). Within it, increases in oil and gas production and fishing stood out, although they were not enough to compensate for the collapses observed in areas such as forestry-industry or petrochemicals.

Regarding the booming hydrocarbon production, CP maintained that it was “the continuity of a medium-term process that the sector has been presenting and transcends the policies of this Government.”. The data supports this vision: while oil production has been growing steadily since 2017, gas production has been doing so since 2014, in both cases thanks to the maturation of the “shale” in Vaca Muerta, which has one of the reserves. most important worldwide.

CP Sectors 2.JPG

The promotion of intensive sectors in natural resources allowed to cushion the general deterioration of economic activity. According to CP, without them the drop would have been almost 6% in the third quarter, and not 3% as it ended up being.

Sectors linked to the domestic market, among the losers

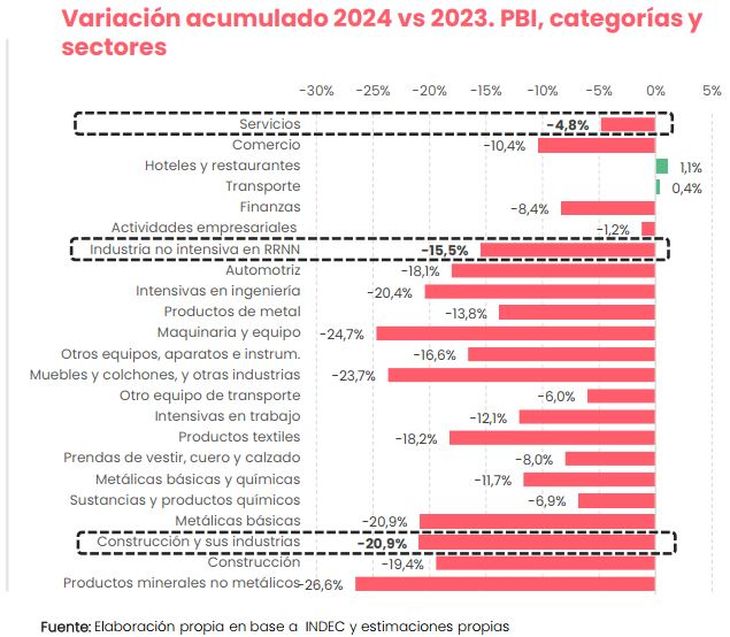

Within the group of “losers” are the “Non-NR intensive industries”which suffered an average drop of 15.5%. Engineering-intensive industries fell the most, followed by automotive, labor-intensive, and basic metal and chemical industries.

Sectors CP 3.JPG

The domestic market depressionthe absence of an industrial policy and the growing commercial openness They configured a strongly negative combo for these activities.

For its part, “Construction and its industries” presented an accumulated fall of 20.9% in the third quarter, mainly due to the fiscal adjustment and the paralysis of public worksalthough also affected by the impact of exchange appreciation on the increase in its costs in dollars. At the same time, the “Services” showed a deterioration of 4.8%, caused mostly by the decline in trade.

Can the winning sectors absorb the jobs lost in the Milei era?

From CP they highlighted that Between the two most benefited categories, there were 7,400 jobs annually as of the third quarter of last year, Therefore, they were far from compensating for the more than 157,000 jobs lost by the sectors that fell the most.. This is where one of the big doubts lies regarding the social sustainability of the model.

Thomas Canosaan economist at Fundar, pointed out precisely that the main debate about the growth model that the Argentine economy seems to be going through is that It is based on sectors that are not very intensive in generating employment. In parallel, he sees a worrying risk in the fact that some industrial segments that are very intensive in the generation of technology cannot sustain themselves in a context like the current one, which combines exchange rate appreciation with trade openness.

For his part, Abbate also warns that the exchange rate delay affects the profitability of the “winning” sectorsbecause they lead exports. In terms of productive chains and generation of indirect jobs, he pointed out that “agriculture and energy can drive some industries, due to their demand for agricultural machinery or capital goods, but they can hardly occupy the place occupied by other productive networks, such as the metalworking, when it comes to job creation”.

“Argentina does not have the productive structure and geography like those of Australia, where agriculture and mining allow them to employ a large part of the population”he noted.

Florence Fiorentinchief economist of the consulting firm EPyCA, expressed that “of course these primary sectors can generate upstream and downstream spills and are not necessarily enclaves, functioning as strategic sectors through which a strategy for economic growth and development is proposed.” . However, he warned that for this “there has to be a productive plan that promotes these effects”.

“Without this plan, the positive effects on employment will be very limited. and, in this way, it would not be sustainable for growth to be supported only in primary areas,” he deepened.

While credit drives the reactivation, salaries put a brake on it

It is worth clarifying, however, that in the last months of 2024 the outlook for economic activity improved slightly, fundamentally hand in hand with the slowdown in inflation, the exchange rate calm and the circulation of dollars from laundering, elements that favored a higher credit and a more dynamic economy.

While credit emerges as the main driver of the reactivation, the outlook for consumption is more uncertain since, after a few months of real recovery, the latest salary adjustments are almost in line with inflation levels, making it difficult to recover everything lost in recent years.

Source: Ambito