I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.

Menu

The CNV imposed the toughest sanction in its history to an Alyc for irregularities linked to the Vicentin case

Categories

Most Read

Blue dollar today: how much it operates at this Tuesday, October 28

October 28, 2025

No Comments

Dollar today: how much is it trading at this Tuesday, October 28

October 28, 2025

No Comments

US banks adjust forecasts on the dollar, after Javier Milei’s resounding victory

October 28, 2025

No Comments

Qualcomm shares jump more than 11% after artificial intelligence super announcement

October 28, 2025

No Comments

Soybeans rose strongly and touched US$400 due to the trade rapprochement between the US and China

October 27, 2025

No Comments

Latest Posts

They announce the start of the exclusive reservation of the new pickup produced in Argentina: when will it go on sale

October 28, 2025

No Comments

October 28, 2025 – 08:56 The model is assembled at the Ferreyra Industrial Complex, marking a new chapter in the brand’s local manufacturing strategy. RAM,

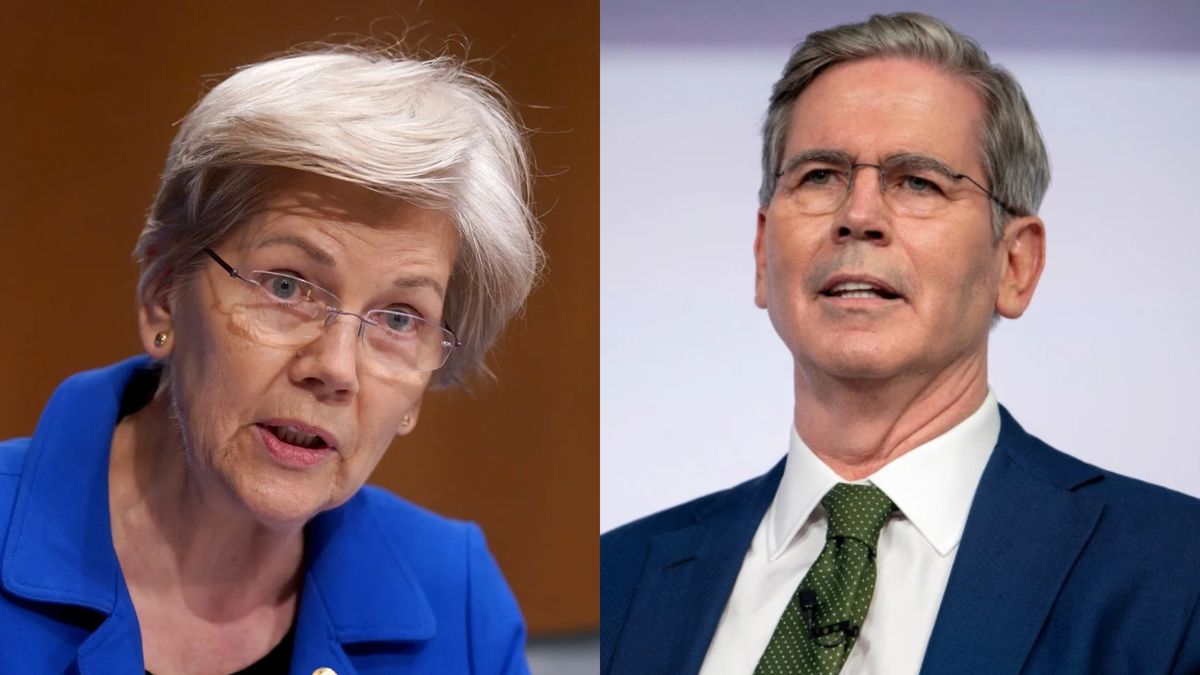

Scott Bessent defends Javier Milei and Elizabeth Warren accuses him of corruption

October 28, 2025

No Comments

October 28, 2025 – 08:21 Trump and Bessent’s help to Javier Milei ignited a political fight in Washington amid the US government shutdown. The help

DFB Cup: Urbig comes home with Bayern – “The hunger is very big”

October 28, 2025

No Comments

PierceI am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.