Last Argentina exported for a total of US $ 79.7 billion, which implied an annual growth of 19%. In his “Quarterly Argentine Export Report”, the Interdisciplinary Institute of Political Economics (IIEP) of the University of Buenos Aires (UBA) It separates exports into two groups: undenalized products, which mostly include commodities, and differentiated products, which contemplate greater sophistication.

In the case of non -differentiated goods, The IIEP considered pertinent to compare against 2022 already constant prices, to remove the effect of the serious drought of 2023 and the great volatility of international values in this segment. The results showed a 13.6% growthequivalent to about US $ 7.3 billion at the end of last year, explained fundamentally by the contributions of cereals and oilseeds, and fuels (in the latter case thanks to the production of Muerta Vaca and the implementation of the Perito Moreno gas pipeline) .

Exports with added value show a stagnation of 15 years

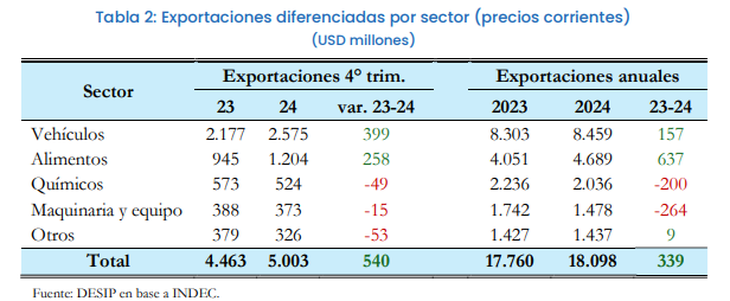

With a very different dynamism, Differentiated goods exhibited a 1.9% increase against 2023 and were below 2022 level. “Exports of differentiated goods are found virtually stagnant for approximately 15 years“, highlighted from the area of productive development and internationalization of the institute.

image.png

Federico Vaccarezzaof the Observatory of Economy of Industrials SMEs Argentinos (IPA), remarked that “Argentina is the least productive country in the region in export productivity only surpassed by Venezuela” and “produces and exports the same amounts and values as in 2014”. “In 10 years, export production grew 0% while Brazil doubled. This is not a problem of a government, but is a structural problem that no one is willing to solve in the background,” he deepened.

The rise in differentiated goods was explained by two groups of products: food and vehicles, in both cases tied to commercial exchange with Brazil. The aforementioned report clarified that It was the greatest demand of the neighboring country, and not so much a productivity gain of Argentine products, which explained the slight increase Annual sales.

While all exports with added value to the main commercial partner presented improvements, In most cases (such as cars, frozen potatoes or medications), a lower participation of local products within Brazilian imports was noticed. The only products that grew in their participation in the Brazilian market were cheese and auto parts, which can be taken as a reflection of greater productivity.

For the rest of the differentiated exports, which includes chemical and machinery, falls were observed with respect to 2023.

image.png

The exchange delay does not provide good prospects for differentiated exports

By 2025 the IIEP estimated an annual increase of 4.2% in external sales, which would be generated entirely by non -differentiated goodswith a projected advance of 6.9% (+US $ 4,263 million). The agricultural sector, the energy and the miner will be the engines of this improvement.

Regarding the first group, the wheat, soy and meat vaccine They emerge as products with better perspectives. The two factors that could put these sales at risk are a drastic change in climatic conditions and a hardening of Chinese tariffs on meat imports.

As for energy, the report remarked to the reactivation of the trans -Andean pipeline for the export of oil Towards Chile and the increase in transport capacity by the Oldelval system to Puerto Rosales, scheduled for March 2025, as indicators of a potential increase, which could be delayed in case of possible delays in the works.

Likewise, the reduction in withholdings for exports of gold and the new projects of lithium They would generate additional currencies in the mining sector. In this case, it is the downward trend in the prices of lithium the factor that can cushion the rises.

Very different is the panorama for exports of differentiated goods, for which the IIEP expects a contraction of 5.1% (-U $ S929 million). From the institute they argued that The negative calculation responds “mainly to exchange appreciation Expected by 2025, which will limit the competitiveness of exporters “, an effect that could be partially compensated by the” trade unregulation and facilitation agenda. “

image.png

The economist of Fundar, Tomás CanosaHe pointed out that the exchange rate appreciation has greater influence on differentiated products, since there “Argentina competes with all the countries of the world.” In that sense, he said, the exchange issue adds to other factors that take away productivity to local items such as complicated access to financing, tax structure and regulations, or the low scale provided by a depressed domestic market.

On the way to a primarization of the export basket

Regarding the deregulatory policy of the ruling party, Canosa considers that it can help but require the alignment of all the previously mentioned variables, as well as productive policies that stimulate brand development and product differentiation.

“It is not a matter of deregulate, but Remove distortive taxes, stimulate productive credit, encourage investment and have a normal exchange regimelike any other country in the region. What is the standard in any country in the region, from Mexico to Paraguay, unfortunately would be almost revolutionary in Argentina, “Vaccarezza said.

In the IIEP they explain that for a better insertion in exports of differentiated goods efforts are needed to market, reliability and quality assurancefactors that are less important in the case of commodities since they are products with greater homogeneity worldwide.

In front of the panorama raised, it is expected Primarization of the export basket Argentina and few advances in diversification, elements that return to the most vulnerable economy to international shocks and erode long -term development.

Source: Ambito