I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.

Menu

Daniel Artana on the dollar: “At some point it will go where to go”

Categories

Most Read

Euro today and Euro Blue today: how much operate this Wednesday, October 8

October 8, 2025

No Comments

Blue dollar today: how much it operates at this Wednesday, October 8

October 8, 2025

No Comments

Dollar today: how much it operates at this Wednesday, October 8

October 8, 2025

No Comments

Wall Street dialogues: Euphoria in the New York Stock Exchange, real bonanza or simple mirage?

October 8, 2025

No Comments

Appetite for gold: central banks bought again in August and the list of countries expanded

October 7, 2025

No Comments

Latest Posts

Simone Biles is already in Argentina: at what time is the talk of the US Olympic medalist

October 8, 2025

No Comments

October 8, 2025 – 09:36 The renowned American gymnast arrived the country to give a motivational talk and a sports clinic. The details. Photo: Gtres

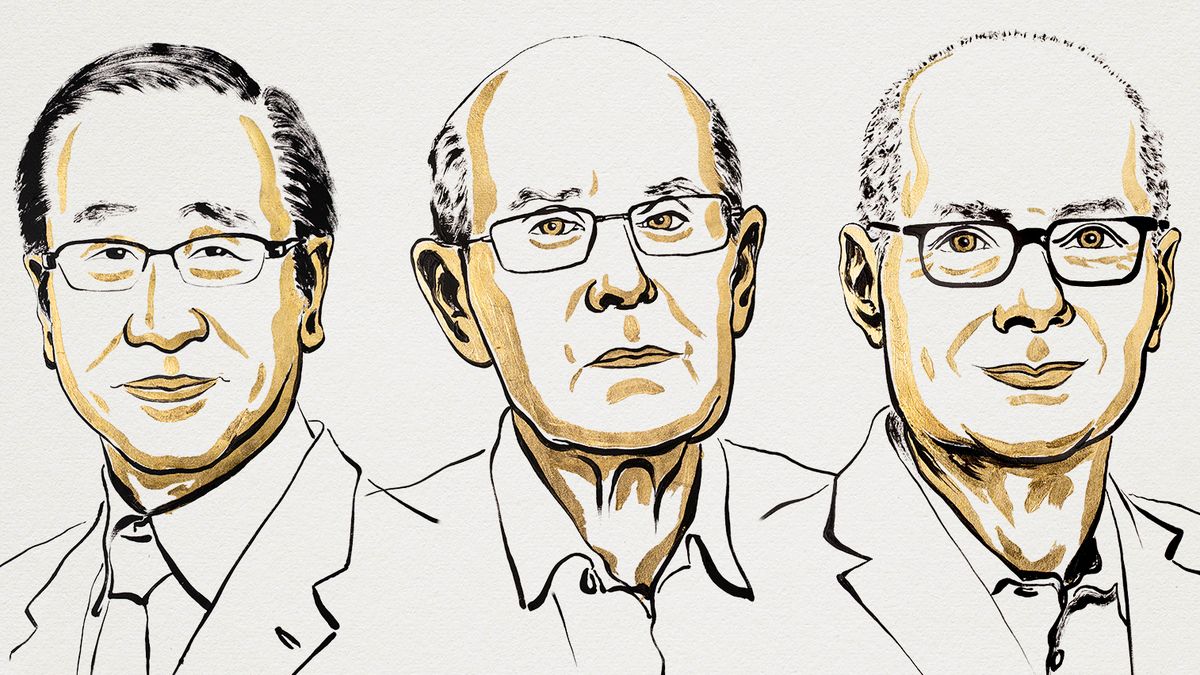

The 2025 Nobel Prize in Chemistry was for the study of the development of metal-organic structures

October 8, 2025

No Comments

October 8, 2025 – 09:31 Susumu Kitagawa, Richard Robson and Omar Yaghi were awarded for creating structures capable of storing gases, filtering pollutants and collecting

Hamas provided the list of Israelis who would be released for the hostage exchange plan

October 8, 2025

No Comments

October 8, 2025 – 09:30 The Palestinian group confirmed the exchange of names within the framework of negotiations in Egypt, under US mediation and Donald

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.