Donald Trump’s tariff policies could impact emerging markets, but one of the main US banks maintains a positive vision of both Argentina and its neighboring Brazil. What values stand out.

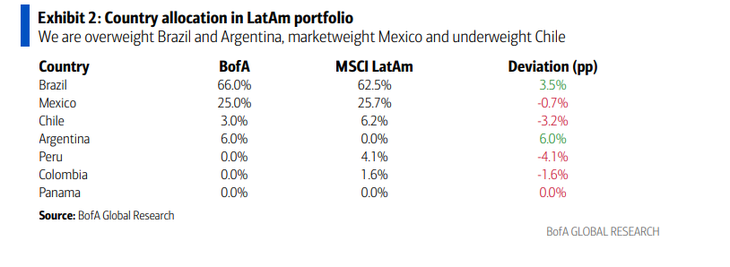

TO despite the US tariff measures, that affect emerging markets, Bank of America (Bofa) maintains an optimistic vision of Latin America, with a particular approach in Brazil and Argentina. According to the bank, Argentina continues in a position of “overponderation” (Overweight) within its regional portfolio, Especially highlighting two of its main companies in the energy and banking sectors.

The content you want to access is exclusive to subscribers.

Despite the correction of the Merval, the Bofa points out that “the country has the largest catalysts in the region: elections, disinflation, lower regulatory risk (Argentina Power & Utilities on liberalization of the electricity sector) and a possible agreement with the IMF before April 25, key to lifting capital controls. “However, it clarifies that an improvement in international markets such as EMPA EMPERENTA -AUJ could take” and it could take “and Remember that Argentina took this and a half years.

Among the main Argentine investments of the bank, the shares of Pampa Energía (PAM) and Grupo Financiero Galicia (Ggal). In the case of Pampa Energía, they emphasize that this company will obtain good returns due to the increase in oil production in the next six months. Meanwhile, in the case of Galicia, they point out that it will be the best beneficiary for greater credit activity in 2024.

Screen capture 2025-02-13 091501.png

Bofa’s porpholio with Latam

Brazil: Bofa’s commitment despite political uncertainty

Despite the devaluation of the real in the last section of 2024 and early 2025Bank of America (Bofa) keeps Brazil in “Overweight” inside its portfolio, FAppealing companies with low risk and ability to operate in an environment of high rates. Although the government of Lula da Silva maintains a debate with the Central Bank on monetary policy, Bofa anticipates that the rates will remain high to contain inflation.

Although it recognizes the negative impact of rates on corporate gains, the bank sees margin for a future reduction and projects that the SELLIC rate will reach 15.25%, compared to 15.75% estimated by the market. In this context, high frequency data suggests an economic slowdown, which could help stabilize inflationary expectations.

Within its portfolio, Bofa maintains investments in several Brazilian companies, with a total participation of 3.5%, less than 6% assigning Argentina.

- LOJAS RENNER SA

- Cray

- Free market

- Vivara

- IBS

- Petrobras

- Bradesco

- Itaú Unibanco

- BB Safety

- BTG Pactual

- HAPVIDA

- Embraer

- Locate

- Vale sa

- GERDAU SA

- Telefónica Brazil

- You know

- Equatorial

So far this year, Merval has been losing 20% while Ibvespa earns 13%. It is worth remembering that in 2024, the returns of the local leader panel exceeded 100% while the Brazilian stock market fell 30%.

Source: Ambito