CEDEARS: What is the differential in the new certificates

Marcelo LezcanoPresident of Catalaxy, Global Investment Agency, explains -in dialogue with Scope- that for example the yield Petrobras (PBR) is underlying the ADR of PBR, which quotes in the New York Stock Exchange (NYSE), with a conversion ratio of 1: 1.

“In this case, it is a derivative of another derivative, which implies additional custody costs. First, of the original action and then, of Adr. In addition, this yield is issued by the Comafi Bankwhich applies commissions of up to 8% more VAT “, which translates into higher operating costs for the investor.

Bovespa.jpg

Bovespa vs. Merval. Source: TrainingView.

“On the other hand, the yield of Pet3 has as underlying the action of PBR that is directly traded in the São Paulo Stock Exchange, also with a ratio of 1: 1, but is issued by the Securities Box and offers more competitive commissions, around 4%. “, that is, much cheaper for which it operates.

In this regard, from Byma they add in statements to this medium that this change brings several advantages for investors. “In the first place, it allows access to Petrobras’ action in Brazil without the intermediation of the US market, which can generate differences in costs, exchange efficiency and commissions.”

In addition, they warn that by being linked to action in Brazil and not to ADR, “prices and spreads may present variations with respect to Cedears based on ADRS”, which opens the door to new arbitration or diversification opportunities.

However, as they point out from Byma it is important to emphasize that Petrobras No It is the only case in which they are already available Two yield: one against ADR and one against action in Brazil. Other cases are:

- VALE SA (VALE Y OLDO3)

- Bradesco Bank (BBD and BBDC3)

- Iitaú Banco (ITUB and ITUB3)

- Telefónica Brazil (Viv and Vivt3)

- Ambev SA (Abev and Abev3)

In a nutshell, the key difference is that the old yield replicated the Petrobras ADR in the US, while the new one is directly backed by the company’s action in the Brazilian Stock Exchange. “This modification can provide benefits in terms of access, costs and price structure for local investors,” concludes byma in line with Lezcano.

The projections for the Brazilian market

The crisis observed by experts in the neighboring country is the fruit of a unprolija fiscal policy that foreshadows what could be a slow development. But despite this, the bets that Bovespa reaches 145,000 points in 2025 increase. This represents a jump of 21,000 points in just under 11 months.

And for local strategists, Bovespa is “cheap.” Nevertheless, Tomás Ambrosettidirector of Capital Guardian, He suggests in statements to this medium “caution at the time of adding Brazilian assets to the principal” by understanding that volatility in Brazil today is high.

However, the expert also argues that there is potential in some of these companies that landed in the Porteña Square Vía Cedears “that were always large and today could look for a recovery and then growth.”

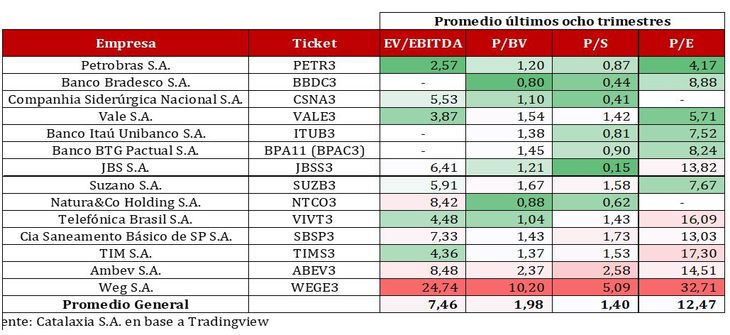

CEDEARS: Where to invest in Brazil

In the last 10 years, commodities were the best performance segment in Brazil. They also promoted much of the growth of profits in the South American giant, strictly speaking, after the pandemic, thanks to the increase in prices of the oilhe iron and cellulose globally, added to the depreciation of the real.

“The conclusion here is obvious: when investing in Brazilian actions, it is crucial In “OFF”.

Sector by sector: which follows the Argentine market

Ambrosetti closely follows two segments of the Brazilian economy. In the banking sector it finds value in Bradesco SA Bank (BBDC3): “One of the main banks of Brazil, with a strong presence in digital banking, insurance and financial services.” Also in BANCO UNIBANCO SA (ITUB3)“The largest private institution in Latin America, recognized for its solidity, innovation and leadership in companies financing,” he says.

In mining and energy he likes VALE SA (Vale3): “One of the largest iron and nickel ore producers in the world, key in the steel industry and energy transition” and Petrobras (Pet3): “Leader of oil and gas with operations in exploration, refining and renewable energy, fundamental in the global energy market. “

Lezcano’s positions of Catalaxy coincide with those of Capital Guardian. “We have strong positions in Petrobras. The company every day has a more attractive valuation. Since last May the price of the lateralization company and for us it is a good time to add it to our portfolios.”

“As for valuation, the Bradesco Bank also looks attractive. We do not invest in highly leveraged businesses because we understand that the real risk of an action is the bankrupt “Driver” to follow closely if this asset adds to portfolio.

Catalaxia.jpg

For Lezcano, La Minera Okay It has very good valuation. On the international context, the international context and the prices of metals “, strictly speaking with the increase in tariffs in the US, Lezcan That north as soon as it sends 3.9% of its sales, “so we do not see great inconveniences.”

Finally, Ambrosetti slides that it is good to remember that if an investor seeks to incorporate Brazil into his principal, but he does not know which sector to choose, he can operate the ETF EWZ which is the “Ishares Msci Brazil ETF”. “An index that regroups shares from all over the country giving exposure to large and medium -sized companies. Similar to what S&P 500 is for the United States,” he concludes.

In this way, given the context of volatility in the local square and waiting for catalysts, the new Yields Linked to Brazil, they offer Argentine investors a way to diversify their portfolio and take advantage of the potential of key sectors such as Energy, Mining and Bankingalthough caution continues as a fundamental actor in the face of the macroeconomic challenges of the neighboring country.

Source: Ambito